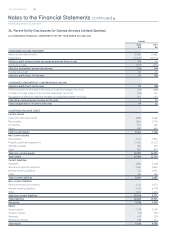

Qantas 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103 ANNUAL REPORT 2011

for the year ended 30 June 2011

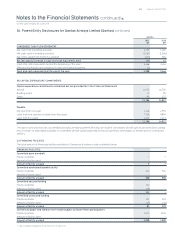

Notes to the Financial Statements continued

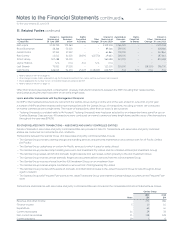

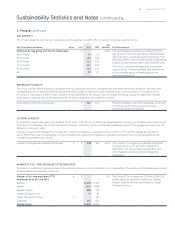

F CAPITAL MANAGEMENT

The Board’s policy is to maintain a strong capital base designed to maximise shareholder value, maintain creditor condence and sustain

future development of the business. Qantas targets a capital structure consistent with an investment grade credit rating while maintaining

adequate liquidity.

The Board remains focussed on balancing funding requirements of the business and investing for future growth with providing dividends for

shareholders. The Board is committed to the resumption of dividend payments. The quantum and timing of this will depend on trading results,

prevailing market conditions, the maintenance of an investment grade credit rating and the level of capital expenditure commitments.

During the year ended June the Qantas Group invested $. billion (: $. billion) in capital expenditure and maintained an

investment grade credit rating despite the pressures of the Global Financial Crisis.

In the year ended June the Qantas Group estimates it will spend $. billion on net capital expenditure. The required funding will be

met primarily through operating cash ows, although further debt funding is planned within the objective of maintaining an investment grade

credit rating. As a consequence, the Board considers it prudent not to pay a dividend for the year ended June .

The Board monitors the level of returns relative to the assets employed in the business measured by the Return on Invested Capital (ROIC).

The target is for ROIC to exceed cost of capital over the long term while growing the business.

35. Events Subsequent to Balance Date

A QANTAS INTERNATIONAL BUSINESS ANNOUNCEMENT

On August the Group announced the outcome of the strategic review of Qantas International.

The key pillars of the review are:

. Continuing focus and investment in the customer experience

. Deepening presence in Asia

. Deepening and broadening alliance relationships

. Ongoing underlying business improvement

Signicantly, as a result of the review, the Group has announced it will restructure its route network and restructure the Joint Services

Agreement with British Airways. As a result, six A aircraft will be deferred by between ve and six years and will deliver from /

to coincide with the retirement of the last B aircraft. In addition, four B aircraft will be retired earlier than previously planned.

The Group also announced that it would establish a premium airline based in Asia.

Whilst the nancial impact is still being nalised, it is anticipated that Non-Recurring expenditure of between $ million and $ million

will be incurred with less than half of this resulting in cash outows in the period.

On August the Group announced the purchase of between and A aircraft with purchase rights and options.

Included in the aircraft are “classic” A aircraft and Aneo, being Airbus’ new engine option for the A family to enter service

in . It incorporates latest generation engines and large “Sharklet” wing tip devices, which together will deliver per cent in fuel and CO

emission savings per aircraft.

Eight of the A aircraft will be allocated to the new airline based in Asia.

In addition the Group announced that it had reached agreement with Japan Airlines and Mitsubishi to establish a low cost carrier based in

Japan in . The new venture will be known as Jetstar Japan. Whilst each partner will have equal voting rights, the Qantas Group will have

per cent economic interest. As such the business will be accounted for as an Investment in Associates using the equity accounting method.

Of the As purchased, will be allocated to this venture and will not be funded by the Qantas Group. Qantas’ equity investment in this

business is expected to total approximately $ million over years.

The net effect on capital expenditure in / of deferring six A aircraft (and associated refund of pre-delivery payments), and the

sign on fees and pre-delivery payments expected in / as a result of the purchase agreement is a net reduction in the Group’s capital

expenditure of approximately $ million.

B OTHER MATTERS

On September the Federal Court of Australia upheld the Qantas Group’s appeal against a decision of the Administrative Appeals

Tribunal in respect of the GST treatment of domestic fares where the passenger did not travel. The Australian Taxation Ofce has days

to seek special leave to appeal the Federal Court decision to the High Court.

Except for the matters disclosed above, there has not arisen in the interval between June and the date of this Report any event

that would have had a material effect on the Financial Statements as at June .

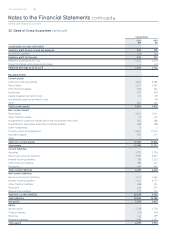

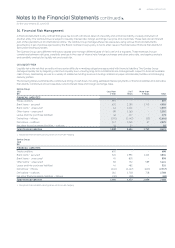

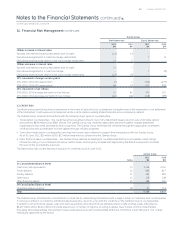

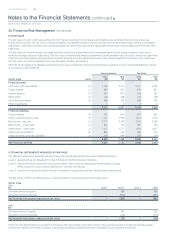

34. Financial Risk Management continued