Square Enix 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

Europe

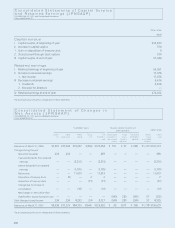

Years ended March 31 Millions of yen

2006 2007 Change

¥1,378 ¥12,271 ¥10,893

The Company primarily conducts Games (Offline), Games (Online)

and Mobile Phone Content businesses in Europe. In this region,

sales of the Company’s game content were generally licensed to

leading European publishers. However, during the period under

review, SQUARE ENIX LTD., a wholly owned subsidiary of the

Company in this region, began preparations for game sales under

the Company’s own brand. Sales during the year included such

titles as “FINAL FANTASY XII,” “KINGDOM HEARTS II” and

“Dragon Quest: The Journey of the Cursed King” for PS2. As a

result, sales in Europe increased ¥10,893 million, to ¥12,271 mil-

lion.

Asia

Years ended March 31 Millions of yen

2006 2007 Change

¥3,025 ¥1,551 ¥(1,474)

In Asia, the Company provides primarily Games (Online) and

Amusement services. In the Games (Online) business, the Company

primarily operates “CROSS GATE” online game service for the

PC platform in China. In the Amusement business, the Company

operates game arcade facilities in South Korea and China. Sales in

Asia decreased ¥1,474 million, to ¥1,551 million.

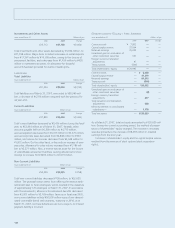

4. Strategic Outlook, Issues Facing

Management and Future Direction

It is management’s main task to grow the Company in the medium

and long term, maintaining profitability with the creation of

advanced, high-quality content.

As the development and popularization of information technol-

ogy (IT) and network environments are rapidly advancing, new digi-

tal entertainment will transform the industry structure in the near

future; customer needs for network-compliant entertainment will

increase; and multifunctional terminals will allow users easy access

to various types of content.

It is the Company’s medium- and long-term strategy to respond

to such changes and open a new era of digital entertainment.

In the fiscal year ending March 31, 2008, as part of our imple-

mentation of a medium-term business strategy, we will focus on

expanding our existing offline game franchises and strengthening

our network-related businesses. We will also work to restore prof-

itability to the Amusement business.

The Group’s targets for the fiscal year ending March 31, 2008

are as follows (as of May 23, 2007):

Years ended March 31 Millions of yen

2004 2005 2006 2007 2008

Results Results Results Results Targets

Net sales ¥63,202 ¥73,864 ¥124,473 ¥163,472 ¥162,500

Operating income 19,398 26,438 15,470 25,916 21,000

Recurring income 18,248 25,901 15,547 26,241 20,000

Net income 10,993 14,932 17,076 11,619 12,000

Owing to the consolidation of Taito at the end of September

2005, Taito’s operating results are reflected in the Company’s con-

solidated statements of income from October 2005. Following this

merger, we have set an operating income ratio of 20% or more

and average annual growth in net income per share (EPS) of 10%

as our main numerical targets.

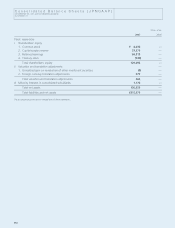

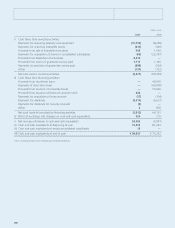

5. Dividend Policy

It is one of the Company’s most important management policies to

return profit to shareholders. We will reserve retained earnings as

we take priority over investments for effective purposes for future

growth of corporate value, such as the enhancement and expan-

sion of existing business operations, capital investments for new

business development and merger and acquisition (M&A) activities.

After ensuring that sufficient funds are retained for these purposes,

we return profit to shareholders in a manner that strikes an optimal

balance between linkage to operating performance and a consis-

tent payout, resulting in continuous and stable dividend payouts.

For dividends linked with consolidated operating results, our target

is a consolidated payout ratio of 30%.

The Company’s basic policy is to pay dividends out of retained

earnings twice each fiscal year, awarding an interim dividend and a

year-end dividend. Decisions on awarding dividends from retained

earnings are made by the annual general meeting of shareholders

for the year-end dividend and by the Board of Directors for the

interim dividend.

As to the dividends for fiscal 2006, in line with our highest level

of consolidated recurring income on record, the Company awarded

dividends for the term of ¥35 per share (¥10 per share in interim

dividends and ¥25 per share as the year-end dividend), an increase

of ¥5 from fiscal 2005, which was ¥30 per share (¥10 per share in

interim dividends and ¥20 as the year-end dividend). This dividend

increase resulted in a consolidated payout ratio of 33.3%.

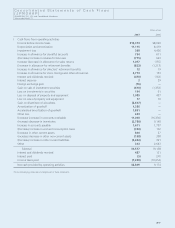

Dividends from retained earnings during the fiscal year were as

follows:

Date of resolution

Total dividends Dividends per share

Board of Directors’ resolution (Millions of yen) (Yen)

November 17, 2006

Board of Directors’ resolution ¥1,105 ¥10

June 23, 2007

Resolution of the annual general

meeting of shareholders 2,768 25

15-52_07スクエニ欧文 07.8.31 14:29 ページ20