Ulta 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

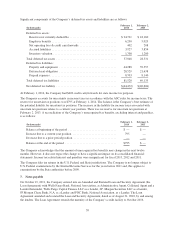

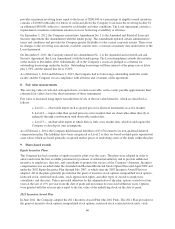

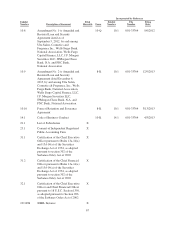

Significant components of the Company’s deferred tax assets and liabilities are as follows:

(In thousands)

February 1,

2014

February 2,

2013

Deferred tax assets:

Reserves not currently deductible ................................ $24,721 $ 18,160

Employee benefits ............................................ 6,290 5,029

Net operating loss & credit carryforwards ......................... 402 208

Accrued liabilities ............................................ 3,927 3,854

Inventory valuation ........................................... 1,708 1,280

Total deferred tax assets ......................................... 37,048 28,531

Deferred tax liabilities:

Property and equipment ....................................... 44,288 39,357

Deferred rent obligation ....................................... 28,529 21,638

Prepaid expenses ............................................. 8,703 8,140

Total deferred tax liabilities ...................................... 81,520 69,135

Net deferred tax liability ......................................... $(44,472) $(40,604)

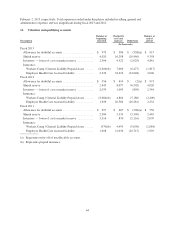

At February 1, 2014, the Company had $402 credit carryforwards for state income tax purposes.

The Company accounts for uncertainty in income taxes in accordance with the ASC rules for income taxes. The

reserve for uncertain tax positions was $795 at February 1, 2014. The balance is the Company’s best estimate of

the potential liability for uncertain tax positions. The increase in the liability for income taxes associated with

uncertain tax positions relates to a current year position. There was no reserve for uncertain tax positions at

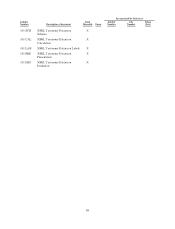

February 2, 2013. A reconciliation of the Company’s unrecognized tax benefits, excluding interest and penalties,

is as follows:

(In thousands)

February 1,

2014

February 2,

2013

Balance at beginning of the period ................................. $ — $ —

Increase due to a current year position .............................. 795 —

Decrease due to a prior period position ............................. — —

Balance at the end of the period ................................... $795 $ —

The Company acknowledges that the amount of unrecognized tax benefits may change in the next twelve

months. However, it does not expect the change to have a significant impact on its consolidated financial

statements. Income tax-related interest and penalties were insignificant for fiscal 2013, 2012 and 2011.

The Company files tax returns in the U.S. Federal and State jurisdictions. The Company is no longer subject to

U.S. Federal examinations by the Internal Revenue Services for the years before 2011 and, this applies to

examinations by the State authorities before 2009.

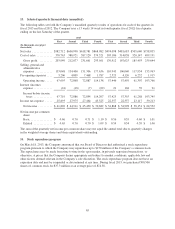

7. Notes payable

On October 19, 2011, the Company entered into an Amended and Restated Loan and Security Agreement (the

Loan Agreement) with Wells Fargo Bank, National Association, as Administrative Agent, Collateral Agent and a

Lender thereunder, Wells Fargo Capital Finance LLC as a Lender, J.P. Morgan Securities LLC as a Lender,

JP Morgan Chase Bank, N.A. as a Lender and PNC Bank, National Association, as a Lender. The Loan

Agreement amended and restated the Loan and Security Agreement, dated as of August 31, 2010, by and among

the lenders. The Loan Agreement extends the maturity of the Company’s credit facility to October 2016,

59