Square Enix 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

F) Allowance for directors’ retirement benefits

An allowance for directors’ retirement benefits is provided

to adequately cover the costs of directors’ retirement

benefits, which are accounted for on an accrual basis in

accordance with internal policy.

• FY2006 (April 1, 2006 to March 31, 2007)

A) Allowance for doubtful accounts

Same as in FY2005

B) Reserve for bonuses

Same as in FY2005

C) Allowance for sales returns

Same as in FY2005

D) Allowance for store closings

Same as in FY2005

E) Allowance for retirement benefits

Same as in FY2005

F) Allowance for directors’ retirement benefits

Same as in FY2005

(4) Translation of foreign currency transactions and accounts:

• FY2005 (April 1, 2005 to March 31, 2006)

All monetary assets and liabilities of the Company and its domestic

consolidated subsidiaries denominated in foreign currencies are

translated at the balance sheet date at the year-end rates. The

resulting translation gains or losses are charged or credited to

income. All monetary assets and liabilities of overseas consoli-

dated subsidiaries are translated as of the balance sheet date at

the year-end rates, and all income and expense accounts are

translated at rates for their respective periods. The resulting

translation adjustments are recorded in minority interests in

consolidated subsidiaries and shareholders’ equity as “Foreign

currency translation adjustments.”

• FY2006 (April 1, 2006 to March 31, 2007)

All monetary assets and liabilities of the Company and its domestic

consolidated subsidiaries denominated in foreign currencies are

translated at the balance sheet date at the year-end rates. The

resulting translation gains or losses are charged or credited to

income. All monetary assets and liabilities of overseas consolidated

subsidiaries are translated as of the balance sheet date at the year-

end rates, and all income and expense accounts are translated at

rates for their respective periods. The resulting translation adjust-

ments are recorded in net assets as “Foreign currency translation

adjustments” and are included in minority interests in consoli-

dated subsidiaries.

(5) Accounting for leases:

• FY2005 (April 1, 2005 to March 31, 2006)

Finance leases, other than those for which the ownership of

the leased assets are considered to be transferred to the

lessees, are accounted for as operating leases.

• FY2006 (April 1, 2006 to March 31, 2007)

Same as in FY2005

(6) Accounting for deferred assets:

• FY2005 (April 1, 2005 to March 31, 2006)

A) Stock issuance expenses

Costs associated with issuances of shares of common stock

are expensed as incurred.

B) Corporate bond issuance expenses

Costs associated with issuances of shares of common stock

are expensed as incurred.

• FY2006 (April 1, 2006 to March 31, 2007)

A) Share delivery expenses

Costs associated with issuances of shares of common stock

are expensed as incurred.

B) Corporate bond issuance expenses

Not applicable

(7) Additional accounting policies used to prepare consolidated

financial statements:

• FY2005 (April 1, 2005 to March 31, 2006)

A) Accounting treatment of consumption taxes

Income statement items are presented exclusive of

consumption taxes.

B) Accounting treatment of overseas subsidiaries

The accounts and records of overseas subsidiaries are

maintained in conformity with accounting principles and

practices generally accepted in their respective countries.

• FY2006 (April 1, 2006 to March 31, 2007)

A) Accounting treatment of consumption taxes

Same as in FY2005

B) Accounting treatment of overseas consolidated subsidiaries

Same as in FY2005

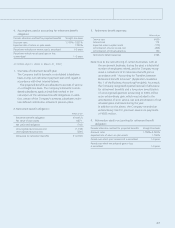

5. Valuation of Assets and Liabilities of

Consolidated Subsidiaries

• FY2005 (April 1, 2005 to March 31, 2006)

All assets and liabilities of consolidated subsidiaries are revalued

on acquisition.

15-52_07スクエニ欧文 07.8.31 14:29 ページ32