Shutterfly 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

periods prior to this acquisition were not material to the consolidated statement of operations and,

accordingly, pro forma financial information has not been presented.

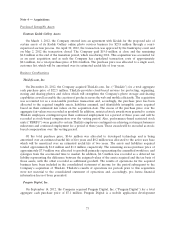

Tiny Prints, Inc.

On April 25, 2011, the Company acquired Tiny Prints, Inc. (‘‘Tiny Prints’’), a privately-held ecommerce

company. Pursuant to the terms of the agreement, all of the outstanding shares of capital stock of Tiny

Prints, together with vested and unvested Tiny Prints equity awards, were acquired by the Company for

aggregate consideration comprised of (i) approximately $146.0 million in cash, and approximately

4.0 million shares of the Company’s common stock issuable in exchange for shares of Tiny Prints capital

stock and (ii) Company equity awards for approximately 1.4 million shares of common stock in exchange

for vested and unvested Tiny Prints’ equity awards assumed by the Company, in each case pursuant and

subject to the terms of the Merger Agreement. The 5.4 million shares of Shutterfly common stock issuable

pursuant to the agreement equal approximately 18.5% of the Company’s outstanding common stock as of

March 30, 2011.

Subsequent to the acquisition date, the Company finalized the Net Working Capital, Net Cash, and

Net Debt amounts resulting in a reduction of purchase price of approximately $1.3 million. In accordance

with the merger agreement, this amount will be repaid from the consideration held in escrow in the same

proportion of cash and stock as was made in the initial escrow contribution. As of December 31, 2011, the

cash proceeds due from escrow have been received and the stock has been deducted from shares

outstanding.

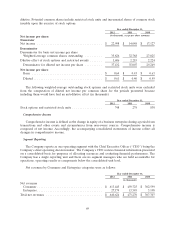

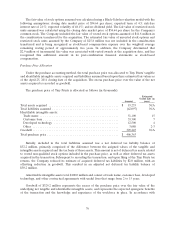

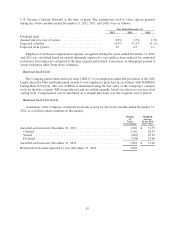

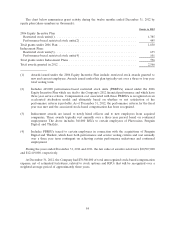

Purchase Price

The total purchase price, after adjusting for changes in Net Working Capital, Net Cash, and Net Debt,

is as follows (in thousands):

Cash consideration .................................................... $ 146,040

Fair value of common stock issued ......................................... 218,557

Fair value of vested stock awards assumed ................................... 41,766

Total fair value of consideration transferred .................................. $ 406,363

Tiny Prints operates tinyprints.com and weddingpaperdivas.com which offer cards, invitations, and

personalized stationery. With the acquisition and combined resources, the Company expects to incur

significant revenue and cost synergies through the Tiny Prints brands, customer base and workforce.

Estimated Fair Value of Stock Awards Assumed

In connection with the acquisition, each Tiny Prints stock option that was outstanding and unexercised

was assumed and converted into an option to purchase the Company’s common stock based on a

conversion ratio of 0.327, which was calculated as the consideration price per share of $12.44 divided by a

fixed per share value of $38. The Company assumed the stock options in accordance with the terms of the

applicable Tiny Prints stock option plan and the stock option agreement. Based on Tiny Prints’ stock

options outstanding at April 25, 2011, the Company converted options to purchase approximately

4.1 million shares of Tiny Prints common stock into options to purchase approximately 1.3 million shares

of the Company’s common stock. The Company also assumed and converted 196,896 unvested shares of

outstanding Tiny Prints restricted stock units into 64,386 shares of the Company’s restricted stock units,

using the same conversion ratios stated above.

75