Square Enix 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

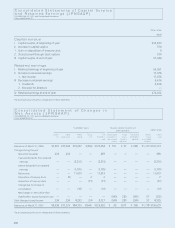

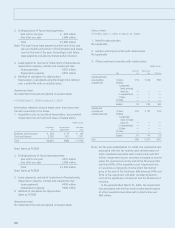

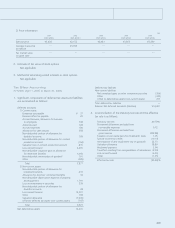

*5 Impairment loss

In this fiscal year, the Group posted impairment losses on

the following non-current assets:

Impairment

Location Usage Category amount

Nagareyama-shi, Chiba Idle assets Land ¥ 42

Tokushima-shi, Tokushima Idle assets Land 146

Chiyoda-ku, Tokyo and other Idle assets Telephone sub- 9

scription rights

Republic of Korea (TAITO

KOREA CORPORATION) — Goodwill 260

The United States of America

(UIEVOLUTION, INC.) —Cost of

investments in

subsidiaries in

exess of net

assets acquired 3,926

Other ——41

Total ¥4,426

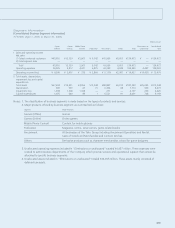

Cash inflows from business segments of the Group are

complementary to one another in terms of similarities in

nature of products, merchandise, services and markets.

Consequently, all assets for operational purposes are classi-

fied in one asset group, and idle assets which are not used

for operational purposes are classified individually. In addi-

tion, assets related to the Group’s headquarters and wel-

fare facilities are classified as common-use assets.

Since the market values of the idle assets listed above

have declined severely in relation to their book values, and

because it remains uncertain as to whether the Group will

be able to utilize these assets in the future, their book

values have been reduced to the recoverable amounts.

The resulting losses have been posted as an impairment loss

totaling ¥198 million.

Furthermore, the recoverable amounts for these assets

have been determined according to market prices calcu-

lated using real estate appraisals.

An amount of ¥260 million related to the Republic of

Korea (TAITO KOREA CORPORATION) has been posted as

an impairment loss. This is the difference between the

appraised income potential in excess of acquisition cost for

amusement facilities in Korea at the time of acquisition, and

the current level of income assessed as recoverable above

acquisition cost.

Goodwill impairment totaling ¥3,926 million listed for

the United States of America (UIEVOLUTION, INC.) has been

posted as an impairment loss. This amount is the appraised

difference between future cash inflows and the current

book value.

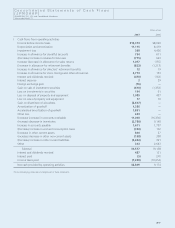

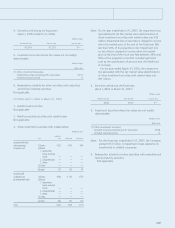

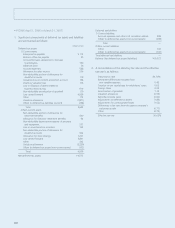

• FY2006 (April 1, 2006 to March 31, 2007)

*1 Selling, general and administrative

expenses include R&D costs of ¥2,374 million.

*2 Breakdown of loss on sale of property and equipment

Tools and fixtures ¥17 million

*3 Breakdown of loss on disposal of property and equipment

Buildings and structures ¥269 million

Tools and fixtures ¥266 million

Amusement equipment ¥484 million

Software ¥56 million

Other ¥7 million

Total ¥1,085 million

*4 Loss on valuation of investment securities was due to the

significant decline in market prices of marketable securities.

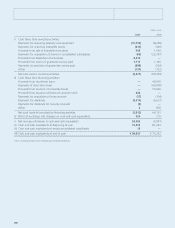

*5 Impairment loss

In this fiscal year, the Group posted impairment losses on

the following asset groups:

Millions of yen

Impairment

Location Usage Category amount

Kumagaya-shi, Saitama Idle assets Buildings, land ¥ 91

Chiyoda-ku, Tokyo

and other Idle assets, other Tools and fixtures 169

Chiyoda-ku, Tokyo

and other Idle assets Telephone sub- 21

scription rights

Republic of Korea Goodwill 40

Other 44

Total ¥368

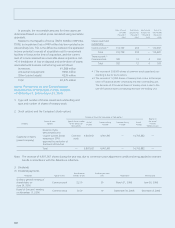

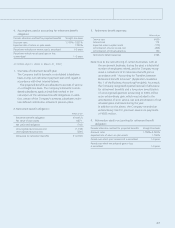

Cash inflows from each business segments of the Group are

complementary to one another in terms of similarities in nature

of products, merchandise, services and markets. Consequently,

all assets for operational purposes are classified in one asset

group, and idle assets which are not used for operational pur-

poses are classified individually. In addition, assets related to

the Group’s headquarters and welfare facilities are classified as

common-use assets.

Of the assets listed above, as a result of the restructuring of

the amusement business, the assets owned by the pachinko

and slot machine department were marked down to their

recoverable values, resulting in an impairment loss of ¥102 mil-

lion, which were recorded as an extraordinary loss.

For e-commerce assets, tools and fixtures were marked

down to their recoverable values, resulting in an impairment

loss of ¥66 million, which was posted as an extraordinary loss.

As the market values of buildings, land and telephone subscrip-

tion rights that were idle were substantially lower than their

market values, and they were not expected to be used in the

future, they were marked down to their recoverable values,

resulting in an impairment loss of ¥112 million, which was

posted as an extraordinary loss.

15-52_07スクエニ欧文 07.8.31 14:29 ページ35