Under Armour 2007 Annual Report Download - page 51

Download and view the complete annual report

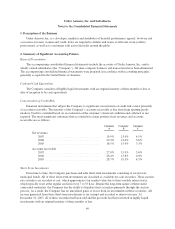

Please find page 51 of the 2007 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.entities to choose to measure many financial instruments and certain other assets and liabilities at fair value on an

instrument-by-instrument basis. SFAS 159 is effective for fiscal years beginning after November 15, 2007. We

do not believe that the adoption of SFAS 159 will have a material impact on our consolidated financial

statements.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS 157”), which

defines fair value, establishes a framework for measuring fair value in accordance with generally accepted

accounting principles, and expands disclosures about fair value measurements. SFAS 157 is effective for fiscal

years beginning after November 15, 2007, however the FASB has delayed the effective date of SFAS 157 to

fiscal years beginning after November 15, 2008 for nonfinancial assets and nonfinancial liabilities, except those

items recognized or disclosed at fair value on an annual or more frequently occurring basis. We do not believe

that the adoption of SFAS 157 will have a material impact on our consolidated financial statements.

In June 2006, the FASB issued FIN 48, which provides additional guidance and clarifies the accounting for

uncertainty in income tax positions. FIN 48 defines the threshold for recognizing tax return positions in the

financial statements as “more likely than not” that the position is sustainable, based on its technical merits. FIN

48 also provides guidance on the measurement, classification and disclosure of tax return positions in the

financial statements. FIN 48 was effective for the first reporting period beginning after December 15, 2006, with

the cumulative effect of the change in accounting principle recorded as an adjustment to the beginning balance of

retained earnings in the period of adoption. Upon adoption of FIN 48 as of January 1, 2007, we recorded a $1.2

million decrease to the beginning balance of retained earnings (see Note 11 to the Consolidated Financial

Statements for a further discussion on FIN 48).

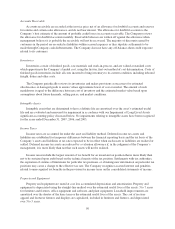

Quantitative and Qualitative Disclosure about Market Risk

Foreign Currency Exchange and Foreign Currency Risk Management and Derivatives

We currently generate a small amount of our consolidated net revenues in Canada and Europe. The

reporting currency for our consolidated financial statements is the U.S. dollar. To date, net revenues generated

outside of the United States have not been significant. As a result, we have not been impacted materially by

changes in foreign currency exchange rates and do not expect to be impacted materially for the foreseeable

future. However, as our net revenues generated outside of the United States increase, our results of operations

could be adversely impacted by changes in foreign currency exchange rates. For example, if we recognize

international sales in local foreign currencies (as we currently do in Canada and Europe) and if the U.S. dollar

strengthens, it could have a negative impact on our international results upon translation of those results into the

U.S. dollar upon consolidation of our financial statements.

Adjustments that arise from foreign currency exchange rate changes on transactions denominated in a

currency other than the local currency are included in other income (expense), net on the consolidated statements

of income. We recorded unrealized foreign currency transaction gains of $2.6 million for the year ended

December 31, 2007, and unrealized foreign currency transaction losses of $0.2 million for the year ended

December 31, 2006. We recorded realized foreign currency transaction gains of $0.2 million, $0.5 million and

$0.1 million for the years ended December 31, 2007, 2006 and 2005, respectively.

In August 2007, we began using foreign currency forward contracts to minimize some of the impact of

foreign currency exchange rate fluctuations on future cash flows. We currently use foreign currency forward

contracts to reduce the risk from exchange rate fluctuations on projected inventory purchases, inter-company

payments and other working capital requirements for our Canadian subsidiary. We do not enter into derivative

financial instruments for speculative or trading purposes. Based on the foreign currency forward contracts

outstanding as of December 31, 2007, we receive US Dollars in exchange for Canadian Dollars at a weighted

average contractual foreign currency exchange rate of 1.04 CAD per $1.00. As of December 31, 2007, the

notional value of our outstanding forward contracts was approximately $6.5 million with maturities of 1 to 12

months. The foreign currency forward contracts are not designated as cash flow hedges, and accordingly,

changes in their fair value are recorded in earnings. The unrealized derivative losses of $0.2 million related to

41