Pfizer 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

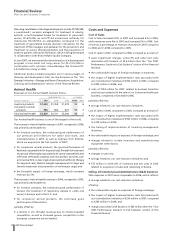

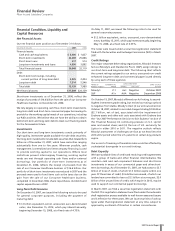

Financial Condition, Liquidity and

Capital Resources

Net Financial Assets

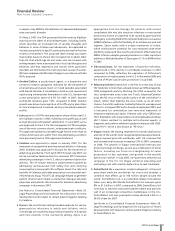

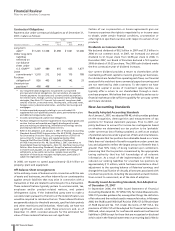

Our net financial asset position as of December 31 follows:

(MILLIONS OF DOLLARS) 2007 2006

Financial assets:

Cash and cash equivalents $ 3,406 $ 1,827

Short-term investments 22,069 25,886

Short-term loans 617 514

Long-term investments and loans 4,856 3,892

Total financial assets 30,948 32,119

Debt:

Short-term borrowings, including

current portion of long-term debt 5,825 2,434

Long-term debt 7,314 5,546

Total debt 13,139 7,980

Net financial assets $17,809 $24,139

Short-term investments as of December 31, 2006, reflect the

receipt of proceeds of $16.6 billion from the sale of our Consumer

Healthcare business on December 20, 2006.

We rely largely on operating cash flow, short-term investments,

long-term debt and short-term commercial paper borrowings to

provide for the working capital needs of our operations, including

our R&D activities. We believe that we have the ability to obtain

both short-term and long-term debt to meet our financing needs

for the foreseeable future.

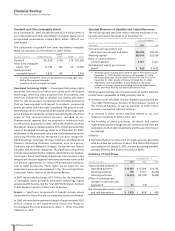

Investments

Our short-term and long-term investments consist primarily of

high-quality, investment-grade available-for-sale debt securities.

Our long-term investments include debt securities that totaled $2.6

billion as of December 31, 2007, which have maturities ranging

substantially from one to five years. Wherever possible, cash

management is centralized and intercompany financing is used

to provide working capital to our operations. Where local

restrictions prevent intercompany financing, working capital

needs are met through operating cash flows and/or external

borrowings. Our portfolio of short-term investments as of

December 31, 2006, reflects the receipt of proceeds from the

sale of our Consumer Healthcare business of $16.6 billion. Our

portfolio of short-term investments was reduced in 2007 and the

proceeds were used to fund items such as the taxes due on the

gain from the sale of our Consumer Healthcare business,

completed in December 2006, share repurchases, dividends and

capital expenditures in 2007.

Long-Term Debt Issuance

On December 10, 2007, we issued the following notes to be used

for general corporate purposes, including the payment of

maturing debt:

•$1.3 billion equivalent, senior, unsecured, euro-denominated

notes, due December 15, 2014, which pay interest annually,

beginning December 15, 2008, at a fixed rate of 4.75%.

On May 11, 2007, we issued the following notes to be used for

general corporate purposes:

•$1.2 billion equivalent, senior, unsecured, euro-denominated

notes, due May 15, 2017, which pay interest annually, beginning

May 15, 2008, at a fixed rate of 4.55%.

The notes were issued under a securities registration statement

filed with the Securities and Exchange Commission (SEC) in March

2007.

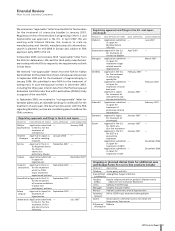

Credit Ratings

Two major corporate debt-rating organizations, Moody’s Investors

Service (Moody’s) and Standard & Poor’s (S&P), assign ratings to

our short-term and long-term debt. The following chart reflects

the current ratings assigned to our senior, unsecured non-credit

enhanced long-term debt and commercial paper issued directly

by us by each of these agencies:

NAME OF COMMERCIAL LONG-TERM DEBT DATE OF LAST______________________

RATING AGENCY PAPER RATING OUTLOOK ACTION

Moody’s P-1 Aa1 Negative October 2007

S&P A1+ AAA Negative December 2006

On October 19, 2007, Moody’s affirmed our Aa1 rating, its second-

highest investment grade rating, but revised our ratings outlook

to negative from stable. Moody’s cited: (i) our announcement on

October 18, 2007, related to recorded charges totaling $2.8 billion

($2.1 billion, net of tax), associated with the impairment of

Exubera assets and other exit costs associated with Exubera (see

the “Our 2007 Performance: Decision to Exit Exubera” section of

this Financial Review); (ii) continuing pressure on U.S. Lipitor

sales and market share; and (iii) the loss of U.S. exclusivity for

Lipitor in either 2010 or 2011. The negative outlook reflects

Moody’s assessment of challenges we face as we head into the

2010-2012 period when the U.S. patents on certain key products

expire.

Our access to financing at favorable rates would be affected by

a substantial downgrade in our credit ratings.

Debt Capacity

We have available lines of credit and revolving-credit agreements

with a group of banks and other financial intermediaries. We

maintain cash and cash equivalent balances and short-term

investments in excess of our commercial paper and other short-

term borrowings. As of December 31, 2007, we had access to $3.7

billion of lines of credit, of which $1.5 billion expire within one

year. Of these lines of credit, $3.6 billion are unused, of which our

lenders have committed to loan us $2.1 billion at our request. $2.0

billion of the unused lines of credit, which expire in 2012, may be

used to support our commercial paper borrowings.

In March 2007, we filed a securities registration statement with

the SEC. This registration statement was filed under the automatic

shelf registration process available to well-known seasoned issuers

and is effective for three years. We can issue securities of various

types under that registration statement at any time, subject to

approval by our Board of Directors in certain circumstances.

2007 Financial Report 29

Financial Review

Pfizer Inc and Subsidiary Companies