Suzuki 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

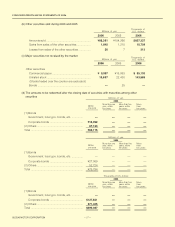

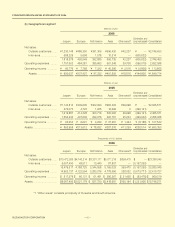

(c) Items related to retirement benefit cost

Remarks:

The retirement benefit cost of subsidiaries where simplified methods are adopted is

accounted for “a. Service cost”.

Thousands of

U.S. dollars

Millions of

yen

2006 2005 2006

a. Service cost ¥6,444 ¥6,100 $54,861

b. Interest cost 1,472 1,470 12,533

c. Assumed return on investment (108) (102) (920)

d. Amortized amount of actuarial difference 961 1,029 8,183

e. Amortized amount of prior service cost (718) (718) (6,118)

f. Retirement benefit cost (a+b+c+d+e) ¥8,051 ¥7,778 $68,538

g. Loss from the withdrawal from Employees

Pension Funds of some subsidiaries

—(88) —

h. Total (f+g) ¥8,051 ¥7,689 $68,538

CONSOLIDATED FINANCIAL STATEMENTS OF 2006

40

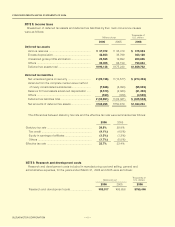

(d) Items related to the calculation standard for the retirement benefit obligation

a. Term allocation of the estimated

amount of retirement benefits : Period fixed amount basis

b. Discount rate : 2006 2.00%

2005 2.00%

c. Assumed return of investment ratio : 2006 0.23% - 1.50%

2005 0.23% - 1.50%

d. Number of years for amortization

of prior service cost : Mainly 15 years

To be amortized by straight line method with

the employees’ average remaining service years

at the time when the difference was caused.

e. Number of years for amortization of

the difference caused by an actuarial

calculation : Mainly 15 years

To be amortized from the next fiscal year by

straight line method with the employees’ average

remaining service years at the time when the

difference was caused.