Under Armour 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

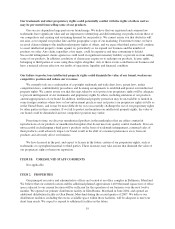

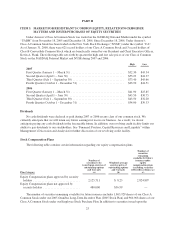

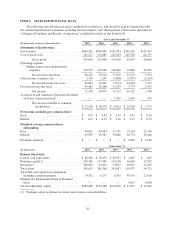

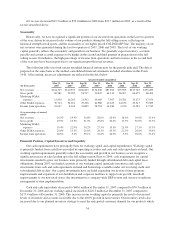

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data is qualified by reference to, and should be read in conjunction with,

the consolidated financial statements, including the notes thereto, and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” included elsewhere in this Form 10-K.

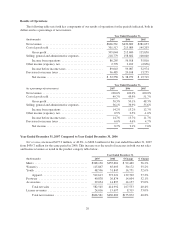

Year Ended December 31,

(In thousands, except per share amounts) 2007 2006 2005 2004 2003

Statements of Income data:

Net revenues ............................. $606,561 $430,689 $281,053 $205,181 $115,419

Cost of goods sold ........................ 301,517 215,089 145,203 109,748 64,757

Gross profit ...................... 305,044 215,600 135,850 95,433 50,662

Operating expenses

Selling, general and administrative

expenses .......................... 218,779 158,682 100,040 70,280 40,709

Income from operations ............ 86,265 56,918 35,810 25,153 9,953

Other income (expense), net ................. 2,778 2,169 (2,836) (1,057) (2,214)

Income before income taxes ......... 89,043 59,087 32,974 24,096 7,739

Provision for income taxes .................. 36,485 20,108 13,255 7,774 1,991

Net income ...................... 52,558 38,979 19,719 16,322 5,748

Accretion of and cumulative preferred dividends

on Series A preferred stock ............... — — 5,307 1,994 475

Net income available to common

stockholders ................... $ 52,558 $ 38,979 $ 14,412 $ 14,328 $ 5,273

Net income available per common share:

Basic ................................... $ 1.09 $ 0.83 $ 0.39 $ 0.41 $ 0.16

Diluted ................................. $ 1.05 $ 0.79 $ 0.36 $ 0.39 $ 0.15

Weighted average common shares

outstanding:

Basic ................................... 48,021 46,983 37,199 35,124 32,106

Diluted ................................. 49,959 49,587 39,686 36,774 34,146

Dividends declared ........................ $ — $ — $ — $ 5,000 $ 3,640

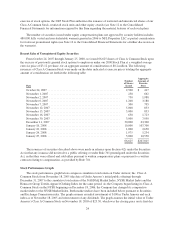

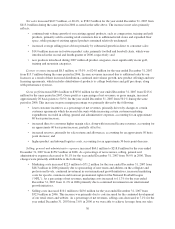

At December 31,

(In thousands) 2007 2006 2005 2004 2003

Balance Sheet data:

Cash & cash equivalents ................... $ 40,588 $ 70,655 $ 62,977 $ 1,085 $ 667

Working capital(1) ........................ 226,546 173,389 134,118 16,690 13,822

Inventories .............................. 166,082 81,031 53,607 48,055 21,849

Total assets .............................. 390,613 289,368 203,687 110,977 54,725

Total debt and capital lease obligations,

including current maturities ............... 14,332 6,257 8,391 45,133 22,018

Mandatorily Redeemable Series A Preferred

Stock ................................. — — — 6,692 4,698

Total stockholders’ equity .................. $280,485 $214,388 $150,830 $ 21,237 $ 11,865

(1) Working capital is defined as current assets minus current liabilities.

26