Red Lobster 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DARDEN RESTAURANTS

This is the Bottom Line

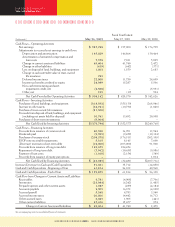

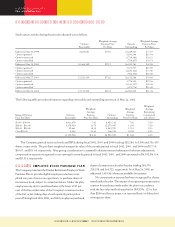

During fiscal 2002, 2001, and 2000, the Company paid income

taxes of $56,839, $63,893, and $53,688, respectively.

The following table is a reconciliation of the U.S. statutory

income tax rate to the effective income tax rate included in the

accompanying consolidated statements of earnings:

Fiscal Year

2002 2001 2000

U.S. statutory rate 35.0% 35.0% 35.0%

State and local income taxes,

net of federal tax benefits 3.1 3.1 3.3

Benefit of federal income

tax credits (3.9) (4.1) (3.9)

Other, net 0.4 0.6 1.1

Effective income tax rate 34.6% 34.6% 35.5%

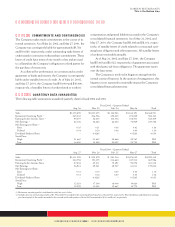

The tax effects of temporary differences that give rise to

deferred tax assets and liabilities are as follows:

May 26, May 27,

2002 2001

Accrued liabilities $ 19,052 $ 14,899

Compensation and

employee benefits 52,804 50,902

Asset disposition and

restructuring liabilities 2,283 5,306

Net assets held for disposal 301 937

Other 2,392 2,436

Gross deferred tax assets $ 76,832 $ 74,480

Buildings and equipment (93,752) (73,578)

Prepaid pension costs (18,096) (17,376)

Prepaid interest (3,478) (3,812)

Deferred rent and interest income (12,496) (13,474)

Capitalized software and other assets (12,127) (5,840)

Other (2,465) (3,182)

Gross deferred tax liabilities $(142,414) $(117,262)

Net deferred tax liabilities $ (65,582) $ (42,782)

A valuation allowance for deferred tax assets is provided

when it is more likely than not that some portion or all of the

deferred tax assets will not be realized. Realization is depend-

ent upon the generation of future taxable income or the rever-

sal of deferred tax liabilities during the periods in which those

temporary differences become deductible. Management con-

siders the scheduled reversal of deferred tax liabilities, pro-

jected future taxable income, and tax planning strategies in

making this assessment. As of May 26, 2002, and May 27,

2001, no valuation allowance has been recognized for

deferred tax assets because the Company believes that suffi-

cient projected future taxable income will be generated to

fully utilize the benefits of these deductible amounts.

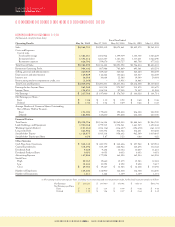

NOTE 14 RETIREMENT PLANS

Defined Benefit Plans and Post-Retirement

Benefit Plan

Substantially all of the Company’s employees are eligible to

participate in a retirement plan. The Company sponsors non-

contributory defined benefit pension plans for its salaried

employees, in which benefits are based on various formulas

that include years of service and compensation factors, and a

group of hourly employees, in which a frozen level of benefits

is provided. The Company’s policy is to fund, at a minimum, the

amount necessary on an actuarial basis to provide for benefits in

accordance with the requirements of the Employee Retirement

Income Security Act of 1974, as amended. The Company also

sponsors a contributory post-retirement benefit plan that pro-

vides health care benefits to its salaried retirees.

Notes to Consolidated Financial Statements

Great Food and Beverage 38 Produce Great Results in 2002