Pfizer 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 2007 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

All derivative contracts used to manage foreign currency risk are

measured at fair value and reported as assets or liabilities on the

balance sheet. Changes in fair value are reported in earnings or

deferred, depending on the nature and effectiveness of the

offset or hedging relationship, as follows:

• We recognize the earnings impact of foreign currency swaps

and foreign currency forward-exchange contracts designated

as cash flow hedges in Other (income)/deductions—net upon

the recognition of the foreign exchange gain or loss on the

translation to U.S. dollars of the hedged items.

• We recognize the earnings impact of foreign currency forward-

exchange contracts that are used to offset foreign currency

assets or liabilities in Other (income)/deductions—net during the

terms of the contracts, along with the earnings impact of the

items they generally offset.

• We recognize the earnings impact of foreign currency swaps

designated as a hedge of our net investments in Other

(income)/deductions—net in three ways: over time-for the

periodic net swap payments; immediately-to the extent of any

change in the difference between the foreign exchange spot

rate and forward rate; and upon sale or substantial liquidation

of our net investments-to the extent of change in the foreign

exchange spot rates.

Any ineffectiveness in a hedging relationship is recognized

immediately into earnings. There was no significant ineffectiveness

in 2007, 2006 or 2005.

Interest Rate Risk—Our interest-bearing investments, loans and

borrowings are subject to interest rate risk. We invest, loan and

borrow primarily on a short-term or variable-rate basis. From

time to time, depending on market conditions, we will fix interest

rates either through entering into fixed-rate investments and

borrowings or through the use of derivative financial instruments.

We entered into derivative financial instruments to hedge or

offset the fixed or variable interest rates on the hedged item,

matching the amount and timing of the hedged item. As of

December 31, 2007 and 2006, the more significant derivative

financial instruments employed to manage interest rate risk

follow:

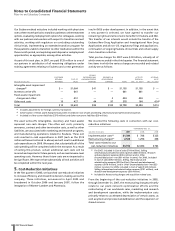

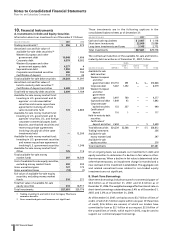

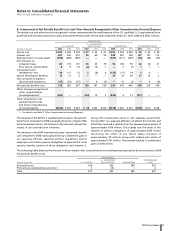

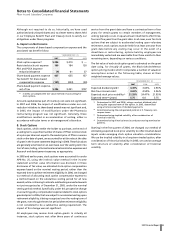

PRIMARY NOTIONAL AMOUNT

BALANCE SHEET HEDGE (MILLIONS OF DOLLARS) MATURITY_________________________________

INSTRUMENT CAPTION(a) TYPE(b) HEDGED OR OFFSET ITEM 2007 2006 DATE

Swap ONCL FV Euro fixed rate debt(c) $1,321 $ — 2014

Swap ONCL FV Euro fixed rate debt(c) 1,321 — 2017

Swaps Other assets — U.S. dollar fixed rate debt 1,278 1,285 2018-2028

Swaps Other assets FV U.S. dollar fixed rate debt(c) 1,050 1,050 2014-2018

Swaps ONCL FV U.S. dollar fixed rate debt(c) 900 900 2009

Swaps OCL FV U.S. dollar fixed rate debt(c) 450 450 2008

Swaps OCL/ONCL FV U.S. dollar fixed rate debt(c) —700 2007

Swaps ONCL — Yen LIBOR interest rate related to forecasted

issuances of short-term debt —1,196 2009-2013

(a) The primary balance sheet caption indicates the financial statement classification of the fair value amount associated with the financial

instrument used to hedge or offset interest rate risk. The abbreviations used are defined as follows: OCL =

Other current liabilities

; ONCL =

Other

noncurrent liabilities

; and Other assets =

Other assets, deferred taxes and deferred charges.

(b) FV = Fair value hedge.

(c) Serve to reduce exposure to long-term U.S. dollar and euro interest rates by effectively converting fixed rates associated with long-term debt

obligations to floating rates (see also

Note 10C. Financial Instruments: Long-Term Debt

).

All derivative contracts used to manage interest rate risk are

measured at fair value and reported as assets or liabilities on the

balance sheet. Changes in fair value are reported in earnings or

deferred, depending on the nature and effectiveness of the offset

or hedging relationship, as follows:

•We recognize the earnings impact of interest rate swaps

designated as fair value hedges or offsets in Other

(income)/deductions—net upon the recognition of the change in

fair value for interest rate risk related to the hedged or offset items.

•We recognize the earnings impact of interest rate swaps in

Other (income)/deductions—net.

Any ineffectiveness in a hedging relationship is recognized

immediately in earnings. There was no significant ineffectiveness

in 2007, 2006 or 2005.

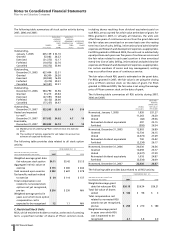

E. Fair Value

The following methods and assumptions were used to estimate

the fair value of derivative and other financial instruments as of

the balance sheet date:

•short-term financial instruments (cash equivalents, accounts

receivable and payable, held-to-maturity debt securities and

debt)—we use cost or contract value because of the short

maturity period.

•available-for-sale debt securities—we use a valuation model that

uses observable market quotes and credit ratings of the securities.

•available-for-sale equity securities—we use observable market

quotes.

•derivative contracts—we use valuation models that use

observable market quotes and our view of the creditworthiness

of the derivative counterparty.

•loans—we use cost because of the short interest-reset period.

•held-to-maturity long-term investments and long-term debt—

we use valuation models that use observable market quotes.