Ulta 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As part of many lease agreements, the Company receives construction allowances from landlords for tenant

improvements. These leasehold improvements made by the Company are capitalized and amortized over the

shorter of their estimated useful lives or the lease term. The construction allowances are recorded as deferred rent

and amortized on a straight-line basis over the lease term as a reduction of rent expense.

Revenue recognition

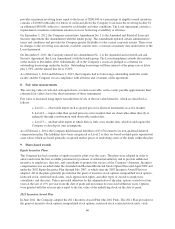

Net sales include merchandise sales and salon service revenue. Revenue from merchandise sales at stores is

recognized at the time of sale, net of estimated returns. The Company provides refunds for product returns within

60 days from the original purchase date. Salon revenue is recognized when services are rendered. Salon service

revenue amounted to $145,815, $121,357 and $98,479 for fiscal 2013, 2012 and 2011, respectively. Company

coupons and other incentives are recorded as a reduction of net sales. State sales taxes are presented on a net

basis as the Company considers itself a pass-through conduit for collecting and remitting state sales tax.

E-commerce sales are recorded based on delivery of merchandise to the customer. E-commerce revenue

amounted to $95,809, $55,086 and $41,333 for fiscal 2013, 2012 and 2011, respectively.

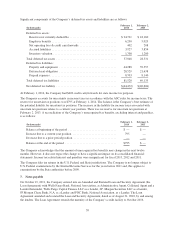

The Company’s gift card sales are deferred and recognized in net sales when the gift card is redeemed for

product or services. The Company’s gift cards do not expire and do not include service fees that decrease

customer balances. The Company has maintained Company-specific, historical data related to its large pool of

similar gift card transactions sold and redeemed over a significant time frame. The Company recognizes gift card

breakage to the extent there is no requirement for remitting balances to governmental agencies under unclaimed

property laws. Gift card breakage is recognized over the same performance period, and in the same proportion,

that the Company’s data has demonstrated that gift cards are redeemed. Gift card breakage is recorded as a

decrease in selling, general and administrative expense in the statements of income. Deferred gift card revenue

was $16,439 and $13,364 at February 1, 2014 and February 2, 2013, respectively, and is included in accrued

liabilities – accrued customer liabilities (Note 5).

Vendor allowances

The Company receives allowances from vendors in the normal course of business including advertising and

markdown allowances, purchase volume discounts and rebates, and reimbursement for defective merchandise,

and certain selling and display expenses. Substantially all vendor allowances are recorded as a reduction of the

vendor’s product cost and are recognized in cost of sales as the product is sold.

Advertising

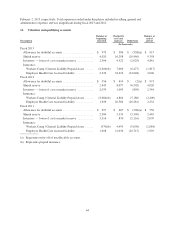

Advertising expense consists principally of paper, print and distribution costs related to the Company’s

advertising circulars. The Company expenses the production and distribution costs related to its advertising

circulars in the period the related promotional event occurs. Total advertising costs, exclusive of incentives from

vendors and start-up advertising expense, amounted to $140,774, $118,365 and $99,446 for fiscal 2013, 2012 and

2011, respectively. Advertising expense as a percentage of sales was 5.3%, 5.3% and 5.6% for fiscal 2013, 2012

and 2011, respectively Prepaid advertising costs included in prepaid expenses and other current assets were

$6,891 and $6,251 as of February 1, 2014 and February 2, 2013, respectively.

Pre-opening expenses

Non-capital expenditures incurred prior to the grand opening of a new, remodeled or relocated store are charged

against earnings as incurred.

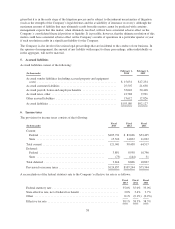

Cost of sales

Cost of sales includes the cost of merchandise sold including a majority of vendor allowances, which are treated

as a reduction of merchandise costs; warehousing and distribution costs including labor and related benefits,

freight, rent, depreciation and amortization, real estate taxes, utilities, and insurance; shipping and handling costs;

store occupancy costs including rent, depreciation and amortization, real estate taxes, utilities, repairs and

maintenance, insurance, licenses, and cleaning expenses; salon payroll and benefits; customer loyalty program

expense; and shrink and inventory valuation reserves.

55