Red Lobster 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

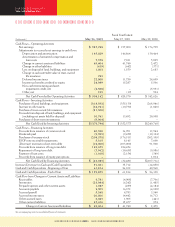

ManagementÕs Discussion and Analysis

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

DARDEN RESTAURANTS

This is the Bottom Line

The Company’s adjusted debt to adjusted total capital

ratio (which includes 6.25 times the total annual restaurant

minimum rent and 3 times the total annual restaurant equipment

minimum rent as a component of adjusted debt and adjusted

total capital) was 46 percent and 44 percent at May 26, 2002,

and May 27, 2001, respectively. The Company’s fixed-charge

coverage ratio, which measures the number of times each

year that the Company earns enough to cover its fixed

charges, amounted to 6.8 times and 6.5 times at May 26, 2002,

and May 27, 2001, respectively. Based on these ratios, the

Company believes its financial condition remains strong. The

composition of the Company’s capital structure is shown in

the following table.

May 26, May 27,

(In millions) 2002 2001

CAPITAL STRUCTURE

Short-term debt $ – $ 12.0

Long-term debt 662.5 520.6

Total debt 662.5 532.6

Stockholders’ equity 1,128.9 1,033.3

Total capital $1,791.4 $1,565.9

ADJUSTMENTS TO CAPITAL

Leases-debt equivalent $ 294.6 $ 275.1

Adjusted total debt 957.1 807.7

Adjusted total capital 2,086.0 1,841.0

Debt to total capital ratio 37% 34%

Adjusted debt to adjusted total capital ratio 46% 44%

The Company’s Board of Directors has approved a stock

repurchase program that authorizes the Company to repur-

chase up to 96.9 million shares of the Company’s common

stock. Net cash flows used by financing activities included the

Company’s repurchase of 9.0 million shares of its common

stock for $209 million in fiscal 2002 compared to 12.7 million

shares for $177 million in fiscal 2001 and 17.2 million shares

for $202 million in fiscal 2000. As of May 26, 2002, a total of

86.3 million shares have been purchased under the program.

The stock repurchase program is used by the Company to off-

set the dilutive effect of stock option exercises and to increase

shareholder value. The repurchased common stock is reflected

as a reduction of stockholders’ equity.

Net cash flows used by investing activities included capital

expenditures incurred principally for building new restaurants,

replacing equipment, and remodeling existing restaurants.

Capital expenditures were $318 million in fiscal 2002, com-

pared to $355 million in fiscal 2001, and $269 million in fiscal

2000. The reduced expenditures in fiscal 2002 resulted pri-

marily from a reduction in renewal and replacement spending

at Red Lobster restaurants. The increased expenditures in fis-

cal 2001 resulted primarily from new restaurant growth. The

Company estimates that its fiscal 2003 capital expenditures will

approximate $400 million. Net cash flows used by investing

activities for fiscal 2002 also included the purchase of $32 mil-

lion of trust-owned life insurance policies that cover certain

Company officers and other key employees. The policies

were purchased to offset a portion of the Company’s obligations

under its non-qualified deferred compensation plan.

The Company is not aware of any trends or events that

would materially affect its capital requirements or liquidity.

The Company believes that its internal cash generating

capabilities and borrowings available under its shelf registra-

tion for unsecured debt securities and short-term commercial

paper program should be sufficient to finance its capital

expenditures, stock repurchase program, and other operating

activities through fiscal 2003.

Financial Condition

The Company’s current assets at May 26, 2002, totaled $450

million, a 37.0 percent increase over current assets of $328 mil-

lion at May 27, 2001. The increase resulted primarily from

increases in cash and cash equivalents of $91 million and

short-term investments of $10 million that resulted principally

from the short-term investment of proceeds received from

the March 2002 medium-term debt issuance. Inventories

also increased by $24 million primarily as a result of

opportunistic seafood purchases and purchases in support

of upcoming promotions.

Other assets of $159 million at May 26, 2002, increased

from $109 million at May 27, 2001, primarily as a result of the

purchase of $32 million of trust-owned life insurance policies

during fiscal 2002 as well as an increase in capitalized costs

associated with software improvements.

Current liabilities increased by $47 million compared to

fiscal 2001, primarily as a result of increases in accrued income

taxes, gift card and gift certificate payables, and employee

benefit related accruals.

Great Food and Beverage 22 Produce Great Results in 2002