Red Lobster 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DARDEN RESTAURANTS

This is the Bottom Line

Great Food and Beverage 43 Produce Great Results in 2002

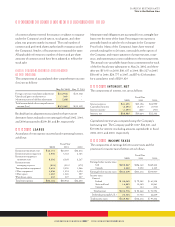

NOTE 17 COMMITMENTS AND CONTINGENCIES

The Company makes trade commitments in the course of its

normal operations. As of May 26, 2002, and May 27, 2001, the

Company was contingently liable for approximately $9,786

and $10,889, respectively, under outstanding trade letters of

credit issued in connection with purchase commitments. These

letters of credit have terms of one month or less and are used

to collateralize the Company’s obligations to third parties for

the purchase of inventories.

As collateral for performance on contracts and as credit

guarantees to banks and insurers, the Company is contingently

liable under standby letters of credit. As of May 26, 2002,

and May 27, 2001, the Company had $30,000 and $30,000,

respectively, of standby letters of credit related to workers’

compensation and general liabilities accrued in the Company’s

consolidated financial statements. As of May 26, 2002, and

May 27, 2001, the Company had $8,608 and $8,166, respec-

tively, of standby letters of credit related to contractual oper-

ating lease obligation and other payments. All standby letters

of credit are renewable annually.

As of May 26, 2002, and May 27, 2001, the Company

had $5,463 and $6,922, respectively, of guarantees associated

with third party sub-lease obligations. The guarantees expire

over the lease terms.

The Company is involved in litigation arising from the

normal course of business. In the opinion of management, this

litigation is not expected to materially impact the Company’s

consolidated financial statements.

Notes to Consolidated Financial Statements

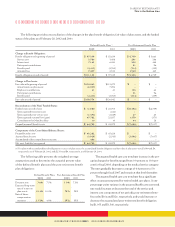

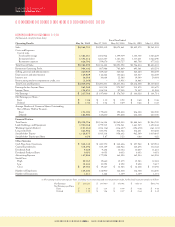

NOTE 18 QUARTERLY DATA (UNAUDITED)

The following table summarizes unaudited quarterly data for fiscal 2002 and 2001:

Fiscal 2002 – Quarters Ended

Aug. 26 Nov. 25 Feb. 24 May 26 Total

Sales $1,073,892 $1,007,475 $1,124,943 $1,162,391 $4,368,701

Restaurant Operating Profit (1) 245,332 206,506 258,435 273,829 984,102

Earnings before Income Taxes (2) 95,577 56,255 102,776 108,701 363,309

Net Earnings (2) 62,156 36,463 66,220 72,949 237,788

Net Earnings per Share:(2)

Basic 0.35 0.21 0.38 0.42 1.36

Diluted 0.34 0.20 0.36 0.40 1.30

Dividends Paid per Share – 0.0265 – 0.0265 0.053

Stock Price:

High 21.667 21.653 28.660 29.767 N/A

Low 16.400 15.400 20.007 23.733 N/A

Fiscal 2001 – Quarters Ended

Aug. 27 Nov. 26 Feb. 25 May 27 Total

Sales $1,011,292 $ 925,879 $ 981,216 $1,074,032 $3,992,419

Restaurant Operating Profit (1) 224,758 191,075 214,640 237,513 867,986

Earnings before Income Taxes 87,838 45,311 75,491 92,578 301,218

Net Earnings 56,921 29,541 49,527 61,011 197,000

Net Earnings per Share:

Basic 0.31 0.17 0.27 0.35 1.10

Diluted 0.31 0.16 0.27 0.33 1.06

Dividends Paid per Share – 0.0265 – 0.0265 0.053

Stock Price:

High 12.583 17.500 18.000 19.660 N/A

Low 10.292 11.083 12.667 13.773 N/A

(1) Restaurant operating profit is calculated as sales less cost of sales.

(2) Includes after-tax restructuring credits of $1,394 and $183 recorded in the second and fourth quarters of fiscal 2002, respectively. The related basic and diluted net earnings

per share impact of the credits recorded in the second and fourth quarters of fiscal 2002 amounted to $0.01 and $0.00, respectively.

.