National Grid 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

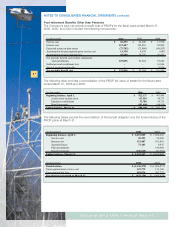

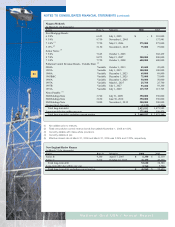

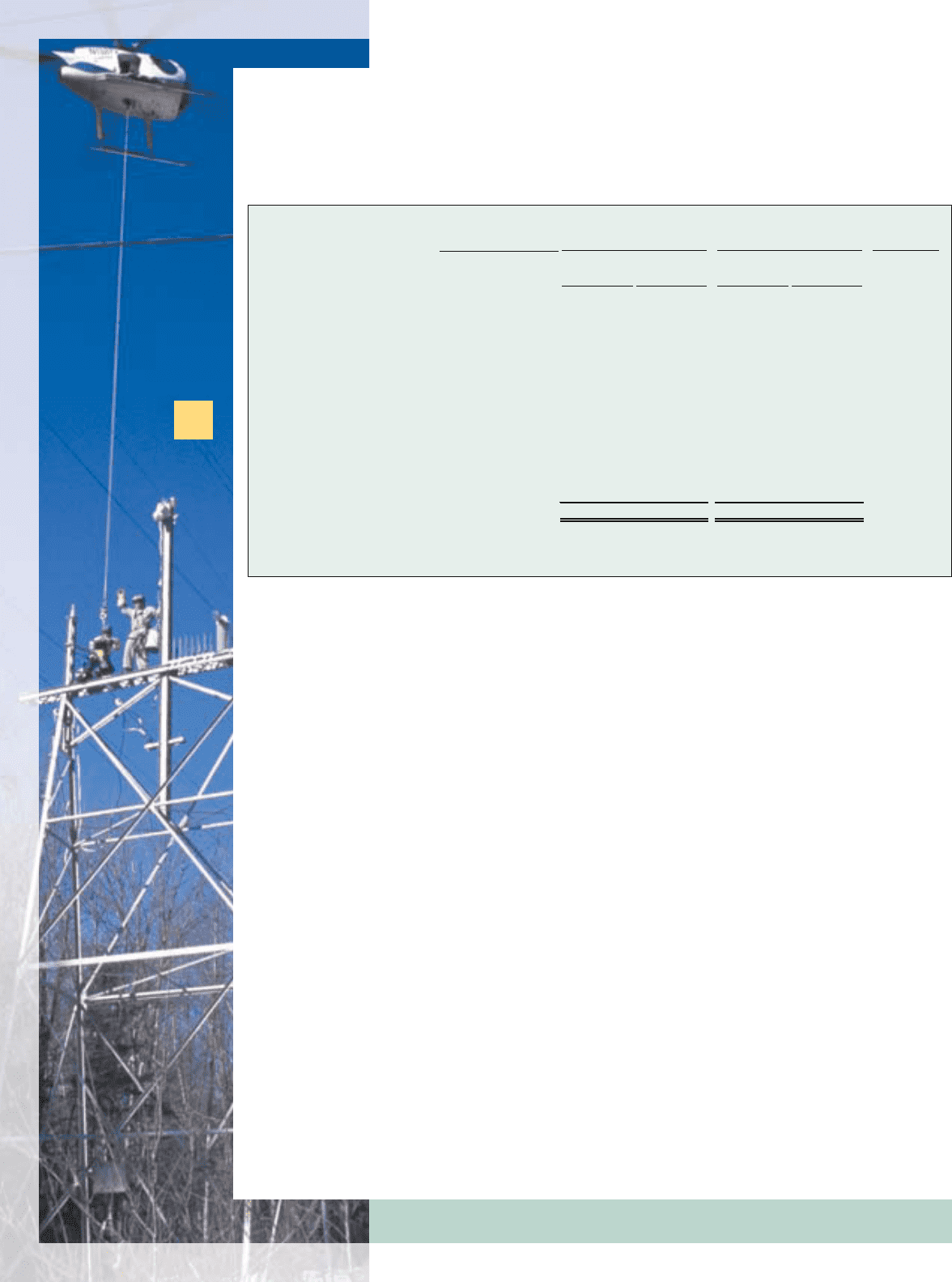

NOTE J – CUMULATIVE PREFERRED STOCK

A summary of cumulative preferred stock at March 31, 2006 and 2005 is as follows (in thousands

except for share data and call price):

