Shutterfly 2012 Annual Report Download - page 33

Download and view the complete annual report

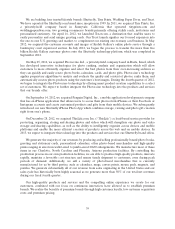

Please find page 33 of the 2012 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• concerns about the security of online transactions and the privacy of personal information;

• delayed shipments or shipments of incorrect or damaged products; and

• inconvenience associated with returning or exchanging purchased items.

If purchasers of digital photography products and services do not choose to shop online, our net

revenues and results of operations would be harmed.

The third party software systems that we utilize to assist us in the calculation and reporting of financial data may

contain errors that we may not identify in a timely manner.

We use numerous third party licensed software packages, most notably our equity software and our

enterprise resource planning software, which are complex and fully integrated into our financial reporting.

Such third party software may contain errors that we may not identify in a timely manner. If those errors

are not identified and addressed timely, our financial reporting may not be in compliance with generally

accepted accounting principles.

If our internal controls are not effective, there may be errors in our financial information that could require a

restatement or delay our SEC filings, and investors may lose confidence in our reported financial information,

which could lead to a decline in our stock price.

It is possible that we may discover significant deficiencies or material weaknesses in our internal

control over financial reporting in the future. Any failure to maintain or implement required new or

improved controls, or any difficulties we encounter in their implementation, could cause us to fail to meet

our periodic reporting obligations, or result in material misstatements in our financial information. Any

such delays or restatements could cause investors to lose confidence in our reported financial information

and lead to a decline in our stock price.

Maintaining and improving our financial controls and the requirements of being a public company may strain our

resources, divert management’s attention and affect our ability to attract and retain qualified board members.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of

1934, the Sarbanes-Oxley Act of 2002 and the rules and regulations of The NASDAQ Stock Market. In

addition, the recently passed Dodd-Frank Wall Street Reform and Consumer Protection Act contains

various provisions applicable to the corporate governance functions of public companies. Additional or

new regulatory requirements may be adopted in the future. The requirements of existing and potential

future rules and regulations will likely continue to increase our legal, accounting and financial compliance

costs, make some activities more difficult, time-consuming or costly and may also place undue strain on our

personnel, systems and resources.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls

and procedures and effective internal control over financial reporting. Significant resources and

management oversight are required to design, document, test, implement and monitor internal control

over relevant processes and to remediate any deficiencies. As a result, management’s attention may be

diverted from other business concerns, which could harm our business, financial condition and results of

operations. These efforts also involve substantial accounting related costs. In addition, if we are unable to

continue to meet these requirements, we may not be able to remain listed on The NASDAQ Global Select

Market.

31