Red Lobster 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DARDEN RESTAURANTS

This is the Bottom Line

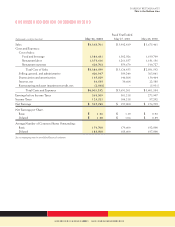

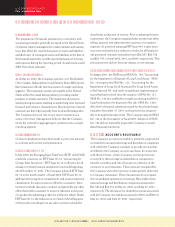

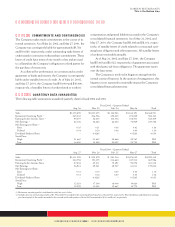

NOTE 5 OTHER ASSETS

The components of other assets are as follows:

May 26, May 27,

2002 2001

Prepaid pension costs $ 48,262 $ 45,624

Capitalized software costs 33,615 14,366

Trust-owned life insurance 30,757 –

Liquor licenses 19,405 18,642

Prepaid interest and loan costs 17,895 19,768

Miscellaneous 9,503 10,477

Total other assets $159,437 $108,877

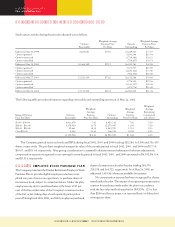

NOTE 6 SHORT-TERM DEBT

Short-term debt at May 26, 2002, and May 27, 2001, consisted

of $0 and $12,000, respectively, of unsecured commercial paper

borrowings with original maturities of one month or less. The

debt bore an interest rate of 4.3 percent at May 27, 2001.

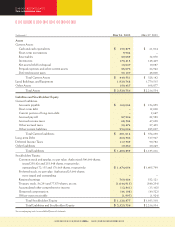

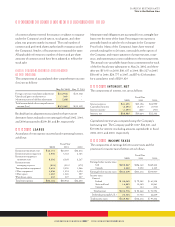

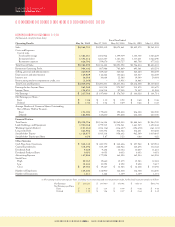

NOTE 7 LONG-TERM DEBT

The components of long-term debt are as follows:

May 26, May 27,

2002 2001

8.375% senior notes due September 2005 $150,000 $150,000

6.375% notes due February 2006 150,000 150,000

5.75% medium-term notes due March 2007 150,000 –

7.45% medium-term notes due April 2011 75,000 75,000

7.125% debentures due February 2016 100,000 100,000

ESOP loan with variable rate of interest

(2.17% at May 26,2002) due

December 2018 39,140 44,455

Other –2,647

Total long-term debt 664,140 522,102

Less issuance discount (1,634) (1,528)

Total long-term debt less issuance discount 662,506 520,574

Less current portion –(2,647)

Long-term debt, excluding current portion $662,506 $517,927

In July 2000, the Company registered $500,000 of debt

securities with the Securities and Exchange Commission (SEC)

using a shelf registration process. Under this process, the

Company may offer, from time to time, up to $500,000 of debt

securities. In September 2000, the Company issued $150,000 of

unsecured 8.375 percent senior notes due in September 2005.

The senior notes rank equally with all of the Company’s other

unsecured and unsubordinated debt and are senior in right of

payment to all of the Company’s future subordinated debt.

In November 2000, the Company filed a prospectus sup-

plement with the SEC to offer up to $350,000 of medium-term

notes from time to time as part of the shelf registration process

referred to above. In April 2001, the Company issued $75,000

of unsecured 7.45 percent medium-term notes due in April 2011.

In March 2002, the Company issued $150,000 of unsecured

5.75 percent medium-term notes due in March 2007. As of

May 26, 2002, the Company’s shelf registration provides for the

issuance of an additional $125,000 of unsecured debt securities.

In January 1996, the Company issued $150,000 of unse-

cured 6.375 percent notes due in February 2006 and $100,000

of unsecured 7.125 percent debentures due in February 2016.

Concurrent with the issuance of the notes and debentures, the

Company terminated, and settled for cash, interest-rate swap

agreements with notional amounts totaling $200,000, which

hedged the movement of interest rates prior to the issuance

of the notes and debentures. The cash paid in terminating the

interest-rate swap agreements is being amortized to interest

expense over the life of the notes and debentures. The effec-

tive annual interest rate is 7.57 percent for the notes and 7.82

percent for the debentures, after consideration of loan costs,

issuance discounts, and interest-rate swap termination costs.

The Company also maintains a credit facility that expires

in October 2004, with a consortium of banks under which the

Company can borrow up to $300,000. The credit facility allows

the Company to borrow at interest rates that vary based on

the prime rate, LIBOR, or a competitively bid rate among the

members of the lender consortium, at the option of the Company.

The credit facility is available to support the Company’s com-

mercial paper borrowing program, if necessary. The Company

is required to pay a facility fee of 15 basis points per annum on

the average daily amount of loan commitments by the consor-

tium. The amount of interest and the annual facility fee are

subject to change based on the Company’s achievement of

certain debt ratings and financial ratios, such as maximum

debt to capital ratios. Advances under the credit facility are

unsecured. At May 26, 2002, and May 27, 2001, no borrow-

ings were outstanding under this credit facility.

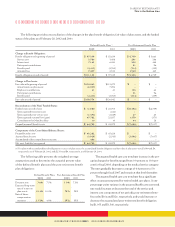

The aggregate maturities of long-term debt for each of

the five fiscal years subsequent to May 26, 2002, and thereafter

are $0 in 2003 through 2005, $300,000 in 2006, $150,000 in

2007, and $214,140 thereafter.

Notes to Consolidated Financial Statements

Great Food and Beverage 34 Produce Great Results in 2002