National Grid 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

NOTE C – COMMITMENTS AND CONTINGENCIES

Environmental issues:

The normal ongoing operations and historic activities of Niagara Mohawk, Massachusetts Electric,

Narragansett Electric, Granite State Electric and NEP are subject to various federal, state and local

environmental laws and regulations. Like most other industrial companies, the Company’s trans-

mission and distribution companies use or generate a broad range of hazardous materials. Under

federal and state Superfund laws, potential liability for the historic contamination of property may

be imposed on responsible parties jointly and severally, without fault, even if the activities were

lawful when they occurred.

Federal and state environmental regulators, as well as private parties, have alleged that the

Company’s transmission and distribution companies are potentially responsible parties under

Superfund laws for the remediation of over 180 contaminated sites in New England and New

York, and for resulting damages. The Company’s greatest potential Superfund liabilities relate to

manufactured gas plant, or MGP, facilities formerly owned or operated by the Company’s sub-

sidiaries or their predecessors. MGP byproducts included fuel oils, hydrocarbons, coal tar, purifier

waste and other waste products that may pose a risk to human health and the environment. The

Company is investigating or remediating these sites, or both, as appropriate.

Management believes that ongoing operations and the Company’s response to the impact of

the Company’s historic operations are in substantial compliance with environmental laws, and that

the obligations imposed on us are not likely to have a material adverse impact on the Company’s

financial condition or results of operations because the Company recovers a majority of these

costs under the Company’s rate plans. The Company is pursuing claims against insurance carriers

and potentially responsible parties to recover investigation and remediation costs, but manage-

ment cannot predict the success of such claims. To the extent that prudently incurred costs

cannot be recovered through insurance or otherwise, these are recoverable under applicable

rate plans. As of March 31, 2006 and 2005, the Company has recorded an obligation of $569

million and $605 million, respectively, along with an offsetting regulatory asset, on its balance

sheet. The potential high end of the range at March 31, 2006 is presently estimated at approxi-

mately $701 million.

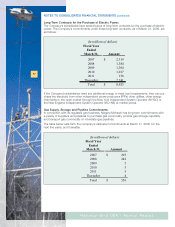

Decommissioning Nuclear Units:

NEP has minority interests in three nuclear generating companies: Yankee Atomic Electric

Company (Yankee Atomic), Connecticut Yankee Atomic Power Company (Connecticut Yankee),

and Maine Yankee Atomic Power Company (Maine Yankee) (together, the Yankees). These owner-

ship interests are accounted for on the equity method. The Yankees own nuclear generating units

that have been permanently retired and are conducting decommissioning operations. The three

units are as follows:

With respect to each of these units, NEP has recorded a liability and a regulatory asset reflecting

the estimated future decommissioning billings from the Yankees. In a 1993 decision, the FERC

allowed Yankee Atomic to recover its undepreciated investment in the plant, including a return

on that investment, as well as unfunded nuclear decommissioning costs and other costs. Maine

Yankee and Connecticut Yankee recover their prudently incurred costs, including a return, in

accordance with settlement agreements approved by the FERC in May 1999 and July 2000,

respectively. The Yankees collect the approved costs from their purchasers, including NEP. The

Company’s share of the decommissioning costs is accounted for in “Purchased energy” on the

income statement. Under settlement agreements, NEP is permitted to recover prudently incurred

decommissioning costs through CTCs.

45

National Grid USA / Annual Report

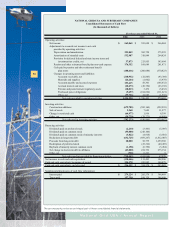

NEP's Equity Investment Future Estimated

as of March 31, 2006 Date Billings to NEP

Nuclear Unit % Ownership $ (millions) Retired $ (millions)

Yankee Atomic 34.5 0.3 February 1992 47

Connecticut Yankee 19.5 9.2 December 1996 94

Maine Yankee 24.0 6.1 August 1997 54