Pfizer 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 2007 Financial Report

Financial Review

Pfizer Inc and Subsidiary Companies

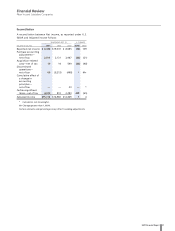

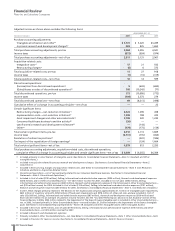

Contractual Obligations

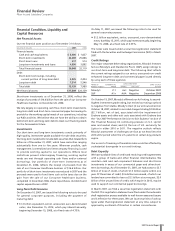

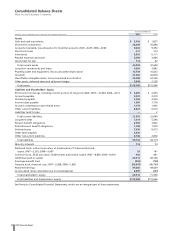

Payments due under contractual obligations as of December 31,

2007, mature as follows:

YEARS

___________________________________________________________

OVER 1 OVER 3

(MILLIONS OF DOLLARS) TOTAL WITHIN 1 TO 3 TO 5 AFTER 5

Long-term

debt(a) $11,203 $1,358 $1,498 $1,061 $7,286

Other long-term

liabilities

reflected on

our balance

sheet under

U.S. GAAP(b) 3,407 480 615 635 1,677

Lease

commitments(c) 1,518 212 343 175 788

Purchase

obligations(d) 826 403 248 142 33

Uncertain tax

positions(e) 408408———

(a) Our long-term debt obligations include both our expected

principal and interest obligations. Our calculations of expected

interest payments incorporates only current period assumptions

for interest rates, foreign currency translations rates and hedging

strategies. (See Note 10. Financial Instruments.) Long-term debt

consists of senior, unsecured notes, floating rate, unsecured notes,

foreign currency denominated notes, and other borrowings and

mortgages.

(b) Includes expected payments relating to our unfunded U.S.

supplemental (non-qualified) pension plans, postretirement plans

and deferred compensation plans.

(c) Includes operating and capital lease obligations.

(d) Purchase obligations represent agreements to purchase goods and

services that are enforceable and legally binding and include

amounts relating to advertising, information technology services

and employee benefit administration services.

(e) Reflects the adoption as of January 1, 2007, of Financial Accounting

Standards Board (FASB) Interpretation No. 48 (FIN 48), Accounting

for Uncertainty in Income Taxes, an interpretation of SFAS 109,

Accounting for Income Taxes, and supplemented by FASB

Financial Staff Position FIN 48-1, Definition of Settlement

of FASB Interpretation No. 48, issued May 2, 2007, (see Notes to

Consolidated Financial Statements—Note 1D. Significant Accounting

Policies: New Accounting Standards). Except for amounts reflected

in Income taxes payable, we are unable to predict the timing of tax

settlements, as tax audits can involve complex issues and the

resolution of those issues may span multiple years, particularly if

subject to negotiation or litigation.

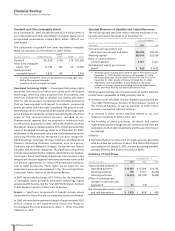

In 2008, we expect to spend approximately $2.0 billion on

property, plant and equipment.

Off-Balance Sheet Arrangements

In the ordinary course of business and in connection with the sale

of assets and businesses, we often indemnify our counterparties

against certain liabilities that may arise in connection with a

transaction or that are related to activities prior to a transaction.

These indemnifications typically pertain to environmental, tax,

employee and/or product-related matters, and patent

infringement claims. If the indemnified party were to make a

successful claim pursuant to the terms of the indemnification, we

would be required to reimburse the loss. These indemnifications

are generally subject to threshold amounts, specified claim periods

and other restrictions and limitations. Historically, we have not

paid significant amounts under these provisions and, as of

December 31, 2007, recorded amounts for the estimated fair

value of these indemnifications are not significant.

Certain of our co-promotion or license agreements give our

licensors or partners the rights to negotiate for, or in some cases

to obtain, under certain financial conditions, co-promotion or

other rights in specified countries with respect to certain of our

products.

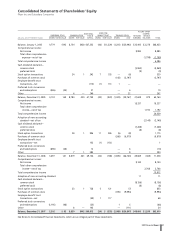

Dividends on Common Stock

We declared dividends of $8.2 billion in 2007 and $7.3 billion in

2006 on our common stock. In 2007, we increased our annual

dividend to $1.16 per share from $0.96 per share in 2006. In

December 2007, our Board of Directors declared a first-quarter

2008 dividend of $0.32 per share. The 2008 cash dividend marks

the 41st consecutive year of dividend increases.

Our current dividend provides a return to shareholders while

maintaining sufficient capital to invest in growing our businesses.

Our dividends are funded from operating cash flows, our financial

asset portfolio and short-term commercial paper borrowings and

are not restricted by debt covenants. To the extent we have

additional capital in excess of investment opportunities, we

typically offer a return to our shareholders through a stock-

purchase program. We believe that our profitability and access to

financial markets provide sufficient capability for us to pay current

and future dividends.

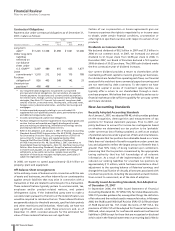

New Accounting Standards

Recently Adopted Accounting Standards

As of January 1, 2007, we adopted FIN 48, which provides guidance

on the recognition, derecognition and measurement of tax

positions for financial statement purposes. Prior to 2007, our

policy had been to account for income tax contingencies based

on whether we determined our tax position to be ’probable’

under current tax law of being sustained, as well as an analysis

of potential outcomes under a given set of facts and circumstances.

FIN 48 requires that tax positions be sustainable based on a ’more

likely than not’ standard of benefit recognition under current tax

law, and adjusted to reflect the largest amount of benefit that is

greater than 50% likely of being realized upon settlement,

presuming that the tax position is examined by the appropriate

taxing authority that has full knowledge of all relevant

information. As a result of the implementation of FIN 48, we

reduced our existing liabilities for uncertain tax positions by

approximately $11 million, which has been recorded as a direct

adjustment to the opening balance of Retained earnings, and

changed the classification of virtually all amounts associated with

uncertain tax positions, including the associated accrued interest,

from current to noncurrent, as of the date of adoption.

Recently Issued Accounting Standards, Not Adopted as

of December 31, 2007

In September 2006, the FASB issued Statement of Financial

Accounting Standards No. 157 (SFAS 157), Fair Value Measurements.

SFAS 157 provides guidance for, among other things, the definition

of fair value and the methods used to measure fair value. In February

2008, the FASB issued FASB Staff Position (FSP) 157-2 Effective Date

of FASB Statement No. 157. Under the terms of FSP 157-2, the

provisions of SFAS 157 will be adopted for financial instruments in

2008 and, when required, for nonfinancial assets and nonfinancial

liabilities in 2009 (except for those that are recognized or disclosed

at fair value in the financial statements on a recurring basis). We do