Shutterfly 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

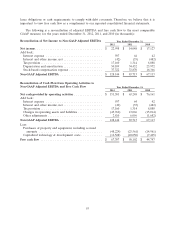

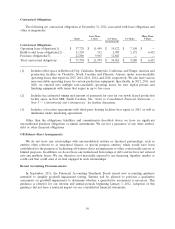

lease obligations or cash requirements to comply with debt covenants. Therefore, we believe that it is

important to view free cash flow as a complement to our reported consolidated financial statements.

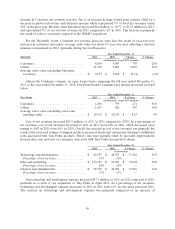

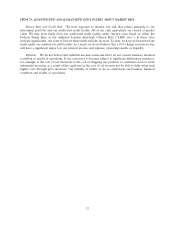

The following is a reconciliation of adjusted EBITDA and free cash flow to the most comparable

GAAP measure, for the years ended December 31, 2012, 2011, and 2010 (in thousands):

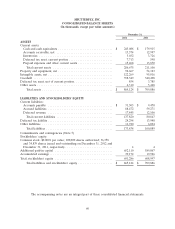

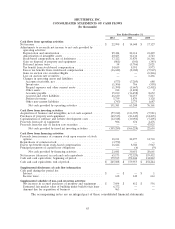

Reconciliation of Net Income to Non-GAAP Adjusted EBITDA Year Ended December 31,

2012 2011 2010

Net income ...................................... $ 22,998 $ 14,048 $ 17,127

Add back:

Interest expense ................................ 597 64 42

Interest and other income, net ...................... (42) (35) (482)

Tax provision ................................... 17,160 1,314 8,088

Depreciation and amortization ...................... 50,109 34,452 25,972

Stock-based compensation expense ................... 37,322 33,870 16,366

Non-GAAP Adjusted EBITDA ........................ $ 128,144 $ 83,713 $ 67,113

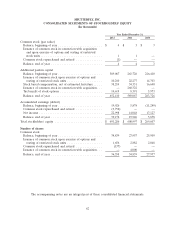

Reconciliation of Cash Flow from Operating Activities to

Non-GAAP Adjusted EBITDA and Free Cash Flow Year Ended December 31,

2012 2011 2010

Net cash provided by operating activities ................ $ 151,381 $ 63,248 $ 76,161

Add back:

Interest expense ................................ 597 64 42

Interest and other income, net ...................... (42) (35) (482)

Tax provision ................................... 17,160 1,314 8,088

Changes in operating assets and liabilities .............. (43,762) 13,066 (15,014)

Other adjustments ............................... 2,810 6,056 (1,682)

Non-GAAP Adjusted EBITDA ........................ 128,144 83,713 67,113

Less:

Purchases of property and equipment, including accrued

amounts .................................... (48,229) (23,561) (14,961)

Capitalized technology & development costs ............ (12,528) (10,050) (7,405)

Free cash flow ................................... $ 67,387 $ 50,102 $ 44,747

55