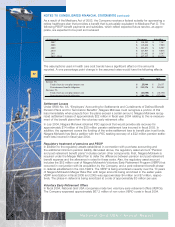

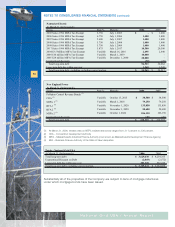

NOTE K – COST OF REMOVAL AND ASSET RETIREMENT OBLIGATION

In 2001, FASB issued SFAS No. 143, “Accounting for Asset Retirement Obligations.” SFAS No.

143 provides accounting requirements for retirement obligations associated with tangible long-

lived assets. The Company was required to adopt SFAS No. 143 as of April 1, 2003. Retirement

obligations associated with long-lived assets included within the scope of SFAS No. 143 are those

for which there is a legal obligation under existing or enacted law, statute, written or oral contract,

or by legal construction under the doctrine of promissory estoppel.

Management does not believe the Company has any material asset retirement obligations arising

from legal obligations as defined under SFAS No. 143. However, under the Company’s current

and prior rate plans it has collected through rates an implied cost of removal for its plant assets.

This cost of removal collected from customers differs from SFAS No. 143’s definition of an asset

retirement obligation in that these collections are for costs to remove an asset when it is no longer

deemed usable (i.e., it is broken or obsolete) and not necessarily from a legal obligation. For a vast

majority of its electric and gas transmission and distribution assets, the Company would use these

funds to remove the asset so a new one could be installed in its place.

The cost of removal collections from customers has historically been embedded within accumulat-

ed deprecation (as these costs have been charged over time through deprecation expense). With

the adoption of SFAS No. 143 the Company has reclassified these cost of removal collections to

a regulatory liability account to more properly reflect the future usage of these collections. The

Company estimates it has collected over time approximately $538 million and $505 million for

cost of removal through March 31, 2006 and March 31, 2005, respectively.

In March 2005, the FASB issued FIN 47, “Accounting for Conditional Asset Retirement

Obligations,” that clarifies that the term ‘conditional asset retirement obligation’ used in SFAS

No.143, refers to a legal obligation to perform an asset retirement activity in which the timing

and (or) method of settlement are conditional on a future event that may or may not be within

the control of the Company. This statement is effective for the Company for its fiscal year ended

March 31, 2006. The Company has a $13 million asset retirement obligation reserve as of March

31, 2006 which does not have a material impact on the Company’s results of operation or finan-

cial position.

67

National Grid USA / Annual Report

Call

Company

Price

March 31, March 31, March 31, March 31,

2006 2005 2006 2005

$100 par value -

3.40% Series Niagara Mohawk 57,536 57,536 5,754$ 5,754$ 103.500$

3.60% Series Niagara Mohawk 137,139 137,139 13,714 13,714 104.850

3.90% Series Niagara Mohawk 94,967 94,967 9,496 9,496 106.000

4.10% Series Niagara Mohawk 52,830 52,830 5,283 5,283 102.000

4.44% Series Mass Electric 22,585 22,585 2,259 2,259 104.068

4.76% Series Mass Electric 24,680 24,680 2,468 2,468 103.730

4.85% Series Niagara Mohawk 35,128 35,128 3,513 3,513 102.000

5.25% Series Niagara Mohawk 34,115 34,115 3,410 3,410 102.000

6.00% Series New England Power 11,117 11,117 1,112 1,112 (a)

$50 par value -

4.50% Series Narragansett 49,089 49,089 2,454 2,454 55.000

4.64% Series Narragansett 57,057 57,057 2,854 2,854 52.125

Total 576,243 576,243 52,317$ 52,317$

(a) Noncallable.

(in 000's)

Amount

Outstanding

Shares