Square Enix 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

those of catalogue titles due to our improved ability to fulfill

repeat orders. As a result, we succeeded in fully capturing

market opportunities in game software for current-generation

game consoles.

For next-generation game consoles, it become important to

select appropriate region, customer segment and timing based

on careful analysis, as opposed to the wining strategy for the

current generation of selecting and concentrating on the wining

game console.

Next-generation game consoles take networked environ-

ments as a given, and offer attractive high-definition (HD) graphics

capability as their selling point. The flip side, of course, is that

these consoles cannot be enjoyed in full unless they are networked

and viewed with HD displays. Handheld game devices, on the

other hand, are self-sufficient and have no particular environment

requirements. Consequently, we expected that the next

generation handheld game devices would penetrate the market

ahead of the next generation consoles in fiscal 2006 and fiscal

2007, and adjusted development resources accordingly.

Examples of our success with this approach in Japan include

sales of the totally remade “FINAL FANTASY III”, which sold

990,000 copies in Japan and 460,000 copies in North America;

and “Dragon Quest Monsters: Joker”, which sold 1.41 million

copies in Japan. Both titles were developed for Nintendo Co.,

Ltd.’s new handheld game device, NINTENDO DS, and played a

major role in our success. Our decision to utilize Nintendo Wi-Fi

connection in “Dragon Quest Monsters: Joker” proved to be

extremely popular, with over 5.6 million cumulative online

accesses, proving new market potential.

This strategy is for the transition period, of course, and we

have no intention of relying solely on handheld game devices in

the future. In fact, over the next few years we aim to put our

resources in research and development of cutting edge tech-

nologies in the next generation consoles and personal computer

(PC). We will also work on improving our development pipelines

to achieve more efficient and flexible game development. For

that purpose, we created the Research and Development

Division as a permanent organization in fiscal 2006, in a

departure from our previous project-based R&D activities.

In the Games (Online) segment, we are continuing to raise

the bar on profits each year. In fiscal 2006, we maintained a

profit margin of 49.5%, which is extremely high. A high

dependency on “FINAL FANTASY XI” is one of our weaknesses

in this business, but in fiscal 2006 we set the stage to move on

to the next generation of games.

In the Mobile Phone Content business, we cleared our profit

target and posted a new record, but our overseas expansion fell

short of expectations. It is becoming apparent that the mobile

phone markets in overseas develop very differently from

Japanese one. We need to calibrate our strategy accordingly.

In the Publication segment, we achieved the highest levels of

sales and profits that we have seen since the days of the former

ENIX. Rather than relying on a single hit product, we acquired

the ability to generate a constant stream of hits, and our strategy

of taking our content across diverse media including, periodicals,

anime titles and comic books, is proving to be effective.

04

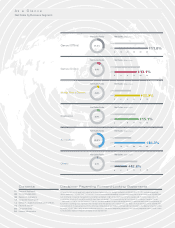

Game Software Unit Sales by Region

■ Europe

■ North

America

■ Japan

Thousands of Units

Years ended March 31

2007200620052004

0

5,000

10,000

15,000

20,000

[Figure 2]

TAITO: Index of Monthly Sales of Existing

Arcade Facilities*

Source: SQUARE ENIX

■ TAITO

Other company

Became wholly

owned subsidiary

TAITO

April 2007April 2006April 2005April 2004

75%

100%

125%

Joined

the SQUARE ENIX

Group

* Change from

previous year

[Figure 3]

#H2-14-07スクエニ-欧文 07.8.31 14:26 ページ4