Qantas 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7 ANNUAL REPORT 2011

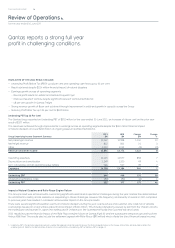

All segments of the Qantas Group were

protable, with the combination of Qantas,

Jetstar, Qantas Frequent Flyer and Qantas

Freight enabling us to deliver our best

performance since the Global Financial Crisis.

The exibility to generate revenue from

different parts of the business and different

market sectors has proved to be a major

asset. We have reported a substantially

improved result for Qantas driven by our

domestic and regional businesses, continued

revenue growth and record results for

Jetstar and Qantas Frequent Flyer.

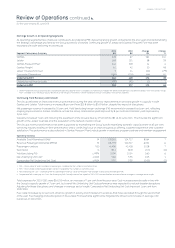

Fleet

During the year the Qantas Group eet

expanded by 29 aircraft to a total of 283 at

30 June 2011, driven primarily by signicant

Jetstar growth and the acquisition of the

Network Aviation business.

Qantas

Qantas Airlines recorded Underlying Earnings

Before Interest and Tax (Underlying EBIT)

of $228 million, compared with $67 million

in the prior year.

During the year Qantas continued to invest

on behalf of our customers. We rolled out

faster, smarter check-in to all major cities

and selected regional airports. We continued

to deliver superior on-time performance in

the domestic market. We launched direct

ights from Sydney to Dallas/Fort Worth,

based on a strengthened partnership with

American Airlines, creating a new gateway

into North America for travelling Australians.

We undertook a comprehensive review of

loss-making Qantas International, with the

objective of turning around the business

and positioning it for a strong and viable

future. The review was predicated upon

Qantas continuing to be Australia’s

leading premium international airline,

a strengthened focus on alliances, removing

capital from non-performing parts of the

business, and participation in the Asian

market opportunity.

Jetstar

Jetstar achieved a record Underlying

EBIT of $169 million, up 29 per cent on

the prior year.

Since launching in 2004 as a domestic

low-fares subsidiary of the Qantas

Group, Jetstar has undergone a major

transformation. It is now one of the

leading pan-Asian low-cost carriers,

ying both short and long-haul services

with operations based in Australia,

New Zealand, Singapore and Vietnam.

Jetstar continued its investment in

innovations for customers, including

airport self-service technology, and

preparations for the introduction of

iPads as an inight entertainment

option. More than 50,000 Jetstar

MasterCards have now been issued.

Qantas Frequent Flyer

Qantas Frequent Flyer increased

Underlying EBIT to $342 million, a record

result. It is Australia’s leading loyalty

program and continued to bring on

board new partners and launch new

initiatives to enhance the value it

delivers to its 8 million members.

The business continued to deliver strong

and stable cash earnings, contributing

strongly to the Qantas brand portfolio,

and positioning Qantas as an aviation

leader in loyalty programs.

Qantas Freight

Qantas Freight Enterprises also delivered

an improved performance, with Underlying

EBIT of $62 million up 48 per cent on the

prior year, reecting the continuing

recovery in the air cargo market.

Looking ahead

No other airline in the world but Qantas can

say it has operated continuously for more

than 90 years, ying each and every year

since 1920. That is something for all

Australians to be proud of.

And it has a lot to do with being Australian.

Qantas has been part of the great opening

of Australia, and in many ways Qantas has

made it possible: by building a global

reputation for safety, by staying at the

leading edge of aviation technology, by

assuring Australians they can always count

on us for help, and by creating the best

network in Australia, linking rural and

regional towns to the great cities of the world.

The Qantas Group has always changed

and evolved in order to stay successful,

and over the coming years it will continue

to do so. With our two strong and

complementary airline brands we will

increasingly be looking to participate in

regional and global opportunities. That

is how we can strengthen our business,

attract and reward our customers, and

deliver for shareholders.

But some things about Qantas will

never change.

We will always be an Australian company,

owned by Australians, with the vast majority

of our operations based in Australia.

We will always call Australia home.

283 $249m

Aircraft in the

Qantas Group eet

Statutory Prot

After Tax

ALAN JOYCE