Suzuki 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

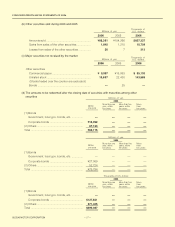

Assets pledged as collateral as of March 31, 2006:

Millions of Thousands of

yen U.S. dollars

Property, plant and equipment .............................................. ¥4,979 $42,385

Millions of Thousands of

Year ending March 31 yen U.S. dollars

2007 ....................................................................................... ¥ 801 $ 6,818

2008 ....................................................................................... 1,068 9,091

2009 ....................................................................................... 2,329 19,832

2010 ....................................................................................... 39,542 336,617

Thereafter .............................................................................. 28,654 243,930

¥72,395 $616,290

The aggregate annual maturities of long-term debt outstanding as of March 31, 2006 were as

follows:

2006 2005 2006

Commitment contract total ...................................... ¥150,000 ¥100,000 $1,276,921

Actual loan balance ................................................ ———

Variance .................................................................. ¥150,000 ¥100,000 $1,276,921

Millions of

yen

Thousands of

U.S. dollars

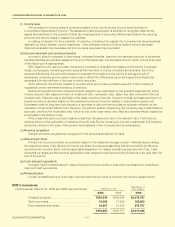

NOTE 6: Loan commitment

The Company has the commitment contract with five banks for effective financing.

The outstanding balance of this contract as of March 31, 2006 and 2005 were as follows:

CONSOLIDATED FINANCIAL STATEMENTS OF 2006

39

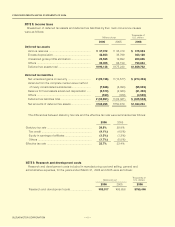

NOTE 7: Accrued retirement and severance benefits

(a) Outline of an adopted retirement benefit system

In the case of the Company, as a defined benefit plan, Employee Pension Fund, Approved

Retirement Annuity System and Termination Allowance Plan are established.

(b) Items related to a retirement benefit obligation

Remarks:1) The premium retirement allowance paid on a temporary basis is not included.

2)

Some of subsidiaries adopt simplified methods for the calculation of retirement benefits.

2006 2005 2006

a. Retirement benefit obligation ¥(113,848) ¥(113,460) $(969,172)

b. Pension assets 57,867 54,799 492,619

c.

Unrecognized retirement benefit obligation (a + b)

¥ (55,980) ¥ (58,661) $(476,552)

d.

Unrecognized difference by an actuarial calculation

13,403 15,170 114,101

e.

Unrecognized prior service cost (decrease of liabilities)

(9,020) (9,739) (76,793)

f.

Accrued retirement and severance benefits (c+d+e)

¥ (51,598) ¥ (53,230) $(439,245)

Millions of

yen

Thousands of

U.S. dollars