Ulta 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

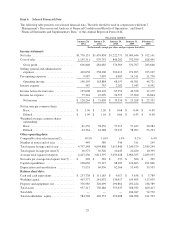

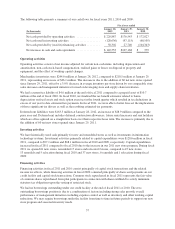

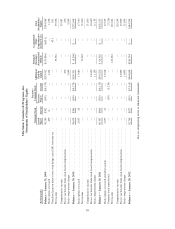

Contractual obligations

We lease retail stores, warehouses, corporate offices and certain equipment under operating leases with various

expiration dates through fiscal 2027. Our store leases generally have initial lease terms of 10 years and include renewal

options under substantially the same terms and conditions as the original leases. In addition to future minimum lease

payments, most of our lease agreements include escalating rent provisions which we recognize straight-line over the

term of the lease, including any lease renewal periods deemed to be probable. For certain locations, we receive cash

tenant allowances and we report these amounts as deferred rent, which is amortized on a straight-line basis as a

reduction of rent expense over the term of the lease, including any lease renewal periods deemed to be probable. While

a number of our store leases include contingent rentals, contingent rent amounts are insignificant.

The following table summarizes our contractual arrangements and the timing and effect that such commitments

are expected to have on our liquidity and cash flows in future periods. The table below excludes variable

expenses related to contingent rent, common area maintenance, insurance and real estate taxes. The table below

includes obligations for executed agreements for which we do not yet have the right to control the use of the

property as of January 28, 2012:

(In thousands) Total

Less Than

1 Year

1to3

Years

3to5

Years

After 5

Years

Operating lease obligations(1) ................. $935,909 $123,945 $252,236 $221,551 $338,177

(1) Variable operating lease obligations related to common area maintenance, insurance and real estate taxes are

not included in the table above. Total expenses related to common area maintenance, insurance and real

estate taxes for fiscal 2011 were $25.3 million.

Critical accounting policies and estimates

Management’s discussion and analysis of financial condition and results of operations is based upon our financial

statements, which have been prepared in accordance with U.S. generally accepted accounting principals (GAAP).

The preparation of these financial statements required the use of estimates and judgments that affect the reported

amounts of our assets, liabilities, revenues and expenses. Management bases estimates on historical experience

and other assumptions it believes to be reasonable under the circumstances and evaluates these estimates on an

on-going basis. Actual results may differ from these estimates. A discussion of our more significant estimates

follows. Management has discussed the development, selection, and disclosure of these estimates and

assumptions with the audit committee of the board of directors.

Inventory valuation

Merchandise inventories are carried at the lower of average cost or market value. Cost is determined using the

weighted-average cost method and includes costs incurred to purchase and distribute goods as well as related

vendor allowances including co-op advertising, markdowns, and volume discounts. We record valuation

adjustments to our inventories if the cost of a specific product on hand exceeds the amount we expect to realize

from the ultimate sale or disposal of the inventory. These estimates are based on management’s judgment

regarding future demand, age of inventory, and analysis of historical experience. If actual demand or market

conditions are different than those projected by management, future merchandise margin rates may be

unfavorably or favorably affected by adjustments to these estimates.

Inventories are adjusted for the results of periodic physical inventory counts at each of our locations. We record a

shrink reserve representing management’s estimate of inventory losses by location that have occurred since the

date of the last physical count. This estimate is based on management’s analysis of historical results and

operating trends. Adjustments to earnings resulting from revisions to management’s estimates of the lower of

cost or market and shrink reserves have been insignificant during fiscal 2011, 2010 and 2009.

39