Square Enix 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

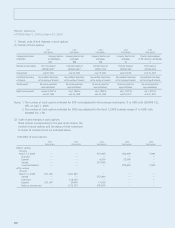

• FY2006 (April 1, 2006 to March 31, 2007)

Same as in FY2005

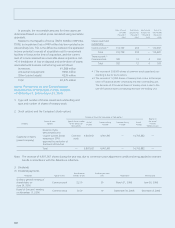

6. Amortization of Cost of Investments in

Subsidiaries in Excess of Net Assets Acquired

• FY2005 (April 1, 2005 to March 31, 2006)

Cost of investments in subsidiaries in excess of net assets

acquired is amortized over a period of 5-20 years on a

straight-line basis.

• FY2006 (April 1, 2006 to March 31, 2007)

Not applicable

7.Amortization of goodwill

• FY2005 (April 1, 2005 to March 31, 2006)

Not applicable

• FY2006 (April 1, 2006 to March 31, 2007)

Goodwill is amortized using the straight-line method over a

period of either five years or 20 years. However, goodwill

whose value has been extinguished is fully amortized during

the consolidated fiscal year in which it was incurred.

8. Appropriation of Retained Earnings

• FY2005 (April 1, 2005 to March 31, 2006)

The consolidated statement of capital surplus and retained

earnings is prepared based on retained earnings (deficit) appro-

priations determined during the fiscal year.

• FY2006 (April 1, 2006 to March 31, 2007)

Not applicable

9. Scope of Cash and Cash Equivalents in the

Statements of Cash Flows

• FY2005 (April 1, 2005 to March 31, 2006)

Cash and cash equivalents in the consolidated statements of

cash flows is comprised of cash on hand, bank deposits which

are able to be withdrawn on demand and highly liquid short-

term investments with an original maturity of three months or

less and with minor risk of significant fluctuations in value.

• FY2006 (April 1, 2006 to March 31, 2007)

Same as in FY2005

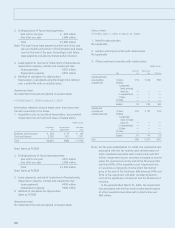

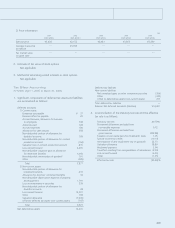

New Accounting Standards

• FY2005 (April 1, 2005 to March 31, 2006)

(Accounting standard for impairment of non-current assets)

Effective this fiscal year, the Company has adopted an

accounting standard for the impairment of fixed assets

“Opinion Concerning Establishment of Accounting Standard

for the Impairment of Fixed Assets” [Business Accounting

Council, August 9, 2002]) and “Guidance on Accounting

Standard for Impairment of Fixed Assets ”(Accounting Standard

Implementation Guidance No. 6 [Accounting Standards Board

of Japan, October 31, 2003]). As a result, income before

income taxes decreased ¥4,426 million in this fiscal year from

the amount which would have been recorded under the

method applied in the previous year. The effect of the new

accounting standard on segment information has been

reflected wherever relevant. The cumulative amount of impair-

ment loss was deducted directly from the book value of each

asset in accordance with the amended consolidated accounting

policy.

• FY2006 (April 1, 2006 to March 31, 2007)

(Accounting Standard for Presentation of Net Assets in the

Balance Sheet)

“Accounting Standard for Presentation of Net Assets in the

Balance Sheet” (Accounting Standards Board of Japan

Statement No. 5, December 9, 2005) and “Guidance on

Accounting Standard for Presentation of Net Assets in the

Balance Sheet” (Accounting Standards Board of Japan

Guidance No. 8, December 9, 2005) was applied from the con-

solidated fiscal year ended March 31, 2007. The amount corre-

sponding to total shareholders’ equity under the previous

method of presentation is ¥129,461 million.

The net assets section of the consolidated balance sheet

was prepared in accordance with the revised “Regulations for

Consolidated Financial Statements”.

(Accounting Standards for Business Combinations)

Effective the fiscal year ended March 31, 2007, the Company

has adopted “Accounting Standard for Business

Combinations” (“Statement of Opinion on Implementing

Accounting Standard for Business Combinations,” (Business

Accounting Council, October 31, 2003), “Accounting Standard

for Business Divestitures” (Accounting Standards Board of

Japan Statement No. 7, December 27, 2005) and “Guidance

on Accounting Standard for Business Combinations and

Accounting Standard for Business Divestitures” (Accounting

Standards Board of Japan Guidance No. 10, December 27,

2005).

15-52_07スクエニ欧文 07.8.31 14:29 ページ33