Shutterfly 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.by the landlord. The Company will increase the asset and financing obligation as additional building uplift

costs are incurred by the landlord during the construction period.

Upon completion of construction, the Company will evaluate the de-recognition of the asset and

liability under the provisions of ASC 840.40 Leases – Sale-Leaseback Transactions. However, if the

Company does not comply with the provisions needed for sale-leaseback accounting, the lease will be

accounted for as a financing obligation and lease payments will be attributed to (1) a reduction of the

principal financing obligation; (2) imputed interest expense; and (3) land lease expense (which is

considered an operating lease and a component of cost of goods sold) representing an imputed cost to

lease the underlying land of the facility. In addition, the underlying building asset will be depreciated over

the building’s estimated useful life of 30 years. And at the conclusion of the lease term, the Company

would de-recognize both the net book values of the asset and financing obligation.

Indemnifications

In the normal course of business, the Company enters into contracts and agreements that contain a

variety of representations and warranties and provide for general indemnifications. The Company’s

exposure under these agreements is unknown because it involves future claims that may be made against

the Company, but have not yet been made. To date, the Company has not paid any claims or been required

to defend any action related to its indemnification obligations. However, the Company may record charges

in the future as a result of these indemnification obligations.

Contingencies

From time to time, the Company may have certain contingent liabilities that arise in the ordinary

course of its business activities. The Company accrues contingent liabilities when it is probable that future

expenditures will be made and such expenditures can be reasonably estimated.

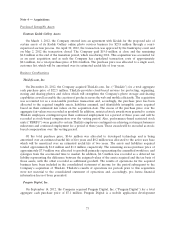

Syndicated Credit Facility

On November 22, 2011, the Company entered into a credit agreement (‘‘Credit Agreement’’) with J.P.

Morgan Securities LLC, Wells Fargo Securities, LLC, Fifth Third Bank, Silicon Valley Bank, US Bank and

Citibank, N.A. (‘‘the Banks’’). JPMorgan Chase Bank, N.A. acted as administrative agent in the Credit

Agreement. The Credit Agreement is for 5 years and provides for a $125.0 million senior secured revolving

credit facility (the ‘‘credit facility’’) and if requested by the Company, the Banks may increase the credit

facility by $75.0 million subject to certain conditions, for a total credit facility of $200.0 million. From

inception through December 31, 2012, the Company has not drawn on the credit facility.

At the Company’s option, loans under the Facility will bear stated interest based on the Base Rate or

Adjusted LIBO Rate, in each case plus the Applicable Rate (respectively, as defined in the Credit

Agreement). The Base Rate will be, for any day, the highest of (a) 1/2 of 1% per annum above the Federal

Funds Effective Rate (as defined in the Credit Agreement), (b) JPMorgan Chase Bank’s prime rate and

(c) the Adjusted LIBO Rate for a term of one month plus 1.00%. Eurodollar borrowings may be for one,

two, three or six months (or such period that is 12 months or less, requested by Intersil and consented to by

all the Lenders) and will be at an annual rate equal to the period-applicable Eurodollar Rate plus the

Applicable Rate. The Applicable Rate for all revolving loans is based on a pricing grid ranging from

0.500% to 1.25% per annum for Base Rate loans and 1.50% to 2.250% for Adjusted LIBO Rate loans

based on the Company’s Leverage Ratio (as defined in the Credit Agreement).

79