Ulta 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Selling, general and administrative expenses

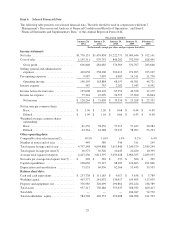

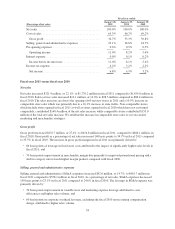

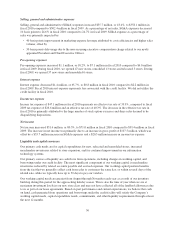

Selling, general and administrative (SG&A) expenses increased $55.7 million, or 18.4%, to $358.1 million in

fiscal 2010 compared to $302.4 million in fiscal 2009. As a percentage of net sales, SG&A expenses decreased

10 basis points to 24.6% in fiscal 2010 compared to 24.7% in fiscal 2009. SG&A expense as a percentage of

sales was primarily impacted by:

‰40 basis points improvement in marketing expense leverage attributed to costs efficiencies and higher sales

volume; offset by

‰30 basis points deleverage due to the non-recurring executive compensation charge related to our newly

appointed President and Chief Executive Officer.

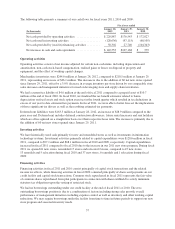

Pre-opening expenses

Pre-opening expenses increased $1.1 million, or 18.2%, to $7.1 million in fiscal 2010 compared to $6.0 million

in fiscal 2009. During fiscal 2010, we opened 47 new stores, remodeled 13 stores and relocated 5 stores. During

fiscal 2009, we opened 37 new stores and remodeled 6 stores.

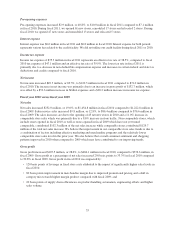

Interest expense

Interest expense decreased $1.4 million, or 65.7%, to $0.8 million in fiscal 2010 compared to $2.2 million in

fiscal 2009. Fiscal 2010 interest expense represents fees associated with the credit facility. We did not utilize the

credit facility in fiscal 2010.

Income tax expense

Income tax expense of $47.1 million in fiscal 2010 represents an effective tax rate of 39.9%, compared to fiscal

2009 tax expense of $26.6 million and an effective tax rate of 40.3%. The decrease in the effective tax rate in

fiscal 2010 is primarily attributed to the large number of stock option exercises and share sales deemed to be

disqualifying dispositions.

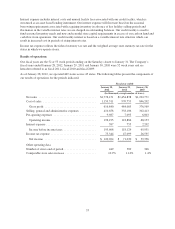

Net income

Net income increased $31.6 million, or 80.5%, to $71.0 million in fiscal 2010 compared to $39.4 million in fiscal

2009. The increase in net income was primarily due to an increase in gross profit of $107.5 million, which was

offset by a $55.7 million increase in SG&A expenses and a $20.5 million increase in income tax expense.

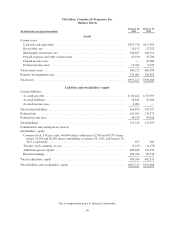

Liquidity and capital resources

Our primary cash needs are for capital expenditures for new, relocated and remodeled stores, increased

merchandise inventories related to store expansion, and for continued improvement in our information

technology systems.

Our primary sources of liquidity are cash flows from operations, including changes in working capital, and

borrowings under our credit facility. The most significant component of our working capital is merchandise

inventories reduced by related accounts payable and accrued expenses. Our working capital position benefits

from the fact that we generally collect cash from sales to customers the same day, or within several days of the

related sale, while we typically have up to 30 days to pay our vendors.

Our working capital needs are greatest from August through November each year as a result of our inventory

build-up during this period for the approaching holiday season. This is also the time of year when we are at

maximum investment levels in our new store class and may not have collected all of the landlord allowances due

to us as part of our lease agreements. Based on past performance and current expectations, we believe that cash

on hand, cash generated from operations and borrowings under the credit facility will satisfy the Company’s

working capital needs, capital expenditure needs, commitments, and other liquidity requirements through at least

the next 12 months.

36