Ulta 2011 Annual Report Download - page 55

Download and view the complete annual report

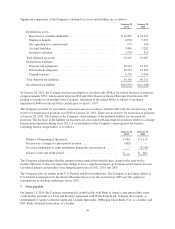

Please find page 55 of the 2011 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fair value of financial instruments

The carrying value of cash and cash equivalents, accounts receivable, and accounts payable approximates their

estimated fair values due to the short maturities of these instruments. The Company had no outstanding debt as of

January 28, 2012 and January 29, 2011.

Derivative financial instruments

The Company had an interest rate swap that expired on January 31, 2010. This derivative financial instrument

was designated and qualified as a cash flow hedge. Accordingly, the effective portion of the gain or loss on the

derivative instrument was reported as a component of accumulated other comprehensive income (loss) and

reclassified into interest expense in the same period or periods during which the hedged transaction affects

earnings. The remaining gain or loss, the ineffective portion, on the derivative instrument, if other than

inconsequential, was recognized in interest expense during the period of change. This derivative, which was

immaterial, was recorded in the January 30, 2010 balance sheet at fair value.

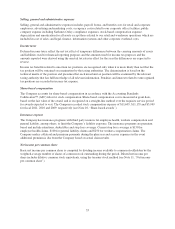

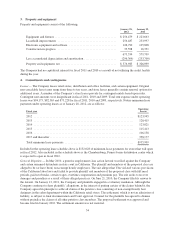

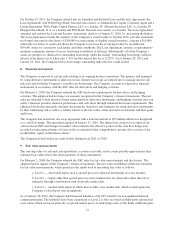

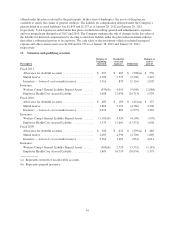

Property and equipment

The Company’s property and equipment are stated at cost net of accumulated depreciation and amortization.

Maintenance and repairs are charged to operating expense as incurred. The Company’s assets are depreciated or

amortized using the straight-line method, over the shorter of their estimated useful lives or the expected lease

term as follows:

Equipment and fixtures ................................................... 3to10years

Leasehold improvements ................................................. 10years

Electronic equipment and software ......................................... 3to5years

The Company capitalizes costs incurred during the application development stage in developing or obtaining

internal use software. These costs are amortized over the estimated useful life of the software.

The Company periodically evaluates whether changes have occurred that would require revision of the remaining

useful life of equipment and leasehold improvements or render them not recoverable. If such circumstances arise,

the Company uses an estimate of the undiscounted sum of expected future operating cash flows during their

holding period to determine whether the long-lived assets are impaired. If the aggregate undiscounted cash flows

are less than the carrying amount of the assets, the resulting impairment charges to be recorded are calculated

based on the excess of the carrying value of the assets over the fair value of such assets, with the fair value

determined based on an estimate of discounted future cash flows.

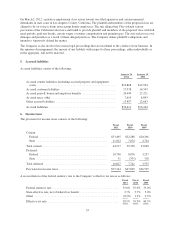

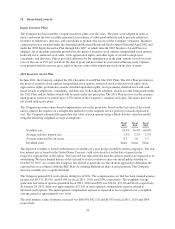

Customer loyalty program

The Company maintains two customer loyalty programs. The Company’s national certificate program provides

reward point certificates for free beauty products. Customers earn purchase-based reward points and redeem the

related reward certificate during specific promotional periods during the year. The Company is also rolling out its

ULTAmate Rewards program in which customers earn purchase-based points on an annual basis which can be

redeemed at any time. The Company accrues the cost of anticipated redemptions related to these programs at the

time of the initial purchase based on historical experience. The accrued liability related to both of the loyalty

programs at January 28, 2012 and January 29, 2011 was $6,207 and $4,883, respectively. The cost of these

programs, which was $17,200, $12,942 and $10,015 in fiscal 2011, 2010 and 2009, respectively, is included in

cost of sales in the statements of income.

Deferred rent

Many of the Company’s operating leases contain predetermined fixed increases of the minimum rental rate

during the lease. For these leases, the Company recognizes the related rental expense on a straight-line basis over

the expected lease term, including cancelable option periods where failure to exercise such options would result

in an economic penalty, and records the difference between the amounts charged to expense and the rent paid as

deferred rent. The lease term commences on the earlier of the date when the Company becomes legally obligated

for rent payments or the date the Company takes possession of the leased space.

51