National Grid 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

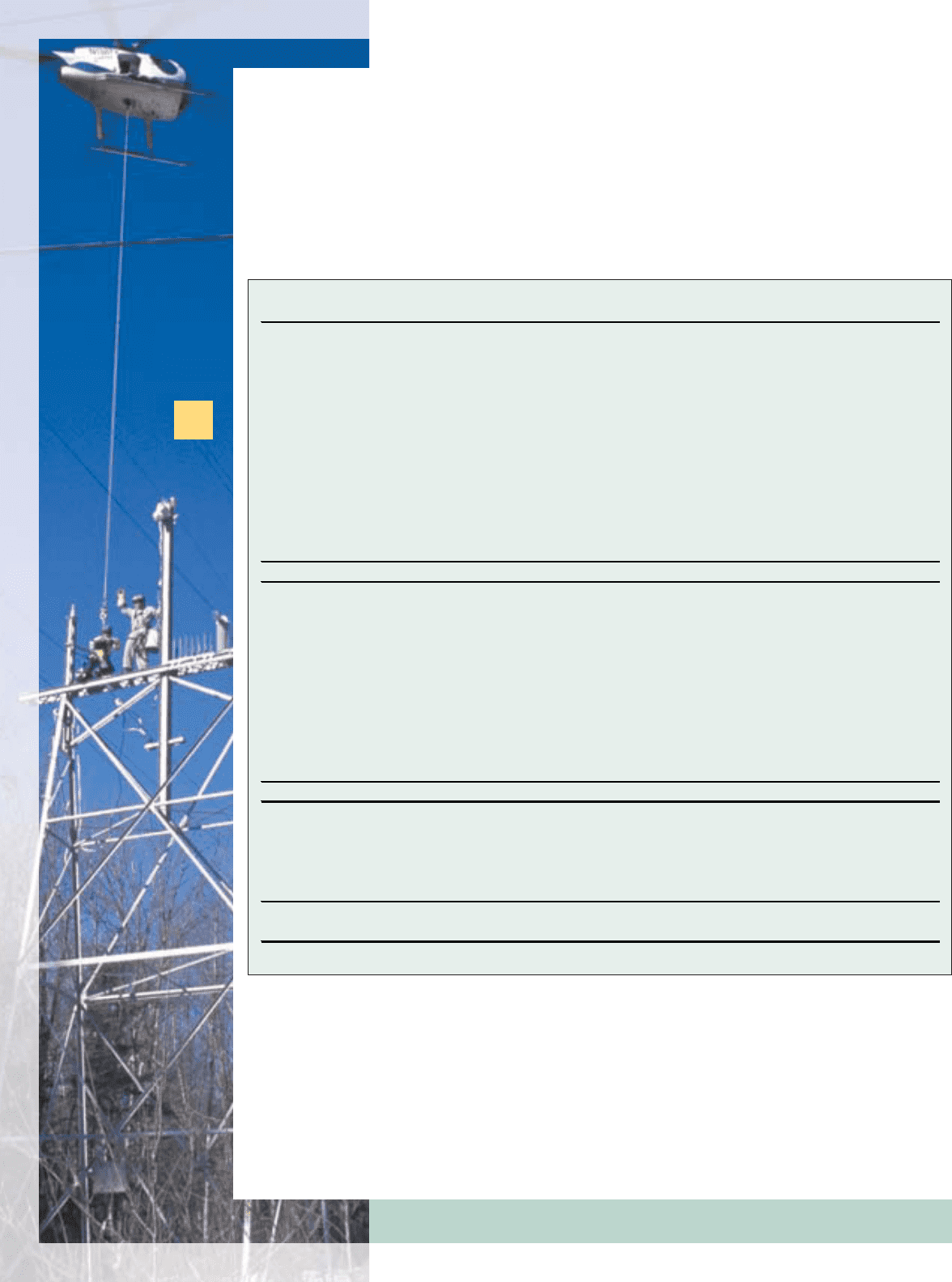

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The Company applies SFAS No. 109, “Accounting for Income Taxes,” which requires recognition

of deferred income taxes using the liability method for temporary differences that are reported in

different years for financial reporting and tax purposes. Under the liability method, deferred tax lia-

bilities or assets are computed using the tax rates that will be in effect when temporary differences

reverse. Generally, for regulated companies, the change in tax rates may not be immediately rec-

ognized in operating results because of rate-making treatment and provisions in the Tax Reform

Act of 1986.

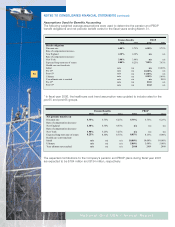

The following is the detail of the Company’s accumulated deferred income taxes:

61

National Grid USA / Annual Report

(In thousands) 2006 2005

Deferred tax assets:

Plant related 112,757$ 110,725$

Alternative minimum tax 119,294 111,609

Unbilled revenues 17,070 54,030

Non-utilized NOL carryforward - 105,023

Liability for environmental costs 191,307 229,723

Voluntary early retirement program 42,089 41,558

Bad debts 62,210 62,046

Pension and other post-retirement benefits 248,446 185,324

Investment tax credit 10,560 12,146

Other 416,477 276,520

Total deferred tax assets 1,220,210 1,188,704

Deferred tax liabilities:

Plant related (1,429,641) (1,358,129)

Equity AFUDC (63,668) (62,468)

Deferred environmental restoration costs (186,842) (200,175)

Merger rate plan stranded costs (795,184) (848,182)

Merger fair value pension and OPEB adjustment (109,478) (128,188)

Bond redemption and debt discount (30,009) (29,233)

Pension and other post-retirement benefits (61,784) (141,422)

Other (569,349) (284,903)

Total deferred tax liabilities (3,245,955) (3,052,700)

Net accumulated deferred income tax liability (2,025,745) (1,863,996)

Current portion (net deferred tax asset) 197,209 340,837

Net accumulated deferred income tax liability

(noncurrent) (2,222,954)$ (2,204,833)$

At March 31,