Qantas 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 36

for the year ended 30 June 2011

Directors’ Report continued

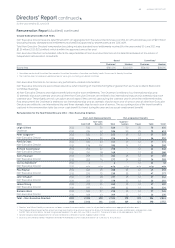

The Remuneration Report sets out remuneration information for

Non-Executive Directors, the Chief Executive Ofcer (CEO) and

Executive Committee. The Key Management Personnel (KMP) and

ve highest remunerated Executives for the / nancial

year are members of the Executive Committee (full membership

is listed on page ).

EXECUTIVE REMUNERATION OBJECTIVES AND APPROACH

In determining Executive remuneration the Board aims to do the

following:

— Attract, retain and appropriately reward a capable Executive team

— Motivate the Executive team to meet the unique challenges it

faces as a major international airline based in Australia

— Link remuneration to performance

To achieve this, Executive remuneration is set with regard to the size

and nature of the role (with reference to market benchmarks) and

the performance of the individual in the role. In addition, remuneration

includes “at risk” or performance related elements for which the

objectives are to:

— Link Executive reward with Qantas’ business objectives

and nancial performance

— Align the interests of Executives with shareholders

— Support a culture of employee share ownership

— Support the retention of participating Executives

ROLE OF THE REMUNERATION COMMITTEE

The Remuneration Committee (a committee of the Board, whose

members are detailed on pages and ) has the role of reviewing

and making recommendations to the Board on Executive remuneration

at Qantas and ensuring remuneration decisions are appropriate from

the perspectives of business performance, governance, disclosure,

reward levels and market conditions.

In fullling its role, the Remuneration Committee is specically

concerned with ensuring that its approach will:

— Motivate the CEO, Executive Committee and broader Executive

team to pursue the long-term growth and success of Qantas

— Demonstrate a clear relationship between performance and

remuneration

— Ensure an appropriate balance between “xed” and “at risk”

remuneration, reecting the short and long-term performance

objectives of Qantas

— Differentiate between higher and lower performers through the

use of a performance management framework

The Remuneration Committee has appointed

PricewaterhouseCoopers as its primary remuneration consultant.

It has also appointed Johnson Winter & Slattery to provide

remuneration advice where this advice may be linked to specic

legal and regulatory requirements. The Remuneration Committee

has implemented protocols around the appointment and use

of remuneration consultants to ensure compliance with the

“Corporations Amendment (Improving Accountability on Director

and Executive Remuneration) Bill ”.

Remuneration Report (Audited)

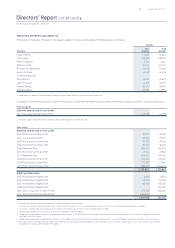

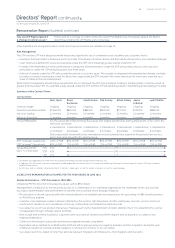

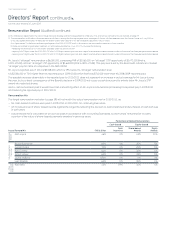

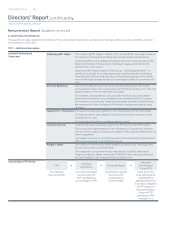

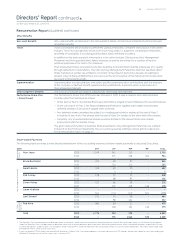

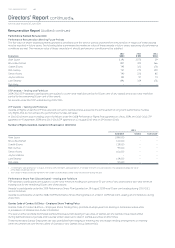

CEO AND EXECUTIVE COMMITTEE REMUNERATION FRAMEWORK

The Executive Remuneration Framework as it applies to the CEO and the Executive Committee comprises:

— Fixed Annual Remuneration (FAR)

— The Short Term Incentive Plan (STIP)

— The Long Term Incentive Plan (LTIP)

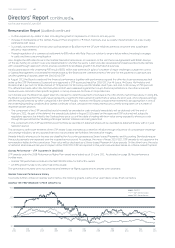

The “at target” pay for the CEO and KMP is set with reference to external benchmark market data including comparable roles in other listed

Australian companies and international airlines. The primary benchmark is comparable roles in other S&P/ASX companies. The Board

believes this is the appropriate benchmark, as it is the comparator group whose roles best mirror the complexity and challenges in managing

Qantas’ businesses and is also the peer group with whom Qantas competes for Executive talent.

Fixed Annual Remuneration (FAR)

What is FAR? FAR is a guaranteed salary level, inclusive of superannuation.

FAR is reviewed annually under normal circumstances – and the opportunity for an annual review

is included in the employment contracts of Executives at Qantas.

Cash FAR, as disclosed in the remuneration tables, excludes superannuation (which is disclosed

as Post-employment Benets) and includes salary sacrice components such as motor vehicles.

Movements in the value of annual leave balances during the year are disclosed as Annual Leave Accrual.

How is FAR set? FAR is set with reference to external benchmark market data including comparable roles in other listed

Australian companies and international airlines.

An individual’s FAR is not related to Qantas’ performance in a specic year.

When is FAR reviewed? The Board performed a general review of CEO and KMP FAR effective July .

This followed a general FAR freeze that had been in place since July .

The FAR for the CEO and KMP are outlined on page .