Ulta 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

given that it is in the early stage of the litigation process and is subject to the inherent uncertainties of litigation

(such as the strength of the Company’s legal defenses and the availability of insurance recovery). Although the

maximum amount of liability that may ultimately result from this matter cannot be predicted with certainty,

management expects that this matter, when ultimately resolved, will not have a material adverse effect on the

Company’s consolidated financial position or liquidity. It is possible, however, that the ultimate resolution of this

matter could have a material adverse effect on the Company’s results of operations in a particular quarter or year

if such resolution results in a significant liability for the Company.

The Company is also involved in various legal proceedings that are incidental to the conduct of our business. In

the opinion of management, the amount of any liability with respect to these proceedings, either individually or

in the aggregate, will not be material.

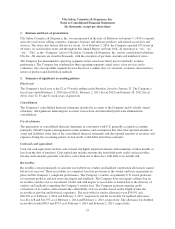

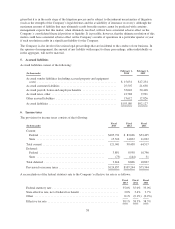

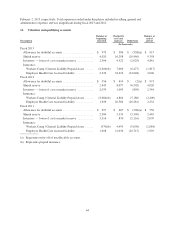

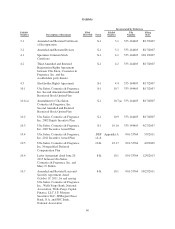

5. Accrued liabilities

Accrued liabilities consist of the following:

(In thousands)

February 1,

2014

February 2,

2013

Accrued vendor liabilities (including accrued property and equipment

costs) ...................................................... $ 15,631 $17,254

Accrued customer liabilities ...................................... 25,507 21,638

Accrued payroll, bonus and employee benefits ....................... 33,642 30,418

Accrued taxes, other ............................................ 12,788 9,991

Other accrued liabilities ......................................... 15,612 12,826

Accrued liabilities .............................................. $103,180 $92,127

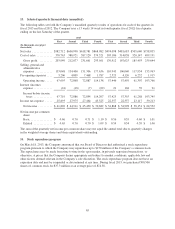

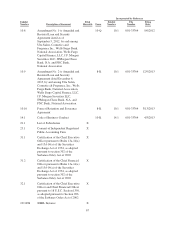

6. Income taxes

The provision for income taxes consists of the following:

(In thousands)

Fiscal

2013

Fiscal

2012

Fiscal

2011

Current:

Federal ............................................ $105,731 $ 83,606 $53,495

State .............................................. 15,310 14,832 11,022

Total current .......................................... 121,041 98,438 64,517

Deferred:

Federal ............................................ 3,891 8,950 10,796

State .............................................. (75) (144) 31

Total deferred ......................................... 3,816 8,806 10,827

Provision for income taxes ............................... $124,857 $107,244 $75,344

A reconciliation of the federal statutory rate to the Company’s effective tax rate is as follows:

Fiscal

2013

Fiscal

2012

Fiscal

2011

Federal statutory rate ............................................. 35.0% 35.0% 35.0%

State effective rate, net of federal tax benefit .......................... 3.0% 3.4% 3.7%

Other ......................................................... 0.1% (0.1%) (0.2%)

Effective tax rate ................................................ 38.1% 38.3% 38.5%

58