Ulta 2013 Annual Report Download - page 64

Download and view the complete annual report

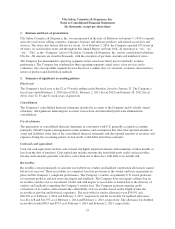

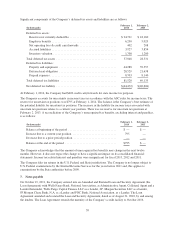

Please find page 64 of the 2013 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.provides maximum revolving loans equal to the lesser of $200,000 or a percentage of eligible owned inventory,

contains a $10,000 subfacility for letters of credit and allows the Company to increase the revolving facility by

an additional $50,000, subject to consent by each lender and other conditions. The Loan Agreement contains a

requirement to maintain a minimum amount of excess borrowing availability at all times.

On September 5, 2012, the Company entered into Amendment No. 1 to the Amended and Restated Loan and

Security Agreement (the Amendment) with the lender group. The Amendment updated certain administrative

terms and conditions and provides the Company greater flexibility to take certain corporate actions. There were

no changes to the revolving loan amounts available, interest rates, covenants or maturity date under terms of the

Loan Agreement.

On December 6, 2013, the Company entered into Amendment No. 2 to the Amended and restated Loan and

Security Agreement (the Loan Amendment) with the lender group. The Loan Amendment extends the maturity

of the facility to December 2018. Substantially all of the Company’s assets are pledged as collateral for

outstanding borrowings under the facility. Outstanding borrowings will bear interest at the prime rate or Libor

plus 1.50% and the unused line fee is 0.20%.

As of February 1, 2014 and February 2, 2013, the Company had no borrowings outstanding under the credit

facility and the Company was in compliance with all terms and covenants of the agreement.

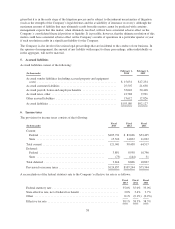

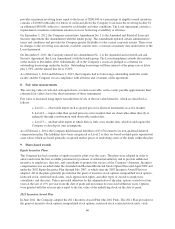

8. Fair value measurements

The carrying value of cash and cash equivalents, accounts receivable, and accounts payable approximates their

estimated fair values due to the short maturities of these instruments.

Fair value is measured using inputs from the three levels of the fair value hierarchy, which are described as

follows:

a. Level 1 — observable inputs such as quoted prices for identical instruments in active markets.

b. Level 2 — inputs other than quoted prices in active markets that are observable either directly or

indirectly through corroboration with observable market data.

c. Level 3 — unobservable inputs in which there is little or no market data, which would require the

Company to develop its own assumptions.

As of February 1, 2014, the Company held financial liabilities of $3,678 related to its non-qualified deferred

compensation plan. The liabilities have been categorized as Level 2 as they are based on third-party reported net

asset values which are based primarily on quoted market prices of underlying assets of the funds within the plan.

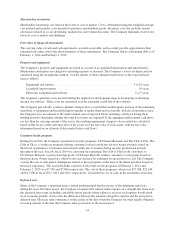

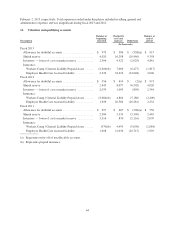

9. Share-based awards

Equity Incentive Plans

The Company has had a number of equity incentive plans over the years. The plans were adopted in order to

attract and retain the best available personnel for positions of substantial authority and to provide additional

incentive to employees, directors, and consultants to promote the success of the Company’s business. Incentive

compensation was awarded under the Amended and Restated Restricted Stock Option Plan until April 2002 and

under the 2002 Equity Incentive Plan through July 2007, at which time the 2007 Incentive Award Plan was

adopted. All of the plans generally provided for the grant of incentive stock options, nonqualified stock options,

restricted stock, restricted stock units, stock appreciation rights, and other types of awards to employees,

consultants, and directors. Unless provided otherwise by the administrator of the plan, options vested over four

years at the rate of 25% per year from the date of grant and most must be exercised within ten years. Options

were granted with the exercise price equal to the fair value of the underlying stock on the date of grant.

2011 Incentive Award Plan

In June 2011, the Company adopted the 2011 Incentive Award Plan (the 2011 Plan). The 2011 Plan provides for

the grant of incentive stock options, nonqualified stock options, restricted stock, restricted stock units, stock

60