Red Lobster 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

DARDEN RESTAURANTS

This is the Bottom Line

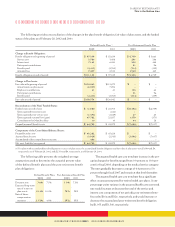

Changes in the fair value of derivatives that are highly

effective and that are designated and qualify as cash flow hedges

are recorded in other comprehensive income until earnings

are affected by the variability in cash flows of the designated

hedged item. Where applicable, the Company discontinues

hedge accounting prospectively when it is determined that

the derivative is no longer effective in offsetting changes in

the cash flows of the hedged item or the derivative is termi-

nated. Any changes in the fair value of a derivative where

hedge accounting has been discontinued or is ineffective are

recognized in earnings. Cash flows related to derivatives are

included in operating activities.

Pre-Opening Expenses

Non-capital expenditures associated with opening new

restaurants are expensed as incurred.

Advertising

Production costs of commercials and programming are charged

to operations in the fiscal year the advertising is first aired. The

costs of other advertising, promotion, and marketing programs

are charged to operations in the fiscal year incurred. Advertis-

ing expense amounted to $187,950, $177,998, and $165,590,

in fiscal 2002, 2001, and 2000, respectively.

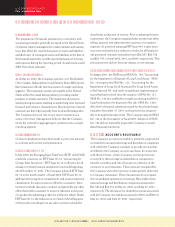

Stock-Based Compensation

SFAS No. 123, “Accounting for Stock-Based Compensation,”

encourages the use of a fair-value method of accounting for

stock-based awards under which the fair value of stock options

is determined on the date of grant and expensed over the vest-

ing period. As allowed by SFAS No.123, the Company has

elected to account for its stock-based compensation plans under

an intrinsic value method that requires compensation expense

to be recorded only, if on the date of grant, the current market

price of the Company’s common stock exceeds the exercise

price the employee must pay for the stock. The Company’s

policy is to grant stock options at the fair market value of

the underlying stock at the date of grant. The Company has

adopted the disclosure requirements of SFAS No.123.

Restricted stock and restricted stock unit (RSU) awards are

recognized as unearned compensation, a component of stock-

holders’ equity, based on the fair market value of the Company’s

common stock on the award date. These amounts are amortized

to compensation expense over the vesting period using assumed

forfeiture rates for different types of awards. Compensation

expense is adjusted in future periods if actual forfeiture rates

differ from initial estimates.

Net Earnings Per Share

Basic net earnings per share is computed by dividing net earnings

by the weighted-average number of common shares outstand-

ing for the reporting period. Diluted net earnings per share

reflects the potential dilution that could occur if securities or

other contracts to issue common stock were exercised or con-

verted into common stock. Outstanding stock options issued

by the Company represent the only dilutive effect reflected

in diluted weighted-average shares outstanding. Options do

not impact the numerator of the diluted net earnings per

share computation.

Options to purchase 161,220, 3,618,900, and 5,379,300

shares of common stock were excluded from the calculation of

diluted net earnings per share for fiscal 2002, 2001, and 2000,

respectively, because their exercise prices exceeded the aver-

age market price of common shares for the period.

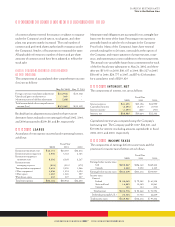

Comprehensive Income

Comprehensive income includes net earnings and other com-

prehensive income items that are excluded from net earnings

under accounting principles generally accepted in the United

States of America. Other comprehensive income items include

foreign currency translation adjustments, the effective unreal-

ized portion of changes in the fair value of cash flow hedges, and

amounts associated with minimum pension liability adjustments.

Foreign Currency Translation

The Canadian dollar is the functional currency for the Company’s

Canadian restaurant operations. Assets and liabilities denomi-

nated in Canadian dollars are translated into U.S. dollars using

the exchange rates in effect at the balance sheet date. Results of

operations are translated using the average exchange rates pre-

vailing throughout the period. Translation gains and losses are

reported as a separate component of accumulated other compre-

hensive income in stockholders’ equity. Gains and losses from

foreign currency transactions, which amounted to $33 and

$1, respectively, are included in the consolidated statements

of earnings for each period.

Great Food and Beverage 31 Produce Great Results in 2002