Square Enix 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

• FY2006 (April 1, 2006 to March 31, 2007)

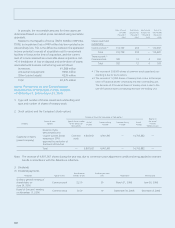

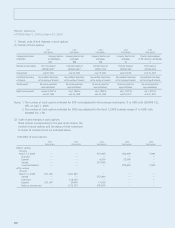

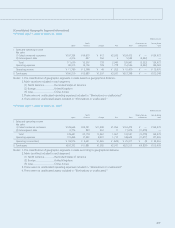

1. Significant components of deferred tax assets and liabilities

are summarized as follows:

Millions of yen

Deferred tax assets

1) Current assets

Enterprise tax payable ¥ 114

Business office tax payable 50

Accrued bonuses, allowance for bonuses

to employees 760

Advances paid 36

Accrued expenses 588

Allowance for sales returns 536

Non-deductible portion of allowance for

doubtful accounts 119

Valuation loss on content production account 158

Inventory valuation loss 176

Loss on disposal of assets related to

business restructuring 919

Non-deductible amortization of goodwill 110

Loss carried forward 4,059

Other 173

Valuation allowance (1,871)

Offset to deferred tax liabilities (current) (298)

Total 5,634

2) Non-current assets

Non-deductible portion of allowance for

retirement benefits 500

Allowance for directors’ retirement benefits 64

Non-deductible depreciation expense of property

and equipment 577

Loss on investments in securities 763

Non-deductible portion of allowance for

doubtful accounts 902

Allowance for store closings 1,201

Loss carried forward 5,891

Other 362

Valuation allowance (5,220)

Offset to deferred tax assets (non-current assets) (102)

Total 4,939

Net deferred tax assets 10,573

Deferred tax liabilities

1) Current liabilities

Accrued expenses and other cost calculation details 298

Offset to deferred tax assets (non-current assets) (298)

Total —

2) Non-current liabilities

Other 102

Offset to deferred tax assets (non-current assets) (102)

Total deferred tax liabilities —

Balance: Net deferred tax assets (liabilities) ¥10,573

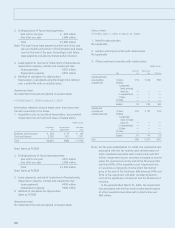

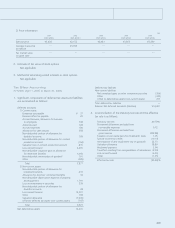

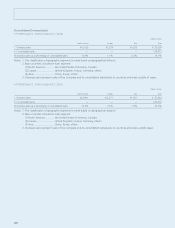

2. A reconciliation of the statutory tax rate and the effective

tax rate is as follows:

Statutory tax rate 40.70%

Permanent differences excluded from

non-taxable expenses 0.45

Taxation on per capita basis for inhabitants’ taxes 0.63

Foreign taxes 0.23

Amortization of goodwill 7.13

Valuation allowance (6.95)

Refunded income taxes (0.62)

Adjustments to deferred tax assets (1.86)

Adjustments for unrecognized losses (1.52)

Differences in tax rates from the parent company’s

statutory tax rate (0.77)

Other (0.79)

Effective tax rate 36.63%

15-52_07スクエニ欧文 07.8.31 14:29 ページ44