Qantas 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99 ANNUAL REPORT 2011

for the year ended 30 June 2011

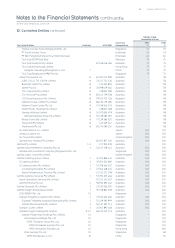

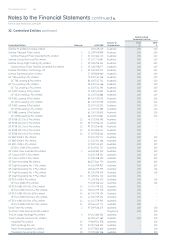

Notes to the Financial Statements continued

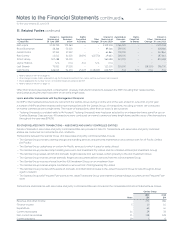

A nancial instrument is any contract that gives rise to both a nancial asset of one entity and a nancial liability or equity instrument of

another entity. The Qantas Group is subject to liquidity, interest rate, foreign exchange, fuel price and credit risks. These risks are an inherent

part of the operations of an international airline. The Qantas Group manages these risk exposures using various nancial instruments,

governed by a set of policies approved by the Board. Qantas Group’s policy is not to enter, issue or hold derivative nancial instruments for

speculative trading purposes.

The Qantas Group uses different methods to assess and manage different types of risk to which it is exposed. These methods include

correlations between risk types, sensitivity analysis in the case of interest rate, foreign exchange and other price risks, and ageing analysis

and sensitivity analysis for liquidity risk and credit risk.

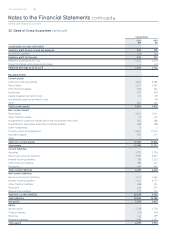

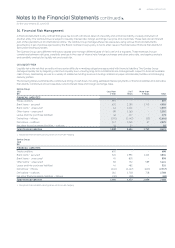

A LIQUIDITY RISK

Liquidity risk is the risk that an entity will encounter difculty in meeting obligations associated with nancial liabilities. The Qantas Group

manages liquidity risk by targeting a minimum liquidity level, ensuring long-term commitments are managed with respect to forecast available

cash inows, maintaining access to a variety of additional funding sources including commercial paper and standby facilities and managing

maturity proles.

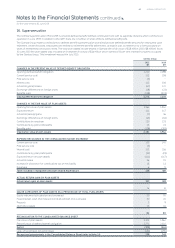

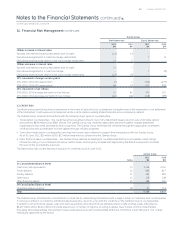

The following tables summarise the contractual timing of cash ows, including estimated interest payments, of nancial liabilities and derivative

instruments. Contractual amount assumes current interest rates and foreign exchange rates.

Qantas Group

$M

Less than

Year

to

Years

More than

Years Total

FINANCIAL LIABILITIES

Trade creditors – –

Bank loans – secured , , ,

Bank loans – unsecured , –,

Other loans – unsecured , –,

Lease and hire purchase liabilities –

Derivatives – inows () (,) () (,)

Derivatives – outows , ,

Net other nancial assets/liabilities – outows –

Total nancial liabilities , , , ,

. Recognised nancial liability carrying values are shown pre-hedging.

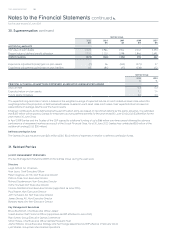

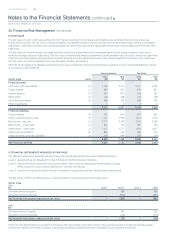

Qantas Group

$M

FINANCIAL LIABILITIES

Trade creditors – –

Bank loans – secured , , ,

Bank loans – unsecured –

Other loans – unsecured ,

Lease and hire purchase liabilities –

Derivatives – inows () (,) () (,)

Derivatives – outows , ,

Net other nancial assets/liabilities – inows () () –()

Total nancial liabilities , , , ,

. Recognised nancial liability carrying values are shown pre-hedging.

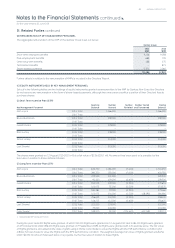

34. Financial Risk Management