Pfizer 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 2007 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

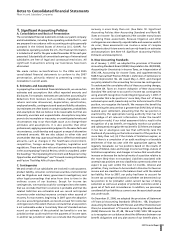

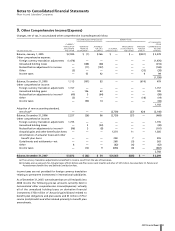

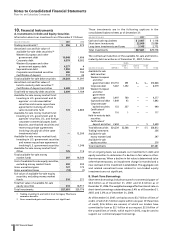

M. Cash Equivalents

Cash equivalents include items almost as liquid as cash, such as

certificates of deposit and time deposits with maturity periods of

three months or less when purchased. If items meeting this

definition are part of a larger investment pool, we classify them

as Short-term investments.

N. Investments

Realized gains or losses on sales of investments are determined

by using the specific identification cost method.

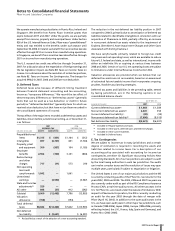

O. Income Tax Contingencies

We are subject to income tax in many jurisdictions and a certain

degree of estimation is required in recording the assets and

liabilities related to income taxes. For a description of our

accounting policy associated with accounting for income tax

contingencies, see Note 1D. Significant Accounting Policies: New

Accounting Standards. All of our tax positions are subject to audit

by the local taxing authorities in each tax jurisdiction. Tax audits

can involve complex issues and the resolution of issues may span

multiple years, particularly if subject to negotiation or litigations.

P. Share-Based Payments

Our compensation programs can include share-based payments.

Beginning in 2006, all grants under share-based payment

programs are accounted for at fair value and these fair values are

generally amortized on an even basis over the vesting terms into

Cost of sales, Selling, informational and administrative expenses

and Research and development expenses, as appropriate. In 2005

and earlier years, grants under stock option and performance-

contingent share award programs were accounted for using the

intrinsic value method.

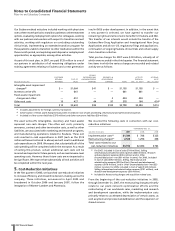

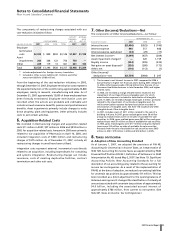

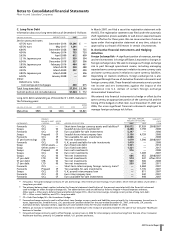

2. Acquisitions

We are committed to capitalizing on new growth opportunities,

a strategy that can include acquisitions of companies, products or

technologies. During the three years ended December 31, 2007,

2006 and 2005, we acquired the following:

•In the first quarter of 2007, we acquired BioRexis Pharmaceutical

Corp., (BioRexis) a privately held biopharmaceutical company

with a number of diabetes candidates and a novel technology

platform for developing new protein drug candidates, and

Embrex, Inc., (Embrex) an animal health company that possesses

a unique vaccine delivery system known as Inovoject that

improves consistency and reliability by inoculating chicks while

they are still in the egg. In connection with these and other

smaller acquisitions, we recorded $283 million in Acquisition-

related in-process research and development charges.

•In February 2006, we completed the acquisition of the sanofi-

aventis worldwide rights, including patent rights and

production technology, to manufacture and sell Exubera, an

inhaled form of insulin, and the insulin-production business and

facilities located in Frankfurt, Germany, previously jointly

owned by Pfizer and sanofi-aventis, for approximately $1.4

billion (including transaction costs). Substantially all assets

recorded in connection with this acquisition have now been

written off. See Note 4. Asset Impairment Charges and Other

Costs Associated with Exiting Exubera. Prior to the acquisition,

in connection with our collaboration agreement with sanofi-

aventis, we recorded a research and development milestone due

to us from sanofi-aventis of $118 million ($71 million, after tax)

in 2006 in Research and development expenses upon the

approval of Exubera in January 2006 by the U.S. Food and

Drug Administration (FDA).

•In December 2006, we completed the acquisition of PowderMed

Ltd. (PowderMed), a U.K. company which specializes in the

emerging science of DNA-based vaccines for the treatment of

influenza and chronic viral diseases, and in May 2006, we

completed the acquisition of Rinat Neurosciences Corp. (Rinat),

a biologics company with several new central-nervous-system

product candidates. In 2006, the aggregate cost of these and

other smaller acquisitions was approximately $880 million

(including transaction costs). In connection with those

transactions, we recorded $835 million in Acquisition-related

in-process research and development charges.

•In September 2005, we completed the acquisition of all of the

outstanding shares of Vicuron Pharmaceuticals Inc. (Vicuron),

a biopharmaceutical company focused on the development

of novel anti-infectives, for approximately $1.9 billion in cash

(including transaction costs). In connection with the acquisition,

as part of our final purchase price allocation, we recorded

$1.4 billion in Acquisition-related in-process research and

development charges, and $243 million of Goodwill, which

has been allocated to our Pharmaceutical segment.

•In April 2005, we completed the acquisition of Idun

Pharmaceuticals Inc. (Idun), a biopharmaceutical company

focused on the discovery and development of therapies to

control apoptosis, and in August 2005, we completed the

acquisition of Bioren Inc. (Bioren), which focuses on technology

for optimizing antibodies. In 2005, the aggregate cost of these

and other smaller acquisitions was approximately $340 million

in cash (including transaction costs). In connection with these

transactions, we recorded $262 million in Acquisition-related

in-process research and development charges.

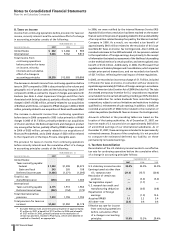

3. Discontinued Operations

We evaluate our businesses and product lines periodically for

strategic fit within our operations. Recent activity includes:

•In the fourth quarter of 2006, we sold our Consumer Healthcare

business for $16.6 billion, and recorded a gain of approximately

$10.2 billion ($7.9 billion, net of tax) in Gains on sales of

discontinued operations—net of tax in the consolidated

statement of income for 2006. In 2007, we recorded a loss of

approximately $70 million, after-tax, primarily related to the

resolution of contingencies, such as purchase price adjustments

and product warranty obligations, as well as pension

settlements. This business was composed of:

䡬substantially all of our former Consumer Healthcare segment;

䡬other associated amounts, such as purchase-accounting

impacts, acquisition-related costs and restructuring and

implementation costs related to our cost-reduction initiatives

that were previously reported in the Corporate/Other

segment; and