Shutterfly 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 5 — Commitments and Contingencies

Operating Leases

The Company leases office and production space under various non-cancelable operating leases that

expire no later than May 2017. Rent expense was $4,776,000, $4,201,000 and $3,964,000, for the years

ended December 31, 2012, 2011 and 2010, respectively. In 2010, the Company renewed the lease for its

corporate office. The lease renewal provided for a $2.1 million tenant improvement reimbursement

allowance which the Company utilized during 2011. Reimbursements under this provision were recorded

as a deferred lease incentive and will reduce rent expense over the remaining lease term.

Rent expense is recorded on a straight-line basis over the lease term. When a lease provides for fixed

escalations of the minimum rental payments, the difference between the straight-line rent charged to

expense, and the amount payable under the lease is recognized as deferred rent.

The Company also has non-cancelable operating leases for certain production equipment with terms

ranging from four to five years. As of December 31, 2012, the total outstanding obligation under all

equipment operating leases was $22,578,000.

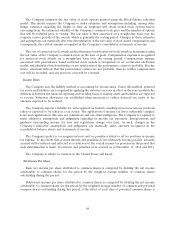

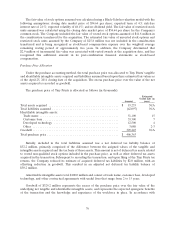

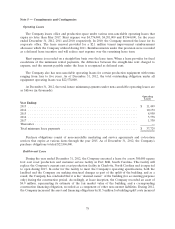

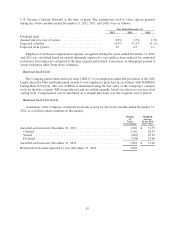

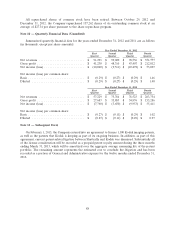

At December 31, 2012, the total future minimum payments under non-cancelable operating leases are

as follows (in thousands):

Operating

Leases

Year Ending:

2013 .............................................................. $ 11,499

2014 .............................................................. 10,172

2015 .............................................................. 8,950

2016 .............................................................. 5,778

2017 .............................................................. 1,330

Thereafter .......................................................... —

Total minimum lease payments ........................................... $ 37,729

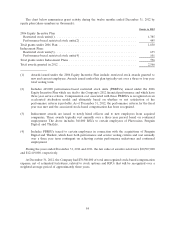

Purchase obligations consist of non-cancelable marketing and service agreements and co-location

services that expire at various dates through the year 2015. As of December 31, 2012, the Company’s

purchase obligations totaled $22,806,000.

Build-to-suit Lease

During the year ended December 31, 2012, the Company executed a lease for a new 300,000 square

foot east coast production and customer service facility in Fort Mill, South Carolina. This facility will

replace the Company’s current east coast production facility in Charlotte, North Carolina and is expected

to open during 2013. In order for the facility to meet the Company’s operating specifications, both the

landlord and the Company are making structural changes as part of the uplift of the building, and as a

result, the Company has concluded that it is the ‘‘deemed owner’’ of the building (for accounting purposes

only) during the construction period. Accordingly, at lease inception, the Company recorded an asset of

$4.9 million, representing its estimate of the fair market value of the building, and a corresponding

construction financing obligation, recorded as a component of other non-current liabilities. During 2012,

the Company increased the asset and financing obligations by $1.5 million for building uplift costs incurred

78