Ulta 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

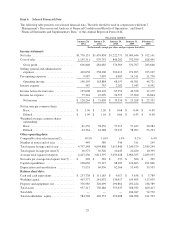

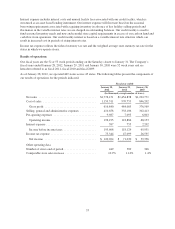

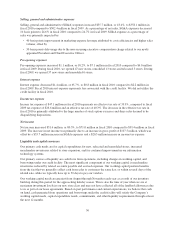

Item 6. Selected Financial Data

The following table presents our selected financial data. The table should be read in conjunction with Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Item 8,

“Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K.

Fiscal year ended(1)

January 28,

2012

January 29,

2011

January 30,

2010

January 31,

2009

February 2,

2008

(In thousands, except per share and per square foot data)

Income statement:

Net sales ............................ $1,776,151 $1,454,838 $1,222,771 $1,084,646 $ 912,141

Cost of sales ......................... 1,159,311 970,753 846,202 752,939 628,495

Gross profit ........................ 616,840 484,085 376,569 331,707 283,646

Selling, general and administrative

expenses .......................... 410,658 358,106 302,413 271,095 225,167

Pre-opening expenses .................. 9,987 7,095 6,003 14,311 11,758

Operating income ................... 196,195 118,884 68,153 46,301 46,721

Interest expense ....................... 587 755 2,202 3,943 4,542

Income before income taxes ............. 195,608 118,129 65,951 42,358 42,179

Income tax expense .................... 75,344 47,099 26,595 17,090 16,844

Net income ........................ $ 120,264 $ 71,030 $ 39,356 $ 25,268 $ 25,335

Net income per common share:

Basic ............................. $ 1.96 $ 1.20 $ 0.68 $ 0.44 $ 0.69

Diluted ............................ $ 1.90 $ 1.16 $ 0.66 $ 0.43 $ 0.48

Weighted average common shares

outstanding:

Basic ............................. 61,259 58,959 57,915 57,425 20,383

Diluted ............................ 63,334 61,288 59,237 58,967 53,293

Other operating data:

Comparable store sales increase(2) ........ 10.9% 11.0% 1.4% 0.2% 6.4%

Number of stores end of year ............ 449 389 346 311 249

Total square footage end of year .......... 4,747,148 4,094,808 3,613,840 3,240,579 2,589,244

Total square footage per store(3) ......... 10,573 10,526 10,445 10,420 10,399

Average total square footage(4) .......... 4,413,236 3,811,597 3,459,628 2,960,355 2,283,935

Net sales per average total square foot(5) . . . $ 402 $ 382 $ 353 $ 366 $ 399

Capital expenditures ................... 128,636 97,115 68,105 110,863 101,866

Depreciation and amortization ........... 75,931 64,936 62,166 51,445 39,503

Balance sheet data:

Cash and cash equivalents ............... $ 253,738 $ 111,185 $ 4,017 $ 3,638 $ 3,789

Working capital ....................... 415,377 241,032 136,417 159,695 117,039

Property and equipment, net ............. 376,985 326,099 290,861 292,224 236,389

Total assets .......................... 957,217 730,488 553,635 568,932 469,413

Total debt ............................———106,047 74,770

Total stockholders’ equity ............... 584,704 402,533 292,608 244,968 211,503

29