Pfizer 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

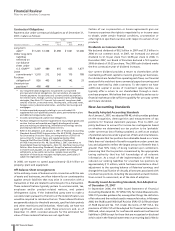

not expect that the provisions to be adopted in 2008 will have a

significant impact on our financial statements and we are in the

process of evaluating the impact of provisions to be adopted in 2009.

In December 2007, the FASB issued SFAS No. 141(R), Business

Combinations. (SFAS 141(R) replaced SFAS No. 141, Business

Combinations, originally issued in June 2001.) SFAS 141(R) retains

the purchase method of accounting for acquisitions, but requires

a number of changes, including changes in the way assets and

liabilities are recognized in purchase accounting. It also changes the

recognition of assets acquired and liabilities assumed arising from

contingencies, requires the capitalization of in-process research and

development at fair value, and requires the expensing of

acquisition-related costs as incurred. Generally, SFAS 141(R) is

effective on a prospective basis for all business combinations

completed on or after January 1, 2009. We are currently in the

process of evaluating the extent of those potential impacts.

In December 2007, the FASB issued SFAS 160, Noncontrolling Interests

in Consolidated Financial Statements, an amendment of ARB 51,

Consolidated Financial Statements. SFAS 160 provides guidance for

the accounting, reporting and disclosure of noncontrolling interests,

also called minority interest. A minority interest represents the

portion of equity (net assets) in a subsidiary not attributable, directly

or indirectly, to a parent. The provisions of SFAS 160 will be adopted

in 2009. The provisions of SFAS 160 will impact our current accounting

for minority interests, which are not significant, and will impact our

accounting for future acquisitions, if any, where we do not acquire

100% of the entity. We are currently in the process of evaluating the

extent of those potential impacts.

In December 2007, the Emerging Issues Task Force (EITF) issued EITF

Issue No. 07-1, Accounting for Collaborative Arrangements. EITF

07-1 provides guidance concerning: determining whether an

arrangement constitutes a collaborative arrangement within the

scope of the Issue; how costs incurred and revenue generated on

sales to third parties should be reported in the income statement;

how an entity should characterize payments on the income

statement; and what participants should disclose in the notes to

the financial statements about a collaborative arrangement. The

provisions of EITF 07-1 will be adopted in 2009. We are in the

process of evaluating the impact of adopting EITF 07-1 on our

financial statements.

In June 2007, the EITF issued EITF Issue No. 07-3, Accounting for

Nonrefundable Advance Payments for Goods or Services to be

Used in Future Research and Development Activities. EITF Issue No.

07-3 provides guidance concerning the accounting for non-

refundable advance payments for goods and services that will be

used in future R&D activities and requires that they be expensed

when the research and development activity has been performed

and not at the time of payment. The provisions of EITF Issue No.

07-3 will be adopted in 2008. We do not expect that the adoption

of EITF Issue No. 07-3 will have a significant impact on our financial

statements.

Forward-Looking Information and Factors

That May Affect Future Results

The Securities and Exchange Commission encourages companies

to disclose forward-looking information so that investors can

better understand a company’s future prospects and make

informed investment decisions. This report and other written or

oral statements that we make from time to time contain such

forward-looking statements that set forth anticipated results based

on management’s plans and assumptions. Such forward-looking

statements involve substantial risks and uncertainties. We have tried,

wherever possible, to identify such statements by using words

such as “will,” “anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,” “believe,” “target,” “forecast” and other words

and terms of similar meaning in connection with any discussion of

future operating or financial performance or business plans and

prospects. In particular, these include statements relating to future

actions, business plans and prospects, prospective products or

product approvals, future performance or results of current and

anticipated products, sales efforts, expenses, interest rates, foreign

exchange rates, the outcome of contingencies, such as legal

proceedings, and financial results. Among the factors that could

cause actual results to differ materially are the following:

•Success of research and development activities;

•Decisions by regulatory authorities regarding whether and

when to approve our drug applications as well as their decisions

regarding labeling and other matters that could affect the

availability or commercial potential of our products;

•Speed with which regulatory authorizations, pricing approvals

and product launches may be achieved;

•Success of external business development activities;

•Competitive developments, including with respect to competitor

drugs and drug candidates that treat diseases and conditions

similar to those treated by our in-line drugs and drug

candidates;

•Ability to successfully market both new and existing products

domestically and internationally;

•Difficulties or delays in manufacturing;

•Trade buying patterns;

•Ability to meet generic and branded competition after the

loss of patent protection for our products and competitor

products;

•Impact of existing and future legislation and regulatory

provisions on product exclusivity;

•Trends toward managed care and healthcare cost containment;

•U.S. legislation or regulatory action affecting, among other

things, pharmaceutical product pricing, reimbursement or

access, including under Medicaid and Medicare, the importation

of prescription drugs from outside the U.S. at prices that are

regulated by governments of various foreign countries, and the

involuntary approval of prescription medicines for over-the-

counter use;

•Impact of the Medicare Prescription Drug, Improvement and

Modernization Act of 2003;

•Legislation or regulatory action in markets outside the U.S.

affecting pharmaceutical product pricing, reimbursement or

access;

2007 Financial Report 33

Financial Review

Pfizer Inc and Subsidiary Companies