Pfizer 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Financial Report 55

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

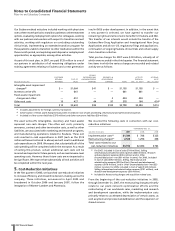

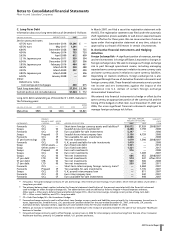

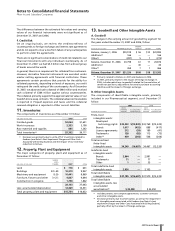

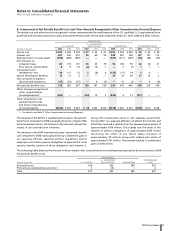

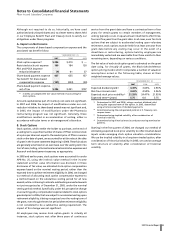

C. Long-Term Debt

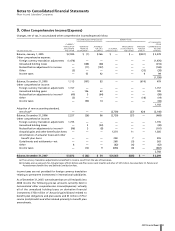

Information about our long-term debt as of December 31 follows:

(MILLIONS OF DOLLARS) MATURITY DATE 2007 2006

Senior unsecured notes:

4.75% euro December 2014 $1,296 $—

4.55% euro May 2017 1,291 —

6.60% December 2028 764 735

4.50% February 2014 753 720

5.63% April 2009 612 609

1.21% Japanese yen February 2011 530 504

6.50% December 2018 527 506

1.85% Japanese yen February 2016 484 461

4.65% March 2018 300 288

3.30% March 2009 297 290

0.80% Japanese yen March 2008 —506

6.00% January 2008 —252

Other:

Debentures, notes,

borrowings and mortgages 460 675

Total long-term debt $7,314 $5,546

Current portion not included above $1,024 $ 712

Long-term debt outstanding as of December 31, 2007, matures in

the following years:

AFTER

(MILLIONS OF DOLLARS) 2009 2010 2011 2012 2012

Maturities $945 $6 $536 $6 $5,821

In March 2007, we filed a securities registration statement with

the SEC. The registration statement was filed under the automatic

shelf registration process available to well-known seasoned issuers

and is effective for three years. We can issue securities of various

types under that registration statement at any time, subject to

approval by our Board of Directors in certain circumstances.

D. Derivative Financial Instruments and Hedging

Activities

Foreign Exchange Risk—A significant portion of revenues, earnings

and net investments in foreign affiliates is exposed to changes in

foreign exchange rates. We seek to manage our foreign exchange

risk in part through operational means, including managing

expected same currency revenues in relation to same currency costs

and same currency assets in relation to same currency liabilities.

Depending on market conditions, foreign exchange risk is also

managed through the use of derivative financial instruments and

foreign currency debt. These financial instruments serve to protect

net income and net investments against the impact of the

translation into U.S. dollars of certain foreign exchange

denominated transactions.

We entered into financial instruments to hedge or offset by the

same currency an appropriate portion of the currency risk and the

timing of the hedged or offset item. As of December 31, 2007 and

2006, the more significant financial instruments employed to

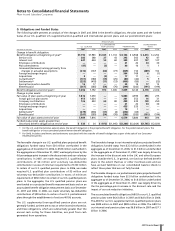

manage foreign exchange risk follow:

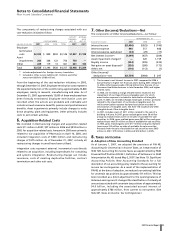

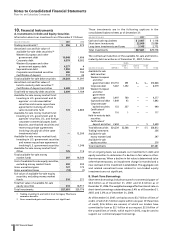

PRIMARY NOTIONAL AMOUNT MATURITY

BALANCE SHEET HEDGE (MILLIONS OF DOLLARS)

________________________________ DATE

INSTRUMENT(a) CAPTION(b) TYPE(c) HEDGED OR OFFSET ITEM 2007 2006 07/06

Forwards OCL — Short-term foreign currency assets and liabilities(d) $10,672 $7,939 2008/2007

Swaps OCL NI Swedish krona net investments(e) 8,288 7,759 2008

Forwards OCL CF Euro available-for-sale investments 5,297 — 2008

Swaps Prepaid CF Swedish krona intercompany loan 5,156 4,759 2008

Forwards OCL CF Yen available-for-sale investments 2,666 — 2008

ST yen borrowings STB NI Yen net investments 1,679 1,598 2008/2007

Forwards OCL CF U.K. pound available-for-sale investments 1,419 — 2008

Swap Other assets — Euro fixed rate debt 1,321 — 2014

Swap Other assets — Euro fixed rate debt 1,321 — 2017

Swaps Prepaid NI Euro net investments 916 — 2008

Swaps OCL NI Euro net investments —1,369 2007

Swaps OCL NI Yen net investments 686 653 2008/2007

LT yen debt LTD NI Yen net investments 574 547 After 2012

ST yen debt STB NI Yen net investments 530 506 2008

LT yen debt LTD NI Yen net investments 530 504 2011

Forwards OCL — Short-term intercompany foreign currency loans(f) —3,484 2007

Forwards Prepaid CF Yen available-for-sale investments —1,135 2007

Swaps OCL CF U.K. pound intercompany loan —811 2007

Forwards OCL CF Euro intercompany loan —542 2007

Forwards OCL CF Euro available-for-sale investments —444 2007

(a) Forwards = Forward-exchange contracts; ST yen borrowings = Short-term yen borrowings; ST yen debt = Short-term yen debt; LT yen debt =

Long-term yen debt.

(b) The primary balance sheet caption indicates the financial statement classification of the amount associated with the financial instrument

used to hedge or offset foreign exchange risk. The abbreviations used are defined as follows: Prepaid =

Prepaid expenses and taxes

;

Other assets =

Other assets, deferred taxes and deferred charges

; STB =

Short-term borrowings, including current portion of long-term debt

;

OCL =

Other current liabilities

; and LTD =

Long-term debt

.

(c) CF = Cash flow hedge; NI = Net investment hedge.

(d) Forward-exchange contracts used to offset short-term foreign currency assets and liabilities were primarily for intercompany transactions in

euros, Japanese yen, Swedish krona, U.K. pounds and Canadian dollars for the year ended December 31, 2007, and euros, U.K. pounds,

Australian dollars, Canadian dollars, Japanese yen and Swedish krona for the year ended December 31, 2006.

(e) Reflects an increase in Swedish krona net investments in 2006 due to the receipt of proceeds related to the sale of our Consumer Healthcare

business in Sweden.

(f) Forward-exchange contracts used to offset foreign currency loans in 2006 for intercompany contracts arising from the sale of our Consumer

Healthcare business, primarily in Canadian dollars, U.K. pounds and euros.