Pfizer 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 2007 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

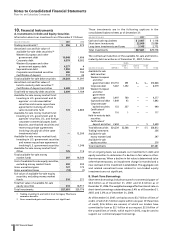

10. Financial Instruments

A. Investments in Debt and Equity Securities

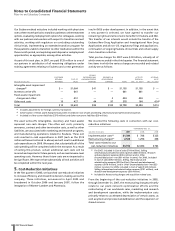

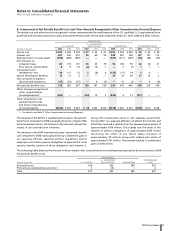

Information about our investments as of December 31 follows:

(MILLIONS OF DOLLARS) 2007 2006

Trading investments(a) $ 256 $ 273

Amortized cost and fair value of

available-for-sale debt securities:(b)

Western European and other

government debt 10,848 1,606

Corporate debt 6,579 8,582

Western European and other

government agency debt 4,277 4

Supranational debt 1,892 460

Corporate asset-backed securities 490 700

Certificates of deposit 117 45

Total available-for-sale debt securities 24,203 11,397

Amortized cost and fair value of

held-to-maturity debt securities:(b)

Certificates of deposit and other 2,609 1,189

Total held-to-maturity debt securities 2,609 1,189

Available-for-sale money market fund:

Investing in U.S. government and its

agencies’ or instrumentalities’

securities and reverse repurchase

agreements involving all of the

same investments held 172 2,885

Available-for-sale money market fund:

Investing in U.S. government and its

agencies’ securities, U.S. and foreign

corporate commercial paper, bank

deposits, asset-backed securities and

reverse repurchase agreements

involving virtually all of the same

investments held —12,300

Available-for-sale money market fund:

Investing in U.S. government securities

and reverse repurchase agreements

involving U.S. government securities —1,246

Available-for-sale money market fund:

Other 125 115

Total available-for-sale money

market funds 297 16,546

Cost of available-for-sale equity securities,

excluding money market funds 202 202

Gross unrealized gains 127 170

Gross unrealized losses (13) (1)

Fair value of available-for-sale equity

securities, excluding money market

funds 316 371

Total fair value of available-for-sale

equity securities 613 16,917

Total investments $27,681 $29,776

(a) Trading investments are held in trust for legacy Pharmacia

severance benefits.

(b) Gross unrealized gains and losses are not significant.

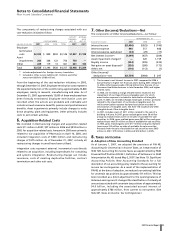

These investments are in the following captions in the

consolidated balance sheets as of December 31:

(MILLIONS OF DOLLARS) 2007 2006

Cash and cash equivalents $ 2,467 $ 1,118

Short-term investments 22,069 25,886

Long-term investments and loans 3,145 2,772

Total investments $27,681 $29,776

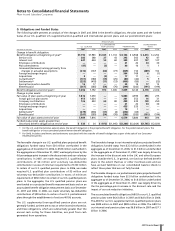

The contractual maturities of the available-for-sale and held-to-

maturity debt securities as of December 31, 2007, follow:

YEARS

_______________________________________________________

OVER 1 OVER 5 OVER

(MILLIONS OF DOLLARS) WITHIN 1 TO 5 TO 10 10 TOTAL

Available-for-sale

debt securities:

Western European

and other

government debt $10,753 $95 $— $— $10,848

Corporate debt 5,287 1,292 — — 6,579

Western European

and other

government

agency debt 3,497 780 — — 4,277

Supranational debt 1,849 43 — — 1,892

Corporate asset-

backed securities 133 357 — — 490

Certificates of

deposit 116 1 — — 117

Held-to-maturity debt

securities:

Certificates of

deposit and other 2,604 — — 5 2,609

Total debt securities $24,239 $2,568 $— $ 5 $26,812

Trading investments 256

Available-for-sale

money market funds 297

Available-for-sale

equity securities 316

Total investments $27,681

On an ongoing basis, we evaluate our investments in debt and

equity securities to determine if a decline in fair value is other-

than-temporary. When a decline in fair value is determined to be

other-than-temporary, an impairment charge is recorded and a

new cost basis in the investment is established. The aggregate cost

and related unrealized losses related to non-traded equity

investments are not significant.

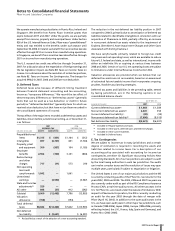

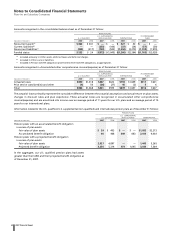

B. Short-Term Borrowings

Short-term borrowings include amounts for commercial paper of

$4.4 billion as of December 31, 2007, and $1.6 billion as of

December 31, 2006. The weighted-average effective interest rate on

short-term borrowings outstanding was 3.4% as of December 31,

2007, and 3.0% as of December 31, 2006.

As of December 31, 2007, we had access to $3.7 billion of lines of

credit, of which $1.5 billion expire within one year. Of these lines

of credit, $3.6 billion are unused, of which our lenders have

committed to loan us $2.1 billion at our request. $2.0 billion of

the unused lines of credit, which expire in 2012, may be used to

support our commercial paper borrowings.