Red Lobster 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

comparison of the carrying amount of the assets to the future

net cash flows expected to be generated by the assets. If such

assets are considered to be impaired, the impairment to be

recognized is measured by the amount by which the carrying

amount of the assets exceeds their fair value. Restaurant sites

and certain other assets to be disposed of are reported at the

lower of their carrying amount or fair value, less estimated

costs to sell, and are included in net assets held for disposal.

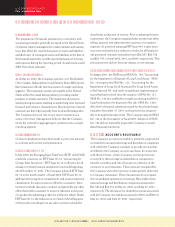

Unearned Revenues

Unearned revenues represent the Company’s liability for gift

cards and certificates that have been sold but not yet redeemed

and are recorded at their expected redemption value. When

the gift cards and certificates are redeemed, the Company

recognizes restaurant sales and reduces the deferred liability.

Unearned revenues are included in other current liabilities and,

at May 26, 2002, and May 27, 2001, amounted to $56,632

and $38,145, respectively.

Self-Insurance Reserves

The Company self-insures a significant portion of expected

losses under its workers’ compensation, employee medical,

and general liability programs. Accrued liabilities have been

recorded based on the Company’s estimates of the ultimate

costs to settle incurred and incurred but not reported claims.

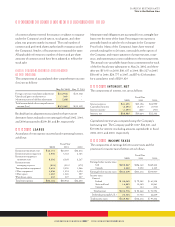

Income Taxes

The Company provides for federal and state income taxes

currently payable as well as for those deferred because of tem-

porary differences between reporting income and expenses

for financial statement purposes versus tax purposes. Federal

income tax credits are recorded as a reduction of income taxes.

Deferred tax assets and liabilities are recognized for the future

tax consequences attributable to differences between the finan-

cial statement carrying amounts of existing assets and liabilities

and their respective tax bases. Deferred tax assets and liabilities

are measured using enacted tax rates expected to apply to tax-

able income in the years in which those temporary differences

are expected to be recovered or settled. The effect on deferred

tax assets and liabilities of a change in tax rates is recognized in

income in the period that includes the enactment date.

Income tax benefits credited to equity relate to tax benefits

associated with amounts that are deductible for income tax

purposes but do not affect net earnings. These benefits are

principally generated from employee exercises of non-qualified

stock options and vesting of employee restricted stock awards.

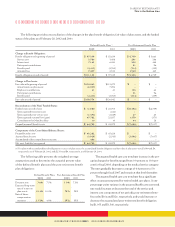

Derivative Instruments and Hedging Activities

In June 1998, the Financial Accounting Standards Board (FASB)

issued Statement of Financial Accounting Standards (SFAS)

No. 133, “Accounting for Derivative Instruments and Hedging

Activities.” In June 2000, the FASB issued SFAS No.138,

“Accounting for Certain Derivative Instruments and Certain

Hedging Activities – an Amendment of FASB Statement

No. 133.” SFAS No. 133 and SFAS No. 138 require that all

derivative instruments be recorded on the balance sheet at

fair value. SFAS No. 133 and SFAS No. 138 are effective for

all fiscal quarters of all fiscal years beginning after June 30,

2000. The Company adopted SFAS No. 133 and SFAS No.

138 on May 28, 2001. There were no transition adjustments

that were required to be recognized as a result of the adop-

tion of these new standards, and therefore, adoption of these

standards did not materially impact the Company’s consoli-

dated financial statements.

The Company uses financial and commodities derivatives

in the management of interest rate and commodities pricing

risks that are inherent in its business operations. The Company’s

use of derivative instruments is currently limited to interest rate

hedges and commodities futures contracts. These instruments

are structured as hedges of forecasted transactions or the vari-

ability of cash flow to be paid related to a recognized asset or

liability (cash flow hedges). The Company may also use finan-

cial derivatives as part of its stock repurchase program, which

is more fully described in Note 10. No derivative instruments

are entered into for trading or speculative purposes. All deriva-

tives are recognized on the balance sheet at their fair value. On

the date the derivative contract is entered into, the Company

documents all relationships between hedging instruments and

hedged items, as well as its risk-management objective and

strategy for undertaking the various hedge transactions. This

process includes linking all derivatives designated as cash flow

hedges to specific assets and liabilities on the consolidated

balance sheet or to specific forecasted transactions. The Company

also formally assesses, both at the hedge’s inception and on an

ongoing basis, whether the derivatives used in hedging

transactions are highly effective in offsetting changes in

cash flows of hedged items.

DARDEN RESTAURANTS

This is the Bottom Line

Great Food and Beverage 30 Produce Great Results in 2002