Square Enix 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

SQUARE

ENIX

C O., L T D.

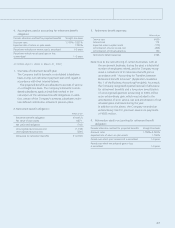

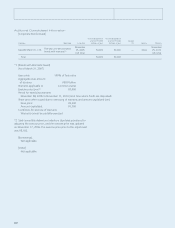

• FY2006 (April 1, 2006 to March 31, 2007)

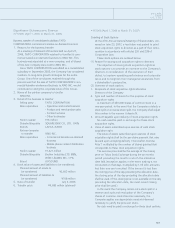

Granting of Stock Options

At the 27th Annual General Meeting of Shareholders, con-

vened on June 23, 2007, a resolution was passed to grant

stock acquisition rights to directors as a part of their remu-

neration in accordance with articles 236 and 238 of

Corporation Law.

These stock options are outlined below.

(1) Reason for issuing stock acquisition rights to directors

The objective of issuing stock acquisition rights as

stock options is to provide an incentive to the Company’s

directors in consideration of the execution of their

duties, to improve operating performance and corporate

value and to heighten their managerial awareness from

a shareholder’s perspective.

(2) Overview of stock options

1. Recipients of stock acquisition rights allocation

Directors of the Company

2. Type and number of shares for the purpose of stock

acquisition rights

A maximum of 450,000 shares of common stock in a

one-year period. In the event that the Company conducts a

stock split or a reverse stock split, the Company shall adjust

this number in the manner it deems fit.

3. Amount payable upon delivery of stock acquisition rights

No cash need be paid in exchange for these stock

acquisition rights.

4. Value of assets subscribed upon exercise of each stock

acquisition right

The value of assets subscribed upon exercise of stock

acquisition rights shall be the per-share payment that may

be paid upon accepting delivery (“hereinafter, Exercise

Price”) multiplied by the number of shares granted that

corresponds to these stock acquisition rights.

The exercise price shall be the average of the closing

price on Tokyo Stock Exchange during the six months

period preceding the month in which the allocation

date falls (exception applies in the event trading is not

conducted on that day), multiplied by 1.05 with amounts

less than one yen truncated. If the amount is less than

the closing price of the day preceding the allocation date,

the closing price of the day preceding the allocation date

shall be used. (If the closing price is not available on the day

preceding the allocation date, the most recent closing

price shall be used.)

In the event the Company carries out a stock split or a

reverse stock split and revaluation of the Company’s

shares of common stocks become nesessary, the

Company applies any appropriate measures deemed

necessary to justify the price per share.

No cash need be paid in exchange for these stock options.

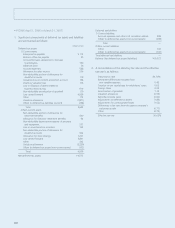

Significant Subsequent Events

• FY2005 (April 1, 2005 to March 31, 2006)

Business transfer of consolidated subsidiary TAITO

CORPORATION’s commercial karaoke-on-demand business

1. Reasons for the business transfer

At a meeting of its Board of Directors held on April 27,

2006, TAITO CORPORATION resolved to transfer its com-

mercial karaoke-on-demand business to XING INC. This

business was separated as a new company, and all shares

of the new company were sold to XING INC.

Since TAITO CORPORTATION was added as a consolidated

subsidiary in September 2005, the Company has considered

medium- to long-term growth strategies for the entire

Group. One of the conclusions reached through this

process was that the sale of TAITO CORPORATION’s com-

mercial karaoke-on-demand business to XING INC. would

contribute to raising the corporate value of the Group.

2. Name of the partner company to transfer

XING INC.

3. Detail of the business to transfer

Selling party TAITO CORPORATION

Main operations - Operation and rental business

- Product and merchandise sales

- Content services

- Other businesses

Paid-in capital ¥16 million

Shareholding ratio SQUARE ENIX CO., LTD. 100%

Brands LAVCA, X2000

Partner company

to transfer XING INC.

Main operations - Commercial karaoke-on-demand

business

- Mobile phone content distribution

business

Paid-in capital ¥1,621 million

Shareholding ratio Brother Industries LTD. 88%,

INTEC LEASING INC. 11%

Brand JOYSOUND

4. Book value of assets and liabilities to be transferred:

Planned amount of assets to

be transferred ¥2,602 million

Planned amount of liabilities to

be transferred ¥708 million

5. Date of transfer July 3, 2006

6. Transfer price ¥4,683 million (planned)

15-52_07スクエニ欧文 07.8.31 14:29 ページ51