Suzuki 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

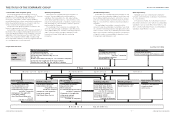

(d) System to ensure proper business operation of the corporate group

To ensure a proper business operation of the corporate group which consists of the Company and its

subsidiaries, the Company has established the “Rules of Business Control Supervision”. They are revised

whenever necessary. The subsidiaries and affiliates report to the Company on their business operation and

consult with the Company on important matters in accordance with those rules, and departments in charge give

guidance and advice to them to enhance their management structure. And our audit department helps to make

rules for the subsidiaries and affiliates, conducts guidance, supporting and auditing for their regulatory

compliance. It also promotes efficiency and standardization of their business.

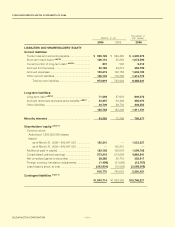

(4) Remuneration for directors

Remuneration paid to directors and corporate auditors is as follows:

(Number of payees:persons, Amount:million yen)

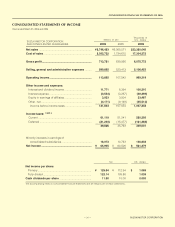

(5) Remuneration for independent auditing

(a) The remuneration amount to be paid by the Company to independent auditors is 39 million yen.

(b) Of the amount shown in (a), the remuneration amount to be paid for audit certification is 39 million yen.

Note: Since the audit agreement between the Company and independent auditors does not distinguish the remuneration for auditing

based on the “Law for Special Exceptions to the Commercial Code Concerning Audits, etc., of Kabushiki Kaisha” from that for

auditing based on the “Securities and Exchange Law”, the Company can not specify respective amounts substantially and has

described the total amount for those audits.

Directors Corporate Auditors Total

Number Amount Number Amount Number Amount

of payees of payees of payees

Remuneration based on resolution

of shareholders’ meeting 30 505 5 52 35 558

Bonus based on appropriation

of retained earnings 29 175 5 25 34 200

Total 680 77 758

MANAGEMENT POLICY

23