Shutterfly 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

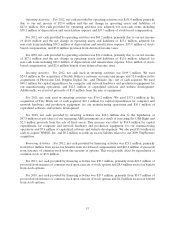

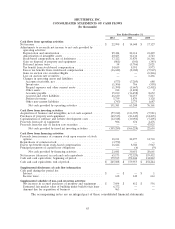

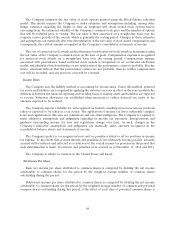

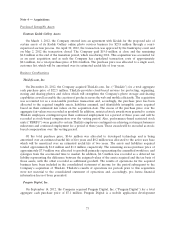

SHUTTERFLY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2012 2011 2010

Cash flows from operating activities:

Net income ....................................... $ 22,998 $ 14,048 $ 17,127

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization ......................... 29,424 22,316 23,429

Amortization of intangible assets ....................... 20,685 12,136 2,543

Stock-based compensation, net of forfeitures ............... 37,322 33,870 16,366

Gain on disposal of property and equipment ............... (861) (301) (345)

Deferred income taxes .............................. 54 (5,766) 2,021

Tax benefit from stock-based compensation ................ 14,619 8,391 5,973

Excess tax benefits from stock-based compensation ........... (16,622) (8,380) (5,967)

Gain on auction rate securities Rights ................... — — (6,266)

Loss on auction rate securities ......................... — — 6,266

Changes in operating assets and liabilities:

Accounts receivable, net ........................... (577) (7,205) 688

Inventories ..................................... (1,306) 766 (558)

Prepaid expenses and other current assets ............... (1,399) (5,667) (2,402)

Other assets .................................... 212 (1,402) 2

Accounts payable ................................ 15,230 (16,458) 8,652

Accrued and other liabilities ......................... 26,610 12,255 5,817

Deferred revenue ................................ 5,739 1,870 1,128

Other non-current liabilities ......................... (747) 2,775 1,687

Net cash provided by operating activities .............. 151,381 63,248 76,161

Cash flows from investing activities:

Acquisition of business and intangibles, net of cash acquired ...... (57,212) (133,705) (5,981)

Purchases of property and equipment ..................... (40,535) (23,149) (14,405)

Capitalization of software and website development costs ........ (12,528) (10,050) (7,405)

Proceeds from sale of equipment ........................ 986 676 2,476

Proceeds from the sale of auction rate securities .............. — — 47,925

Net cash provided by (used in) investing activities ........ (109,289) (166,228) 22,610

Cash flows from financing activities:

Proceeds from issuance of common stock upon exercise of stock

options ......................................... 10,211 22,277 14,703

Repurchases of common stock .......................... (3,752) — —

Excess tax benefits from stock-based compensation ............ 16,622 8,380 5,967

Principal payments of capital lease obligations ............... — (6) (9)

Net cash provided by financing activities ............... 23,081 30,651 20,661

Net increase (decrease) in cash and cash equivalents ........... 65,173 (72,329) 119,432

Cash and cash equivalents, beginning of period ............... 179,915 252,244 132,812

Cash and cash equivalents, end of period ................... $ 245,088 $ 179,915 $ 252,244

Supplemental disclosures of cash flow information:

Cash paid during the period for:

Interest ......................................... $ — $ — $ 1

Income taxes ..................................... 618 140 663

Supplemental schedule of non-cash investing activities:

Net increase in accrued purchases of property and equipment . . . $ 7,694 $ 412 $ 556

Estimated fair market value of building under build-to-suit lease . 6,372 — —

Amount due for acquisition of business .................. 963 — —

The accompanying notes are an integral part of these consolidated financial statements.

63