Pfizer 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Financial Report 57

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

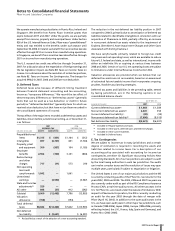

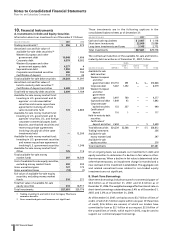

The differences between the estimated fair values and carrying

values of our financial instruments were not significant as of

December 31, 2007 and 2006.

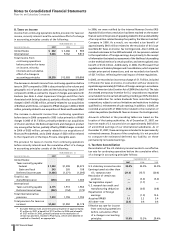

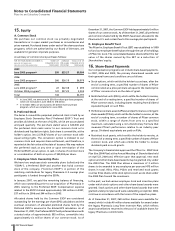

F. Credit Risk

On an ongoing basis, we review the creditworthiness of

counterparties to foreign exchange and interest rate agreements

and do not expect to incur a loss from failure of any counterparties

to perform under the agreements.

There are no significant concentrations of credit risk related to our

financial instruments with any individual counterparty. As of

December 31, 2007, we had $4.3 billion due from a broad group

of banks around the world.

In general, there is no requirement for collateral from customers.

However, derivative financial instruments are executed under

master netting agreements with financial institutions. These

agreements contain provisions that provide for the ability for

collateral payments, depending on levels of exposure, our credit

rating and the credit rating of the counterparty. As of December

31, 2007, we advanced cash collateral of $460 million and received

cash collateral of $364 million against various counterparties.

The collateral primarily supports the approximate fair value of our

Swedish krona swap contracts. The collateral advanced receivables

is reported in Prepaid expenses and taxes, and the collateral

received obligation is reported in Other current liabilities.

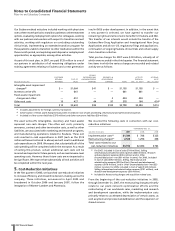

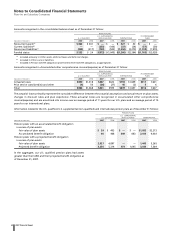

11. Inventories

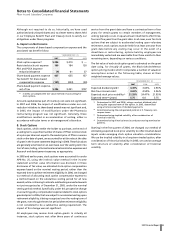

The components of inventories as of December 31 follow:

(MILLIONS OF DOLLARS) 2007 2006

Finished goods $2,064 $1,651

Work-in-process 2,353 3,198

Raw materials and supplies 885 1,262

Total inventories(a) $5,302 $6,111

(a) Decrease was primarily due to write-off of inventories related to

Exubera (see

Note 4. Asset Impairment Charges and Other Costs

Associated with Exiting Exubera

) and the impact of our inventory-

reduction initiatives.

12. Property, Plant and Equipment

The major categories of property, plant and equipment as of

December 31 follow:

USEFUL

LIVES

(MILLIONS OF DOLLARS) (YEARS) 2007 2006

Land — $ 718 $ 641

Buildings 331⁄3-50 10,319 9,947

Machinery and equipment 8-20 10,441 9,969

Furniture, fixtures and other 3-121⁄24,867 4,644

Construction in progress — 1,758 1,862

28,103 27,063

Less: accumulated depreciation 12,369 10,431

Total property, plant and equipment $15,734 $16,632

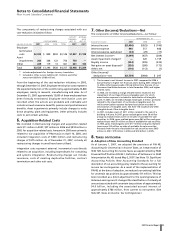

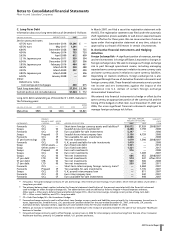

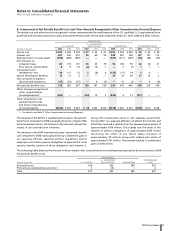

13. Goodwill and Other Intangible Assets

A. Goodwill

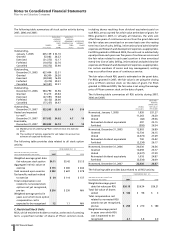

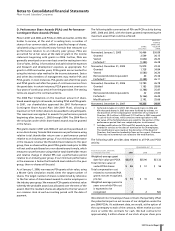

The changes in the carrying amount of goodwill by segment for

the years ended December 31, 2007 and 2006, follow:

ANIMAL

(MILLIONS OF DOLLARS) PHARMACEUTICAL HEALTH OTHER TOTAL

Balance, January 1, 2006 $20,919 $ 56 $10 $20,985

Additions(a) 166 — — 166

Other(b) (287) 5 7 (275)

Balance, December 31, 2006 20,798 61 17 20,876

Additions(a) —40— 40

Other(b) 458 7 1 466

Balance, December 31, 2007 $21,256 $108 $18 $21,382

(a) Primarily related to Embrex in 2007 and Exubera in 2006.

(b) In 2007, primarily relates to the impact of foreign exchange. In

2006, includes reductions to goodwill related to the resolution of

certain tax positions, adjustments for certain purchase accounting

liabilities and the impact of foreign exchange.

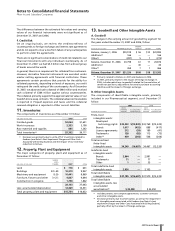

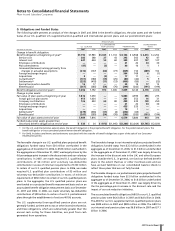

B. Other Intangible Assets

The components of identifiable intangible assets, primarily

included in our Pharmaceutical segment, as of December 31

follow:

2007 2006

GROSS GROSS

CARRYING ACCUMULATED CARRYING ACCUMULATED

(MILLIONS OF DOLLARS) AMOUNT AMORTIZATION AMOUNT AMORTIZATION

Finite-lived

intangible assets:

Developed

technology rights $32,433 $(15,830) $32,769 $(12,423)

Brands 1,017 (452) 888 (417)

License agreements 212 (59) 189 (41)

Trademarks 128 (82) 113 (73)

Other(a) 459 (264) 508 (266)

Total amortized

finite-lived

intangible assets 34,249 (16,687) 34,467 (13,220)

Indefinite-lived

intangible assets:

Brands 2,864 — 2,991 —

Trademarks 71 — 77 —

Other 1—35 —

Total indefinite-lived

intangible assets 2,936 — 3,103 —

Total identifiable

intangible assets $37,185 $(16,687) $37,570 $(13,220)

Total identifiable

intangible assets, less

accumulated

amortization(b) $ 20,498 $ 24,350

(a) Includes patents, non-compete agreements, customer contracts

and other intangible assets.

(b) Decrease primarily due to amortization, as well as the impairment

of intangible assets associated with Exubera (see

Note 4. Asset

Impairment Charges and Other Costs Associated with Exiting Exubera),

partially offset by the impact of foreign exchange.