National Grid 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

As a result of the Medicare Act of 2003, the Company receives a federal subsidy for sponsoring a

retiree healthcare plan that provides a benefit that is actuarially equivalent to Medicare Part D. The

following PBOP benefit payments and subsidies, which reflect expected future service, as appro-

priate, are expected to be paid and received:

The assumptions used in health care cost trends have a significant effect on the amounts

reported. A one percentage point change in the assumed rates would have the following effects:

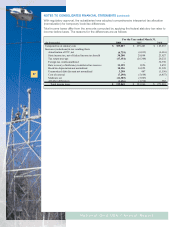

Settlement Losses

Under SFAS No. 88, “Employers’ Accounting for Settlements and Curtailments of Defined Benefit

Pension Plans and for Termination Benefits”, Niagara Mohawk must recognize a portion of this

loss immediately when payouts from the plans exceed a certain amount. Niagara Mohawk recog-

nized settlement losses of approximately $22 million in fiscal year 2004 relating to the re-measure-

ment of the benefit plans from the voluntary early retirement offer.

In July 2004, Niagara Mohawk obtained PSC approval that would provide rate recovery for

approximately $14 million of the $30 million pension settlement loss incurred in fiscal 2003. In

addition, the agreement covers the funding of the entire settlement loss to benefit plan trust funds.

Niagara Mohawk has filed a petition with the PSC seeking recovery of a $22 million pension settle-

ment loss incurred in fiscal year 2004.

Regulatory treatment of pensions and PBOP

In addition to the regulatory assets established in connection with purchase accounting and

the additional minimum pension liability discussed above, the regulatory asset account “Pension

and post-retirement benefit plans” includes certain other components. First, Niagara Mohawk is

required under the Merger Rate Plan to defer the difference between pension and post-retirement

benefit expense and the allowance in rates for these costs. Also, the regulatory asset account

includes the $52 million cost of Niagara Mohawk’s Voluntary Early Retirement Program (VERP) that

occurred in conjunction with its acquisition by the Company, and a post-retirement benefit phase-

in deferral established in the mid-1990’s. The VERP is being amortized unevenly over the 10 years

of Niagara Mohawk’s Merger Rate Plan with larger amounts being amortized in the earlier years.

VERP amortization in fiscal 2006 and 2005 was approximately $4 million and $7 million, respec-

tively. The phase-in deferral is being amortized at a rate of approximately $3 million per year.

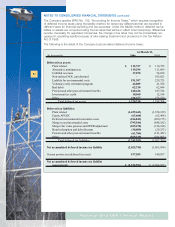

Voluntary Early Retirement Offers

In fiscal 2004, National Grid USA companies made two voluntary early retirement offers (VEROs).

The Company expensed approximately $67.2 million of non-union VERO costs in fiscal 2004.

58

National Grid USA / Annual Report

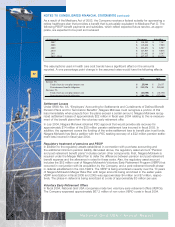

(in thousands) Payments Subsidies

2007 114,283$ 7,347$

2008 119,666$ 7,980$

2009 123,471$ 8,587$

2010 127,807$ 9,038$

2011 131,602$ 9,347$

2012 - 2016 657,237$ 50,175$

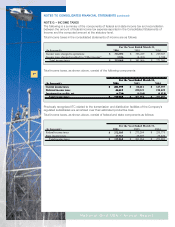

2006 2005

Increase 1%

Total of service cost plus interest cost 25,944$ 21,637$

Postretirement benefit obligation 313,376$ 295,000$

Decrease 1%

Total of service cost plus interest cost (21,558)$ (18,196)$

Postretirement benefit obligation (280,250)$ (257,030)$