Red Lobster 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementÕs Discussion and Analysis

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

DARDEN RESTAURANTS

This is the Bottom Line

uses a combination of long-term and short-term borrowings

to fund its liquidity needs.

The Company manages its business and its financial ratios

to maintain an investment grade bond rating, which allows

access to financing at reasonable costs. Currently, the Company’s

publicly issued long-term debt carries “Baa1” (Moody’s Investors

Service), “BBB+” (Standard & Poor’s) and “BBB+” (Fitch) ratings.

The Company’s commercial paper has ratings of “P-2” (Moody’s

Investors Service), “A-2” (Standard & Poor’s) and “F-2” (Fitch).

These ratings are only accurate as of the date of this annual

report and have been obtained with the understanding that

Moody’s Investors Service, Standard & Poor’s, and Fitch will

continue to monitor the credit of the Company and make future

adjustments to such ratings to the extent warranted. The ratings

may be changed, superseded, or withdrawn at any time.

The Company’s commercial paper program serves as its

primary source of short-term financing. As of May 26, 2002,

there were no borrowings outstanding under the program. To

support its commercial paper program, the Company has a

credit facility with a consortium of banks under which the

Company can borrow up to $300 million. The credit facility

expires in October 2004 and contains various restrictive

covenants, such as maximum debt to capital ratios, but does not

contain a prohibition on borrowing in the event of a ratings

downgrade. None of these covenants is expected to impact the

Company’s liquidity or capital resources. As of May 26, 2002,

no amounts were outstanding under the credit facility.

At May 26, 2002, the Company’s long-term debt consisted

principally of: (1) $150 million of unsecured 8.375 percent

senior notes due in September 2005, (2) $150 million of

unsecured 6.375 percent notes due in February 2006,

(3) $75 million of unsecured 7.45 percent medium-term notes

due in April 2011, (4) $100 million of unsecured 7.125 percent

debentures due in February 2016, and (5) an unsecured, variable

rate, $39.1 million commercial bank loan due in December 2018

that is used to support two loans from the Company to the

Employee Stock Ownership Plan portion of the Darden Savings

Plan. In addition, in March 2002, the Company issued $150

million of unsecured 5.75 percent medium-term notes due in

March 2007. A portion of the proceeds from the issuance were

used to repay short-term debt, and the remaining proceeds are

being used to fund working capital needs. Through a shelf

registration on file with the Securities and Exchange

Commission, the Company has provided for the issuance of

an additional $125 million of unsecured debt securities from

time to time. The debt securities may bear interest at either

fixed or floating rates, and may have maturity dates of nine

months or more after issuance.

Great Food and Beverage 21 Produce Great Results in 2002

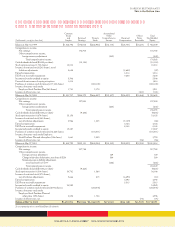

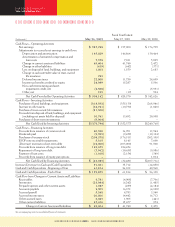

A summary of the Company’s contractual obligations and commercial commitments as of May 26, 2002, is as follows (in thousands):

Payments Due by Period

Less Than After

Contractual Obligations Total 1 Year 2-3 Years 4-5 Years 5 Years

Long-term debt $664,140 $ – $ – $450,000 $214,140

Operating leases 259,429 51,951 77,964 55,382 74,132

Total contractual cash obligations $923,569 $51,951 $77,964 $505,382 $288,272

Amount of Commitment Expiration per Period

Other Commercial Total Amounts Less Than Over

Commitments Committed 1 Year 2-3 Years 4-5 Years 5 Years

Trade letters of credit $ 9,786 $ 9,786 $ – $ – $ –

Standby letters of credit (1) 38,608 38,608–––

Guarantees (2) 5,463 1,204 1,285 1,171 1,803

Total commercial commitments $ 53,857 $49,598 $ 1,285 $ 1,171 $ 1,803

1) Includes letters of credit for $30,000 of workers’ compensation and general liabilities accrued in the Company’s consolidated financial statements; also includes letters of

credit for $7,289 of lease payments included in contractual operating lease obligation payments noted above.

2) Consists solely of guarantees associated with sub-leased properties. The Company is not aware of any non-performance under these sub-lease arrangements that would

result in the Company having to perform in accordance with the terms of the guarantees.