Square Enix 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

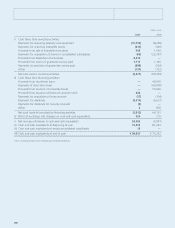

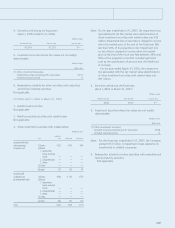

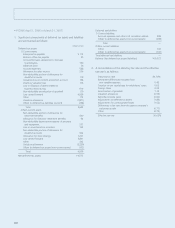

Reclassifications

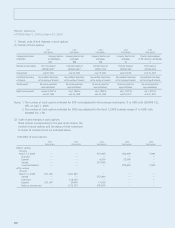

• FY2005 (April 1, 2005 to March 31, 2006)

Not applicable

• FY2006 (April 1, 2006 to March 31, 2007)

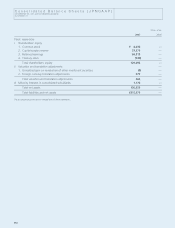

(Consolidated Balance Sheets)

In accordance with revisions made in the regulations for the

consolidated balance sheet, the consolidation adjustment

account and the “goodwill” portion of the “other” item within

intangible assets at March 31, 2006 were reclassified into

“goodwill” effective the fiscal year ended March 31, 2007. In

the consolidated balance sheet at March 31, 2006, the “good-

will” portion of the “other” item within intangible fixed assets

amounted to ¥218 million.

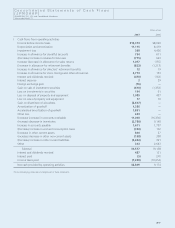

(Consolidated Statements of Cash Flows)

Within cash flows from operating activities, for the fiscal year

ended March 31, 2006, foreign exchange gains and losses

were recorded in the “other” category of cash flows from

operating activities. This has been listed as a separate account-

ing category effective the fiscal year ended March 31, 2007.

The amount within the “other” category corresponding to

foreign exchange gains and losses for the fiscal year ended

March 31, 2006 was ¥223 million.

For the fiscal year ended March 31, 2006, goodwill amorti-

zation was included within the “other” segment in cash flows

from operating activities. This has been listed as a separate

accounting category effective the fiscal year ended March 31,

2007.

Amortization of the consolidated adjustment account,

included in the “other” category for the fiscal year ended

March 31, 2006 was ¥1,445 million.

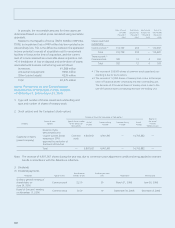

Notes to Consolidated Balance Sheets

• FY2005 (April 1, 2005 to March 31, 2006)

*1 Investments in non-consolidated subsidiaries and affiliates:

Investment securities ¥35 million

Investments and other assets ¥24 million

*2 Number of shares of common stock outstanding:

Common stock 110,729,623

*3 Number of shares of treasury stock:

Common stock 182,139

*4 Contingent liabilities for guarantees:

The Company has issued a revolving guarantee to a maxi-

mum limit of U.S.$15 million on behalf of consolidated subsidiary

SQUARE ENIX, INC., in favor of SONY COMPUTER ENTERTAIN-

MENT AMERICA INC. As of March 31, 2006, there was no liabil-

ity outstanding under the guarantee.

The Company has issued a guarantee on behalf of consoli-

dated subsidiary TAITO CORPORATION covering its bank over-

draft agreement (maximum amount: ¥41,000 million).

As of March 31, 2006, there is no liability outstanding under

this guarantee.

Consolidated subsidiary TAITO CORPORATION has issued

guarantees on behalf of its commercial audiovisual products cus-

tomers covering their leasing fee liabilities to TOKYO LEASING

Corporation and KYOCERA Leasing Co., Ltd. These guarantees

cover leasing fee liabilities up to ¥60 million.

*5 Notes maturing at the end of FY2005

Not applicable

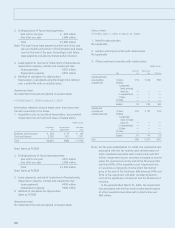

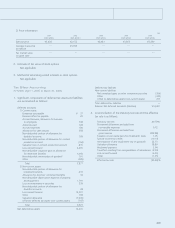

• FY2006 (April 1, 2006 to March 31, 2007)

*1 Investments in non-consolidated subsidiaries and affiliates:

Investments and other assets ¥119 million

*2 Number of shares of common stock outstanding:

Not applicable

*3 Number of shares of treasury stock:

Not applicable

*4 Contingent liabilities for guarantees:

The Company’s consolidated subsidiary TAITO CORPORA-

TION has issued a guarantee of ¥12 million covering its lease

obligations to Diamond Asset Finance Co., Ltd., one of the

Company’s sales partners.

*5 Notes maturing at the end of FY2006:

Notes maturing at the end of FY2006 was as if the notes

had been settled as of the end of FY2006, although that date

fell on a bank holiday. The amount of notes maturing at the

end of FY2006 was as follows.

Notes receivable ¥410 million

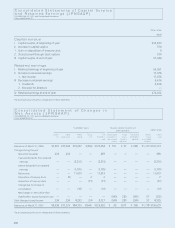

Notes to Consolidated Statements of Income

• FY2005 (April 1, 2005 to March 31, 2006)

*1 Selling, general and administrative

expenses include R&D costs of ¥1,145 million.

*2 Breakdown of loss on sale of property and equipment

Tools and fixtures ¥19 million

*3 Breakdown of loss on disposal of property and equipment

Buildings and structures ¥52 million

Tools and fixtures ¥220 million

Amusement equipment ¥159 million

Software ¥22 million

Other ¥3 million

Total ¥457 million

*4 Loss on valuation of investment securities was due to the

significant decline in market prices of marketable securities.

15-52_07スクエニ欧文 07.8.31 14:29 ページ34